Bruce Zhang is the Xiamen-based representative of Financial PR, an investor relations company in Singapore.

FIBRECHEM TECHNOLOGIES once was a darling of institutional and retail investors. But it has recently turned out that the company's solid financial performance in the past may have been founded on accounting irregularities.

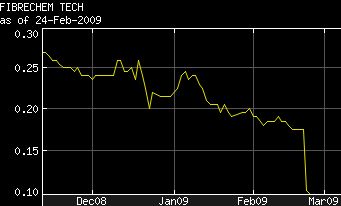

The company’s external auditor, Ernst & Young, could not finalise an audit of its trade receivables and cash balances for FY 2008. Then the stock collapsed and it was suspended from trading on the Singapore Exchange in February this year.

Mr James Zhang, 41, FibreChem’s founder, executive chairman and CEO, offered to resign with immediate effect from his positions, and the company appointed nTan Corporate Advisory as an independent investigator and financial adviser.

The company has yet to announce its full-year results (which was scheduled in February).

More than two months after it first shocked the market, there have been no media reports, or company updates, on how the developments have impacted the company’s day-to-day operations.

Adding to the gloom and uncertainty, FibreChem announced in March that it had defaulted on a US$35 million facility agreement it entered into with a consortium of local and international banks in 2006.

The default was triggered by the suspension of trading in the company's shares, and led to the outstanding loan, together with accrued interest, becoming immediately due and payable.

What has been happening to its factory which produces chemical fibres for making fabrics and synthetic leather? Have its operations shut down?

To find out, I drove last week to the Xiang’an East Industrial area.

I knew where FibreChem was located as I had visited it last July along with more than 10 fund managers and analysts on a trip organized by Financial PR, the leading investor relations company in Singapore. (FibreChem was not, and is not, a client of Financial PR.)

At that time, we met with Mr Zhang and his senior management, who showed us around the impressive multi-storey administration building and the manufacturing facilities, and explained the operations.

Last week when I drove up to the factory, the first thing that caught my eye was a security guard solemnly performing his duty, which included saluting every time a car went in or came out.

When I spotted a container truck parked at a side entrance. I went over to chat with the driver, asking him how often he went there to transport goods produced by Fibrechem.

“It’s not fixed, it depends…”

In recent months, had there been any change to his schedule?

“Not really, almost the same as before.”

Workers later loaded the truck, which drove off shortly later.

Under the hot sun near the factory, several motorcycle-taxi drivers were waiting for workers to finish their work. Motorcycle taxis are a cheap and convenient mode of transport for the workers as the company is located in a relatively remote area.

Employees I later spoke to said the FibreChem plant currently was operating as usual. Asked if there was any pay cut, an employee said: “No, my income hasn’t changed. It’s still around RMB2, 500 per month.”

Another worker said: “We have the same work load as before. I don’t think the economic downturn has affected the company much.”

Another worker added: “Yup, our department has two work shifts. Other departments even have three shifts."

Have they heard that their CEO had resigned?

”I don’t know much about that.”

Some employees are looking forward to moving to a new employee hostel, which is being constructed just opposite the existing one within the company’s grounds.

So, the company’s business seems to be operating normally, a notion that was further reinforced by something which I normally would not have bothered to note.

Looking through the perimeter fence that surrounds the company’s grounds, I spotted a sprinkler system at work. And the grass did look like it had been trimmed not too long ago.

All that I had seen and heard on my visit may represent, I hope, very good news to minority shareholders of FibreChem (and, like it or not, Mr Zhang, who is the biggest shareholder with 30.6% stake).

If business operations are going strong, there is at least some value left to the company’s shares - when the trading suspension is eventually lifted - even if accounting irregularities have taken place.

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

FIBRECHEM'S factory humming with business - NextInsight finding

- Details

- Bruce Zhang (in Xiamen)

Flags were aflutter at FibreChem's building last week. The grass lawn looked maintained and a sprinkler system was at work. Photo by Bruce Zhang.

Entrance to FibreChem. Photo by Bruce Zhang

Truck transporting goods from FibreChem last week. Photo by Bruce Zhang

FibreChem collapsed on heavy volume just prior to its suspension in February.

You may also be interested in:

|

FIBRECHEM'S James Zhang still with the company? |

|

FIBRECHEM gives premium fabrics suppliers a run for their money |