Dawnrays produces various kinds of system-specific medicines.

Dawnrays produces various kinds of system-specific medicines.

THE SWINE flu outbreak is triggering a rally in pharmaceutical stocks in many markets. In Hong Kong, Dawnrays Pharmaceutical rose 10 HK cents to close at HK84 cents yesterday (Apr 27).

Prior to this, China’s pharmaceutical industry had been resilient and poised for continued growth on the back of improving consumer affordability, tighter regulations and government support for healthcare.

We met up with the management of Suzhou-based Dawnrays -- one of the largest manufacturers of a specific type of antibiotics -- during its FY08 results briefing, and were struck by their optimistic outlook.

According to the State Food and Drug Administration’s (SFDA) Southern Medicine Economic Institute, the pharmaceutical market in the PRC is expected to become one of the largest in the world within 5 years.

The main growth drivers - rising per-capita income, the expansion of national healthcare insurance coverage and higher government spending on healthcare infrastructure - coupled with demand inelasticity, will ensure that this sector continues expanding even in an economic downturn.

The State Basic Medical Insurance Scheme and the New Rural Cooperative Medical Scheme were introduced by the Government to improve and expand access to basic healthcare for the population.

The schemes subsidize patient purchases of pharmaceutical products listed in National Basic Drugs Catalogue. The inclusion of pharmaceutical products in the catalogue enhances affordability, as well as product sales.

Dawnrays, which has its best selling products expected to include in this catalogue, will clearly benefit.

According to the National Bureau of Statistics of China, social healthcare spending by the government rose by a compound rate of 13.5% to RMB 259 billion in 2005, from RMB 94 billion in 1997, reflecting the broadened coverage of the insurance schemes.

Cephalosporins, which Dawnrays specializes in, had a market size of around RMB 25 billion in the PRC in 2008 according to Intercontinental Medical Statistics (IMS).

It is considered one of the highest growth segments in the antibiotic market, with consumption increment of approximately 28.2% compared with 2007. In addition, Dawnrays is also venturing into hypertension drugs, which had an estimated PRC market size of RMB 13.5 billion last year according to Medicine Economic New(医药经济日报).

2 key medicines

Dawnrays is principally engaged in the development, manufacture and sale of 1) Cephalosporins (bulk medicines & injectible powder) and 2) system specific medicines.

Cephalosporins

Dawnrays produces the first to fourth generation Cephalosporin products. It is the second company after Pfizer in the PRC to have breakthroughs in Cefoperazone production by the solvent crystallization technique.

The Group is one of a few third generation Cephalosporin manufacturers in the PRC able to fully vertically integrate the production of pharmaceutical intermediates, bulk medicines and injectible powder.

According to China Pharmaceutical Statistics Report (中国医药统计年报), in 2007, the Group had a market share of 40% and 14% in the Cefoperazone Sodium (头孢呱酮钠) and Ceftriaxone Sodium (头孢曲松钠) bulk medicine sectors, respectively.

The Group can produce 950 tonnes of Cephalosporin intermediates and 800 tonnes of Cephalosporin bulk medicines, making it one of the largest such producers in China. A new production facility in Nantong, Jiangsu Province was completed in November 2008 and started commercial production recently, increasing its production capacity of pharmaceutical intermediates by 150 tonnes and will further increase the capacity by 2010 after total completion.

System Specific Medicines

Dawnrays also produces a wide range of products which address problems with the cardiovascular, endocrine, urinary and digestive systems, as well as various anti-allergic drugs. These are marketed under the proprietary brand name in cardiovascular system specific medicines “ Anneizhen(安内真)” & “Anneixi” (安内喜) and anti-allergic drugs “Xikewei” (西可韦). The management expects this division to have escalating sales in the future.

16 new products registered

Dawnrays has 48 staff at an R&D centre which focuses on gaining technical know-how via overseas exchanges and cooperation. The R&D centre has good relations and close connections with technology firms, universities, technological institutions and experts in R&D for possible correspondences, knowledge-sharing and other forms of tie-ups.

In 2008, the Group applied to the State Food and Drug Administration of the PRC to register a total of 16 products. There were 7 products approved for production, with 8 production permits and 3 certificates of new pharmaceutical products granted.

From 2006 to 2007, Dawnrays obtained 30 production permits for 16 new products from the State Food and Drug Administration (SFDA) of the PRC.

70 sales offices

The Group’s sales network spans all provinces and many major cities in the PRC with over 70 sales offices and 500 sales & marketing personnel. The staff established business relationships with over 1,000 hospitals: 40% in first-tier cities and 60% in second-tier cities. Export markets include Italy, Germany, Switzerland, Spain, Lithuania, South Asia, Russia, Southeast Asia, the Middle East and South America.

Mr Gao Yi, the company CEO, had this to say when we asked him exactly what differentiates Dawnrays Pharmaceutical from the thousands of competitors in China:

“Most of the drugs in China are modified from the western formulas. In our case, we were the first Chinese manufacturer to move into Cefoperazone Sodium (头孢呱酮钠) production by the solvent of crystallization technique. This first-mover advantage allows us to quickly establish our brand name in this category of antibiotics. We focused on this category and went on to produce the second, third and fourth generation products. This trust built up over the years is not something that is easily replaceable. Through an established vertical integration enhancing production technique and assuring quality, we strike to maintain the leading position in this sector”.

Exclusive supplier

Dawnrays participated in the Chinese Hypertension Intervention Efficacy (CHIEF) Study, the largest integrated medical project in China for the intervention and treatment of hypertension. Dawnrays was the exclusive R&D partner and designated supplier of drugs used in the research.

It is the first eleventh Five-Year Plan project in the medical field supported by the State, which basically covers major hospitals in the PRC. Dawnrays is entitled to all profits from commercialization of the research results of the project which should strengthen the Group’s marketing and R&D capabilities in the area of cardiovascular drugs. The Group also expects its major products to be included into the “National Basic Drugs Catalogue,” which will promote the sales of such products in a more effective manner.

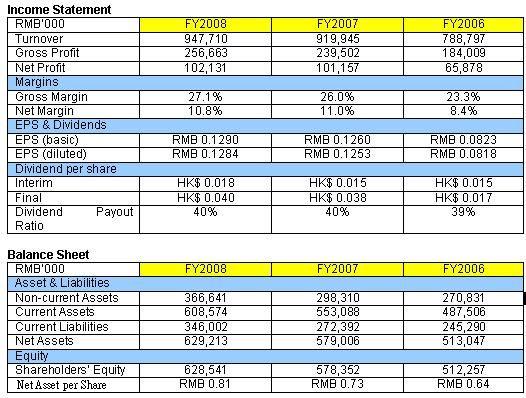

| Consistent dividend payout of 40% Dawnrays Pharmaceutical achieved stable growth in revenue over the past three years. Gross profit margins have improved as a result of higher contribution from the higher margin system-specific medicines. Given the size of the production facilities, the non-current assets seem to be underweight. Ms Wu Jihong, Financial Controller explained, “We value the land and the plants at historical cost. As a result, our long term assets can be said to be undervalued.” As at 31 December 2008, the Group had RMB 39 million in cash and cash equivalents and notes receivables of RMB 227 million (which are all issued by the bank and can be converted into cash easily in the PRC). “We have sufficient financial and internal resources to fund our capital expenditure in 2009/2010," Ms Wu added. Since it was listed in 2003, the Group has been consistently paying dividends of around 40% of net profit after tax. The share price at 21 April 2009 was 74 cents, translating into a 7.8% dividend yield. The stock is trading at a historical PE of 6X. |

Related story: SWINE FLU: Is outbreak a buying op now?