Mark Lee is with Aries Consulting in HK, and can be reached at

THE SLOGAN of Fujikon Industrial “A Sound Company” pretty much describes its field of expertise. But is it a “sound” investment too?

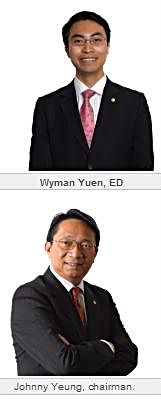

It was already 5 pm when we arrived at Fujikon’s office to meet Mr Wyman Yuen, its Executive Director, to learn more about its business.

All these products are sold on an ODM/OEM basis to well-known brands and international customers. The company’s manufacturing facility is located in Dongguan city, Guangdong province.

Mr Johnny Yeung, Mr Simon Yuen and Mr Michael Chow co-founded the Company in 1982, producing audio headsets. It progressed to produce audio speaker systems and headphones for airline in-flight entertainment before expanding into the fast developing multimedia space in the 1990s.

The company has transformed itself from being a private label manufacturer to being a partner to top-tier customers. The Company went public in 2000 in Hong Kong.

Every year, Fujikon can produce up to 60 million pieces of headphones a year. It employs over 10,000 workers.

Export-oriented business a sunset industry?

Export-driven industries have come under heavy pressure with falling demand from the US and Europe markets. As the pie gets smaller, the competition intensifies. So what is Fujikon doing to stay ahead?

Mr Yuen said: “This is a bread-and-butter industry. Somebody has to produce these products and China still works out to have the best cost-benefits ratio.”

“By having our integration production facilities in Dongguan, we can streamline our production process, thereby increasing our operational efficiency. We have formed strategic alliances with global partners and we work towards broadening our product offerings. This will greatly enhance our reputation internationally,” Mr Yuen added.

For its HY2009 (ended Sept), revenue declined 5.4% to HKD 787 million. Gross profit dropped marginally to HKD 164.1 million. Gross margin improved from 20% to 20.9%. The Company is doing its best to keep the “full-year gross margin above the 20% mark,” said Mr Yuen.

While sales for its core audio and multimedia product segments rose, the Company experienced a drop in sales for its communication product segment in HY2009 as it was undergoing a transitional period from an OEM model to an ODM business model.

The Company is working with a leading European mobile phone manufacturer to roll out a new range of products, while phasing out the lower margin products. Hence, sales for its communication segment dropped from HKD 286 million to HKD 149 million. Mr Yuen pointed out that its multimedia product segment recorded a 71% growth y-o-y to HKD 132 million.

This is due to Microsoft’s increased orders for production of headsets to be bundled with its Xbox 360 game consoles during the period. In addition, there was a sizable growth in headset orders, used with personal computers, from a global manufacturer of multimedia products.

Infrared, Bluetooth and 2.4GHz technology to drive Fujikon’s growth

While a deteriorating global economy has brought about enormous challenges to Fujikon, the management has adopted a holistic strategy to deal with them. For a start, it is looking to make further inroads in the audio products segment. The management will seek to strengthen ties with top-tier customers with the objective of working together to capture a larger market share of the high-end headphone market by providing superior quality acoustic products. Mr Yuen sees good market demand for wireless headphone products that are equipped with infrared (IR), Bluetooth, and 2.4GHz digital audio capabilities.

“These are the technologies that we are looking to explore to enhance our product range,” he added. He also highlighted the strength of the company’s balance sheet. As at 30 September 2008, the Company had zero long-term borrowings and only HKD 47.4 million in short-term borrowings. Cash and cash equivalent stood at approximately HKD 360.6 million.

“The customers want to know if you are financially strong to be their outsourcing partner. We are in a net cash position and have unused trade facilities of around HK 223.1 million as at 31 March 2008,” Mr Yuen concluded.

Fujikon has declared dividends consistently over the past few years. In FY08, the Company declared 3 (HK) cents as interim dividend, a final dividend of 5 (HK) cents and a special dividend of 7 (HK) cents. The Company is looking to maintain its interim and final dividend in 2009.