| Reit/Shipping Trust | Buyer | Date of purchase | No. of shares purchased | Average price/share (S$) | Nov 7 price |

| Cambridge Industrial | Hunter Hall Investment Management | 24-10-2008 | 2,096,000 | 0.25 | 27 cents |

| UBS AG* | 29-10-2008 | 1,044,000 | Not available | ||

| Schroder Investment Management Group* | 30-10-2008 | 216,000 | Not available | ||

| MacarthurCook Industrial | MacarthurCook Limited | 24-10-2008 | 1,243,000 | Not available | 39 cents |

| MacarthurCook Limited | 20-10-2008 | 3,714,000 | Not available | ||

| Lion Global Investors | 20-08-2008 | 936,000 | Not available | ||

| Ascendas India Trust | Philip Yeo Liat Kok | 31-10-2008 | 100,000 | 0.4897 | 55 cents |

| Burton Ltd | 29-10-2008 | 1,856,000 | 0.4176 | ||

| Saizen Reit | ASM Asia Recovery Fund | 14-10-2008 | 386,000 | 0.2895 | 21 cents |

| ASM Asia Recovery Fund | 13-10-2008 | 3,585,000 | Not available | ||

| ASM Hudson River Fund | 13-10-2008 | 717,000 | Not available | ||

| Rickmers Maritime | Andreas Sohmen-Pao | 04-11-2008 | 100,000 | 0.45 | 45 cents |

| Lim How Teck | 16-10-2008 | 50,000 | 0.52 | ||

| First Ship Lease Trust | American International Assurance * | 31-10-2008 | 599,000 | Not available | 50 cents |

| Cheong Chee Tham | 23-10-2008 | 50,000 | 0.5175 | ||

| Philip Clausius | 22-10-2008 | 50,000 | 0.5165 |

*Schroder and UBS had sold some Cambridge Industrial shares earlier in October.

UBS and Lion Capital sold some Macarthur Cook Industrial shares in August.

AIA had sold some First Ship Lease Trust shares earlier.

Rickmers directors Andreas Sohmen-Pao and Lim How Teck were buyers of Rickmers units last month.

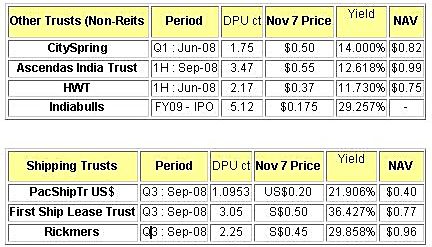

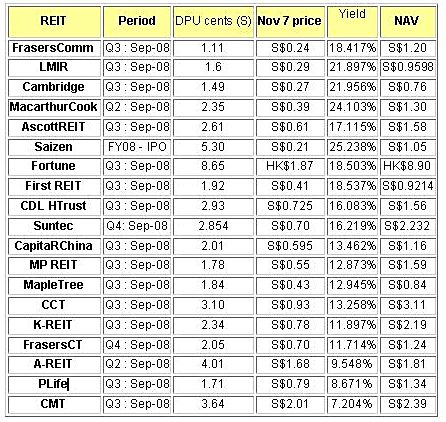

THE PRICES of Reits and shipping trusts have been bashed down so much – especially in October - that their annualized yields are looking awesome.

There is deep uncertainty though over whether the dividends of the recent past can be sustained in the future. The shipping industry is caught in a perfect storm, while the Reits are facing higher costs of financing.

On the flip side, shipping leases and property leases are multi-year in nature, so there’s cashflow so long as clients don’t default.

At Cambridge Industrial Reit, for example, the weighted average remaining lease term of existing portfolio of 43 properties remained stable at 5.9 years as at 30 September 2008.

That’s only one factor. What if management decides to cut the dividend payout in order to hoard cash?

That’s what Saizen Reit hinted on Oct 17: ”The management may review the dividend policy with a view to preserving liquidity and cash resources at this volatile market.”

Saizen, whose portfolio of properties is located in Japan, is buffetted by news of a downturn in the Japanese real estate market and the collapse of large Japanese developers.

Saizen Reit is down 73% from a year ago.

Just the opposite has happened at MacarthurCook Industrial Reit. On Nov 7, the management announced a 26% increase in distribution per unit (DPU) to 2.35 cents (xd on Nov 13) as net property income jumped 58% in Q2 ended Sept.

Taking DPU in Q1 and Q2 into account, the Reit's annualised yield is 24%, based on its closing price of 39 cents last Friday.

Similar good news has just come out of Rickmers Maritime, which announced that it expects “strong and growing cashflow in the next 12 months.”

Its payout for Q3 ended Sept will be 2.25 US cents per unit (xd on Nov 13), unchanged from Q2’s. Annualised, the yield is 29% based on a recent stock price of 45.5 cents.

Valuing Reits and trusts is a science, and takes into account many other factors, especially gearing.

That’s why on balance, a sharp commentator at our forum, MacGyver, isn’t putting his money on Reits and trusts: “I am still of the opinion that some REITs and shipping trusts will collapse or be taken over in 2009 as they experience difficulties in refinancing their loans.

“The REITs analysts in Singapore are still too bullish. They probably are too young to have experienced the last shipping crash.”

Source: http://sreit.blogspot.com/

It is worth noting that there are sizeable purchases made by fund managers and insiders of the Reits and trusts, as our compilation above illustrates.

Is it then a case of the Reits and trusts being highly attractive on a risk-reward ratio? That’s not implausible.

Some of the purchases were made after an earlier paring down of stakes by the holders, which suggest that at current levels the investments are looking good.

CIMB-GK in its Nov 7 report highlighted Parkway Life Reit as its top pick for its limited earnings downside and strong financial flexibility. CapitaCommercial Trust emerged as a deep-value pick with the lowest P/BV of 0.28x among REITs under CIMB’s coverage, and below the S-REIT average of 0.5x.

“We believe that all negatives have been priced in and forward yields at 12.2% (CY09) look attractive.”

As for Cambridge Industrial Reit, CIMB-GK has increased its cost-of-debt assumptions, and found that forward dividend yield of the Reit in FY09 remains attractive at 17.3% due to overselling of the stock.

“CIT remains the cheapest industrial REIT under our coverage, with a P/BV of 0.36x and forward yields of 17.3%.”

There is a blog that tracks analyst recommendations on Reits. Check it out: http://sreit.blogspot.com/

There is also an excellent site for tips on how to value Reits.

Source: http://sreit.blogspot.com/

Recent stories:

SHIPPING TRUSTS see opportunity in shipping slump

ASL MARINE, FIRST SHIP LEASE TRUST: Insider buying spree

You are welcomed to post a comment or question at our forum.