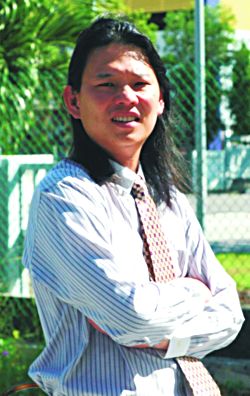

ALONG WITH a couple of investment professionals, I recently sat down for lunch with Danny Tan, 43, chairman and president of Nico Steel Holdings, and it proved to be a highly enjoyable affair.

In a mix of English and Mandarin - and some breathtaking Hokkien expressions - at Suntec City’s Soup Restaurant, he gushed about his little ‘baby’ (which is what he calls his business), the competitive PRC industry, and his love-hate relationship with the Taiwanese.

His company, Nico Steel, is a metallurgical service centre solutions provider. Put simply, it is engaged in the business of providing innovative metallurgical solutions to meet the needs of a host of industries. Here’s how Danny elaborated on the business:

“Basically, we are a material supplier. We talk to customers and understand their material requirements. Then we tailor alloys to their specifications. We develop our own proprietary chemistry, which may improve upon traditional industry standards in terms of cost or quality.

“Take for instance, a certain product may require high heat resistance and high electrical conductivity but must be light and cost-efficient. The usual material would be copper. However, copper price has more than tripled to over US$7,300 per tonne. Hence, we attempt to create an alloy with these characteristics at a 30-50% lower cost to the customers. Nico Steel has the knowledge and experience in mixing base metals to give us a reasonable yield. This gives us a competitive edge over industry peers.”

OCBC Research wrote in a report last year that the management believes “Nico has uniquely positioned itself by developing strong marketing relationships with end users of its products. Not only do these relationships help Nico understand where it can add the most value, but they also allow it to cut to the head of the queue as end-users may pre-approve or even request for Nico's products when dealing with Contract Manufacturers, especially important if its product is a replacement for a widely used industry standard. Being the first-mover is crucial to Nico's survival as a value-adding player, and its R&D and end-user marketing efforts have helped its case so far.”

Listed on SGX-SESDAQ in April 2005, the Company’s main customers then were the metal stampers in Singapore like Seksun and Miyoshi.

Danny was happy to update us that more than 60% of his company’s revenue now comes from China.

Danny explained between sips of ginseng soup: “We are in a different playing field now. Our competitors are the MNCs from Europe, Japan and Korea as well as small PRC suppliers. While I used to marvel at orders for 500 tonnes in Singapore, this has become a daily event in PRC.”

Nico Steel Executive Director, Steven Tang, chipped in: “Nico Steel was focusing on the HDD market in Singapore. After our listing, the directors felt that we had to diversify our markets so as to reduce our reliance on this sector. After 3 years of hard work in the PRC, we are now firmly entrenched in the telecommunications and consumer electronics industries in China.”

Nico’s end-users include Motorola, Nokia, Seagate, Hewlett-Packard, Toshiba, and BenQ. Its direct customers are mainly Taiwanese OEM and ODM players. A guest at the lunch asked if it was easy working for Taiwanese customers.

Danny replied: “Singapore businessmen and investors are worried because they have heard only half the story. While Taiwanese manufacturers are famed for squeezing your margins and for long payment terms, they are also the ones who are most willing to work with you if you have new ideas that can help them in cost savings. If you treat them as partners, you will realize that they also want to make sure that we (the suppliers) remain profitable. If you treat them solely as customers, then the relationship is strictly business. If bad times come, don’t expect favours from them. ”

Another asked about the PRC credit crunch situation, and Danny replied: "It's really bad. Many banks are pulling back their loans to the PRC SMEs. We believe it would affect most of the industries in China, including ours. Already, some companies in our industry are having difficulties collecting payment from their customers.

“However, we see opportunities in this crisis. Nico Steel is borrowing from Singapore banks at a competitive rate compared to our competitors in PRC. Even though our customers may be hit by the credit crunch, we bought credit insurance for our receivables and would remain relatively insulated from bad debts.

“Several of our competitors are already sweating over their receivables to these customers. They never have a habit of buying credit insurance. If the credit crunch prolongs, we could be seeing a massive industry consolidation. When that happens, Nico Steel would have the financial strength to gobble up a couple of good ones.”

Does that mean that Nico Steel is already talking to potential M&A candidates? Danny answered: “Discussing with potential partners is part and parcel of the Company’s daily operations. We have nothing concrete at the moment. Our immediate plans are to strengthen our electroplating operations, which we started last year. There are not many companies in China who have the financial strength to expand capacity and take on new projects now. Nico Steel has good orders coming in and we are capitalizing on the current situation to grow our market share in this niche market.

An analyst asked how Nico Steel started life. Danny recounted his early days as a Canon salesman. “I was a salesman in Canon, selling photocopiers. At that time, my brother, Steven, was working for a Japanese steel mill. With his technical expertise, we quickly identified a niche market to venture into steel trading. We started with S$33,000, monies pooled together by my parents. It was a lot of hard work at first. We did the sales, wrote the invoices, did the transportation ourselves etc...

"Today, the two of us are still very hands-on. We rotate our time in our Suzhou plant so as to supervise the production. I am happy to say that the S$33,000 has materialized into a company with sales of around S$58 million last year. We intend to keep going. I have not made any retirement plans and I believe we would continue until we are in our 60s.”