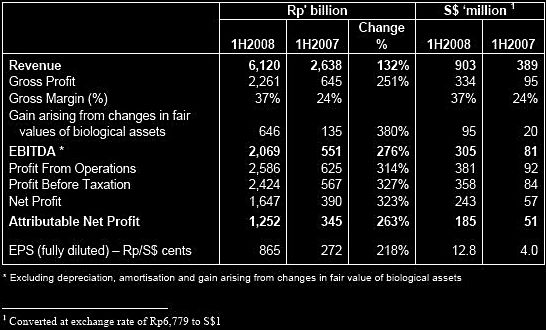

INDOFOOD AGRI RESOURCES, a major vertically integrated agribusiness group and manufacturer of leading brands of edible oils and fats in Indonesia’s, has posted a 263% increase in its net profit attributable to shareholders to Rp1.3 trillion (S$185 million) for the six months ended 30 June 2008.

The group’s 1H2008 revenue was up 132% to Rp6.1 trillion (S$903 million) with improved performance recorded across all business divisions.

Gross profits soared 251% driven by acquisitions, organic growth and rising CPO prices.

CPO sales volume increased from 134,731mt to 344,240 mt. Sales of branded cooking oil increased by 18%, and gross margin improved from 24% in 1H2007 to 37% in 1H2008.

Mr Mark Wakeford, CEO and Executive Director of IndoAgri said, “We have achieved another set of strong results and improved margins as we continue to capitalize on our integrated agribusiness model. Most notable is the improved CPO production, and the 18% growth in our sales of branded cooking oil.

"Our focus remains on improving plantation yields, new planting program and cost efficiencies to ensure we remain a low cost producer. We also announced in July the completion of the refinancing of the Rp 4 trillion of bridging financing for the Lonsum acquisition, and our balance sheet remains strong with a net debt to equity ratio of 0.34. ”

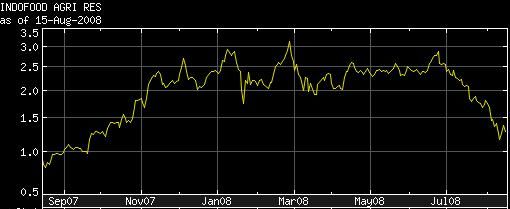

Following the release of the results.last Thursday, UOB Kayhian and DMG & Partners issued 'buy' calls on the stock. Target prices are $3.27 and $2.92, respectively. Excerpts of other broker reports are presented below.

On Friday, palm oil futures in Malaysia, the global benchmark for the commodity, plunged to the lowest in 15 months on speculation Chinese buyers may have canceled soybean and vegetable oil cargoes, and as other commodities fell.

Bloomberg News reported that palm oil for October delivery, the most-actively traded contract on the Malaysia Derivatives Exchange, slumped by as much as 8.7 percent to 2,392 ringgit (US$715) a metric ton, the lowest since May 9, 2007. The contract closed at 2,453 ringgit.

Goldman Sachs: Target price $3.10

Goldman Sachs maintained its ‘buy’ rating but lowered its 12-month target price to S$3.10 (prior S$3.20) using the same 14X 2008E P/E multiple.

It believes its full-year 2008E forecast is achievable, given that 2H08 is seasonally going to be stronger on higher CPO production (IndoAgri believes that 2008E should see typical 1H:2H split of 45%:55%).

Rising fertilizer prices are partly offset by increased yields and the company anticipates that 2008E CPO production costs may rise 10-15% YoY (our estimate assumes a 20% YoY increase), with fertilizer comprising 25-30% of costs. Fertilizer costs increased QoQ in 2Q08 mainly due to ahigher rate of application while the impact of higher fertilizer prices shouldbe more visible in 2H08.

Key risk: “CPO or oil price decline, or if management does not reduce costs at London Sumatra IPas we expect.”

Credit Suisse: Target price $2.40

”We continue to be positive with IFAR as we believe that the IFAR’s fundamental remains robust. In addition, IFAR is currently trading at the lowest 08E and 09E PER (excluding for biologicalasset revaluations) of all CPO counters under our coverage.

“We maintain OUTPERFORM rating on IFAR but cut our target price multiple for IFAR from 14x 2009E P/E to 11x 2009E P/E given weak market sentiment. Our new target price of S$2.4 is based on 11x 09E P/E. IFAR continues to be our top pick for Indonesia CPO sector given that the stock is trading at the lowest 2008E and 2009E P/E of all CPO counters under our coverage.

”We maintain OUTPERFORM rating on IFAR, but cut our target price by 27% to S$2.4reflect (1) our lower 2009E net income estimates and (2) lower target price multiple (trimmed from 14x 2009E P/E to 11x 2009E P/E) given weak market sentiment.”

CIMB-GK: Target price $1.63

”We have raised our earnings estimates by 3-6% for FY08-11 to account for the better contributions from cooking oils & fats and commodities. Our new forecasts assume lower earnings in 2H08 due to weakerCPO prices and higher estate costs. Our target price has been raised to S$1.63 (from $1.53) after our earnings revisions, still based on 10x forward P/E. The share price has corrected by 34% in the last month. As such, it now offers 19% upside to our revised target price, which is in line with expected market returns. Coupled with the better performances from its downstream units, we upgrade the stock to NEUTRAL from UNDERPERFORM.”

AMRESEARCH: Target price $1.50

”We maintain a SELL on Indofood Agri-Resources even though its share price has fallen belowour target price. We see little potential for a re-rating as CPO prices are expected to remain under pressure. Our target price is based on FY09F PE of 10x.

“We are revising IFAR’s FY08F earnings forecast downwards by 25% to account for lower CPO price assumption of RM3,000/tonne versus RM3,500/tonne previously and higher-than-expected minority interest.”

Recent story: INDOFOOD AGRI: More than just palm oil