China Kangda executive director An Fengjun (left, in jacket) and CFO Stanley Leung briefing analysts today. Photo by Sim Kih

RABBIT MEAT tastes similar to chicken, is lean and low in cholesterol. The meat is in demand in some parts of the European Union and Russia, which accounted for a jump in rabbit meat sales by China Kangda Food.

In the second quarter of this year, its rabbit meat sales amounted to RMB48.1 million, up 99% from the same period last year.

Taken together, the first and second quarters of this year saw its rabbit meat sales soar 85% to RMB83.4 million.

Listed on the Singapore Exchange, China Kangda is one of only three companies in the PRC which has the European Union authorization to sell its rabbit meat to the EU. Of the three, China Kangda is the largest.

Aside from EU authorization, China Kangda CFO, Stanley Leung, told analysts at a briefing today (Aug 12): “This business has a high barrier to entry. You need to know the breeding techniques, and ensure quality in the production process.”

Rabbit meat sales made up 18.3% of the company’s total sales in the first half of this year. The percentage contribution is set to jump as China Kangda is doubling its production capacity to 12,000 tonnes annually by next year.

A little rabbit at China Kangda's farm is the subject of attention of visiting Singapore analysts recently. Photo by Leong Chan Teik

The move is set to expand China Kangda’s overall profit margin given that rabbit meat commands a higher margin than other business segments.

This can be seen in the fact that altgough accounting for 18.3% of sales, rabbit meat contributed 30% of the company’s gross profit in the first half.

Net profit up 33.0%

China Kangda’s first-half results:

* Revenue up 47.4% to RMB456.1 million;

* Net profit up 33.0% to RMB60.2 million.

Aside from rabbit meat, China Kangda reported a jump in sales of chicken meat. In Q2, chicken meat sales rose 60.4% to RMB 105.4 million.

For the first half, sales jumped 93.5% to RMB 200.3 million.

Explaining the trend, Stanley said as pork prices in PRC shot up, chicken meat prices lagged behind which persuaded consumers to switch from pork to chicken.

China Kangda rears rabbits and chickens, which mean it is able to keep the lid on costs and yet increase selling prices. As a result, its gross profit margins on both rabbit and chicken meats have gone up.

In a third business segment, processed food, China Kangda reported a slight increase in sales. Its processed food is sold mainly to Japan. The company said it is about to launch two major products, which will boost the performance of the processed food segment.

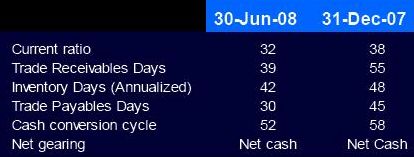

Healthy figures.

China Kangda was faced with an increase in operating costs in the first half, including:

* Selling and distribution expenses rose 30.7% to RMB6.2 million;

* Administration expenses rose 70.5% to RMB15.6 million.

China Kangda is in a net cash position, even after paying RMB61.8 million to acquire two subsidiaries, a move which is earnings accretive.

The company has cash and cash equivalents of RMB266 million as at the end of June.

Overall, China Kangda expects its growth momentum to continue for the rest of the year.

In the meantime, it is in the process of seeking a dual listing on the stock exchange of Hong Kong. “This is to increase investor exposure to our company,” said Stanley.

At 29.5 cents, the stock trades at a historical PE of 5.8 X.

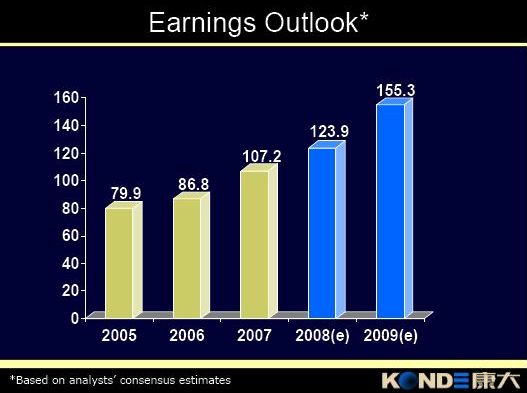

Earnings outlook for China Kangda

Read about NextInsight’s recent visit to rabbit farms: CHINA KANGDA: Insights into its production facilities.

Also, CHINA KANGDA: 'Olympic play with low valuations'