Fourth & final report

Analysts and fund managers at the road show in Capital Tower. Photo by William Lim / SageStudioCHINA ANIMAL Healthcare (CAH) is the biggest PRC manufacturer of powdered drugs used for preventing diseases in farm animals.

Analysts and fund managers at the road show in Capital Tower. Photo by William Lim / SageStudioCHINA ANIMAL Healthcare (CAH) is the biggest PRC manufacturer of powdered drugs used for preventing diseases in farm animals.Powdered drugs are administered to poultry because chickens do not have taste buds to detect the drugs mixed with their feed.

Pigs and cows, on the other hand, have to be injected with liquid drugs.

CAH's business model is unlike its competitors, which are mainly manufacturers selling to distributors who in turn have multi-levels of sub-distributors and retailers.

CAH, on the other hand, manufactures and then sells direct to 5,400 retailers in the villages – that is, the retailers who sell to the farmers. The retailers pay CAH cash on delivery, which averts the problem of debt that cannot be collected.

CAH has a sales force of 1,200 people who service the retailers across 28 provinces, municipalities and autonomous regions in China. It also employs 600 technical personnel who advise farmers on the use of the drugs.

At the "Bountiful Harvest - Agricultural Roadshow", Edwin Goh, the CFO, said this business model is CAH’s key competitive strength. “By doing so, we are able to save 30-40% of the gross profit margin. Our gross profit margin is about 70% - very high.”

The net profit margin is 30-40%, or about double CAH’s competitors’ margins, said Edwin.

Aside from village retailers, CAH also sells to 20 large poultry corporations, which get credit terms instead of having to pay on delivery.

Edwin Goh, CFO.

What CAH makes

It manufactures about 300 types of drugs, most of which are administered to farm animals on a regular basis – not only when they fall sick.

About 90% of CAH’s sales are powdered drugs. The chicken farmer spends about RMB 0.3-0.4 on powdered drugs for each of his chickens, which eventually can sell for about RMB20-25, according to Edwin.

The small cost means that farmers won’t cut back on the drugs and risk their chickens falling sick.

CAH has nine production lines which are GMP-certified.

Its existing production capacity is enough to support further expansion as the utilization rate is far from 100%, as the table shows:

| Powdered drugs (kg) | 2005 | 2006 | 2007 |

| Annual production capacity* | 1,764,000 | 4,684,000 | 4,684,000 |

| Actual production volume | 1,379,886 | 1,590,781 | 3,236,613 |

| Utilisation rate | 78.2% | 34% | 69.1% |

“To double or even triple sales, there’s minimal capex that we need at this point in time,” said Edwin.

China Animal Healthcare looks set for a boom year this year.Few big players

China Animal Healthcare looks set for a boom year this year.Few big playersAs a result of GMP implementation in early 2006, there are now 1,300 animal drug manufacturers in China, down from 2,400 in 2005.

Regulatory requirements continue to multiply, which will lead to further industry consolidation. “We may see 100-200 players remaining as time goes by,” said Edwin.

Currently, only 19 manufacturers have sales over RMB100 million, accounting for 21% of the market.

Integrating acquired companies: CAH has acquired seven businesses in the past when they were loss-making or just breaking even because they didn’t have a sales network.

CAH acquired them for RMB1-2 million each, which is relatively cheap, said Edwin, and "turned them into profitable companies almost overnight.”

That applies as well to a loss-making vaccine producer, Shanxi Longkeer, purchased for RMB 45 million in March this year: it broke even in the first month after.

CAH is looking to expand in the vaccine and injection drug segments.

Financials

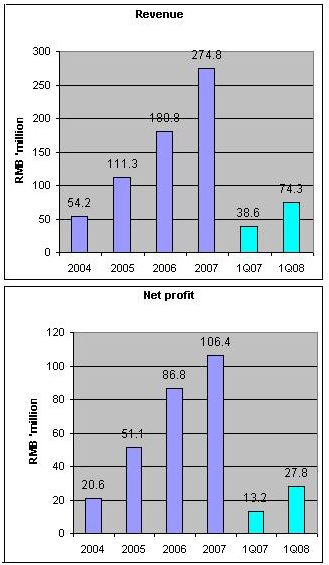

Q1 is typically the slowest because farmers sell off their livestock ahead of Chinese New Year and return to work after a long break.

In Q1 this year, sales shot up 92% to RMB74.3 million. Net profit was up 110% to RMB 27.8 million. Net profit margin is about 37.4%.

Typically, the first half accounts for about 40% of annual sales. At 16.5 cents, CAH stock trades at a historical PE of 16.3 X based on net profit of RMB 58.9 million after writing off goodwill of RMB47.5 million related to the reverse takeover.

The company has a market cap of $216 million currently.

Mr Wang, chairman of CAH, at a SGX event to mark the listing of CAH shares last year.Highlights of the Q&A session:

Mr Wang, chairman of CAH, at a SGX event to mark the listing of CAH shares last year.Highlights of the Q&A session:Q How much do you spend on R&D?

Edwin: At this point in time, very little: 0.3% in 2004, 2005 and 2006. The research work was done by research institutes. We don’t have to buy the drug formula. There’s no intellectual property. Nothing prevents my competitor from re-engineering the drug and selling it to the market.

We give the research institutes a subsidy to carry out their work. But we are setting up our own research lab. We foresee spending a total of RMB 20 million over the next 2-3 years, and that includes lab equipment and salaries.

Q You have 12 brands of drugs. Do your retailers know that you are behind all these brands?

Edwin: Retailers do know that but it doesn’t matter to them. They only require that they are the sole distributor of any brand in their village. Farmers are not brand-loyal. Animal drugs are generic – you don’t have Lexus versus Toyota.

But farmers are loyal to retailers as the latter give credit terms to regulars. Farmers don’t pay when they get the drugs but only when they have sold their livestock. Retailers want to be sole distributors of brands so they don’t have to compete on price with other retailers.

Q Can your existing 9 production lines be used to produce vaccine? And what is the capacity of Shanxi Longkeer?

Edwin: Our existing lines cannot be used to produce vaccine. Each line was set up for a particular purpose, and its GMP certification is narrow. Based on current infrastructure, which is being improved as we speak, we should be able to generate at least RMB100 million turnover this year.

Q About 8.5% stake is held by investors who are under a moratorium. When is their lock-period over?

Edwin: It was over on June 30.

Q: Can you shed some light on those who sold vendor shares (6.9%)?

Edwin: 40 million were from my chairman, Mr Wang, and the other 50 million were from pre-IPO investors. “Referral party” shares of 4.2% stake were for the deal-maker (for the reverse takeover of Colorland Animation, leading to the listing of CAH).

Q: Do you give subsidies to your retailers?

90% of CAH's sales are for drugs fed to chickens.Edwin: Yes. In 2006, we gave about RMB6 million to our bigger customers to get the necessary infrastructure to be ready for GSP. The background: GMP is targeted at manufacturers. There’s GSP for retailers and distributors in time to come. GSP governs storage conditions for drugs in terms of temperature, humidity, etc, and the transport of drugs, etc. We have not given any subsidy this year because the amount we have given is sufficient to see them through.

90% of CAH's sales are for drugs fed to chickens.Edwin: Yes. In 2006, we gave about RMB6 million to our bigger customers to get the necessary infrastructure to be ready for GSP. The background: GMP is targeted at manufacturers. There’s GSP for retailers and distributors in time to come. GSP governs storage conditions for drugs in terms of temperature, humidity, etc, and the transport of drugs, etc. We have not given any subsidy this year because the amount we have given is sufficient to see them through.There’s no firm news but we expect GSP to be implemented this year. That poses a threat to our competitors who have not helped their retailers and distributors to be GSP-ready. They will have a problem selling drugs.

Q Can you clarify your inventory turnover days?

Edwin: I expect inventory turnover days to hold steady at 14 days.

Earlier Agri Roadshow stories:

OCEANUS: "We are on the cusp of a tremendous jump in sales"

GMG taps on Africa's vast resources