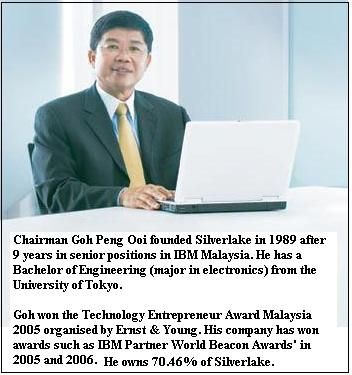

YOU MAY be aware of a Stock Challenge organized by NextInsight and that I am one of the invited participants. In my virtual portfolio is a stock called Sliverlake Axis, and I’m writing this article as many people are not familiar with it.

The company is a software services provider for banks, with a focus on Asian banking.

Here is how the company describes itself on its website: “Silverlake Axis is a leading provider of end-to-end universal integrated banking solution. The Group's award winning Silverlake Axis Integrated Banking Solutions are implemented at over 75 customer sites in Asia including 40% of the Top 20 Largest Banks in South East Asia.”

I shall not go too much into the details of what constitutes core banking software, which is what Silverlake provides.

Generally, my research on a company’s business does not go beyond the first layer. Instead, I generally try to understand the competitive strengths of the company and its place in the industry value chain, rather than its product specifics.

Silverlake (market cap: S$381 million at stock price of 34 cents) has two key characteristics which appeal to me:

1. Financial strength

It has a very clean balance sheet with little debt and a lot of cash. It has a business model which produces strong operating cashflow because it collects licence income for its software. Its recurring capital spending is modest.

The cash it generates, plus the contracts it secures from Asian banks, suggests that the intangible assets associated with its Silverlake software are significant.

As a result, the fact that it’s trading at 5X NTA (net tangible assets) should not be given too much negative attention.

If a stock continues to generate high returns on its equity (>50%) with limited cash reinvestment, then that is a classic Buffett stock (think See’s Candy).

Related to its ability to generate strong cashflow, Silverlake has strong dividend payouts. It even issued a quarterly dividend of 0.5 cents recently after its Q3 result, bringing its payment to date to 2 cents in the current financial year.

I always like to focus on financial and earnings strength and sustainability, plus dividend sustainability, first and foremost because it gives a downside cushion – that is, it automatically allows me to manage the downside risk.

FY JUNE |

2006 |

2007 |

2008F |

Turnover (RM m) |

124.5 |

137.3 |

177 |

Net profit (RM m) |

79.6 |

80.0 |

113 |

EPS (S cts) |

3.1 |

3.1 |

4.3 |

Source: DBS Vickers

2. Business potential

One of my main investing approaches is to pick sectors that I like and Malaysian banking really does look quite interesting to me, especially Islamic finance. Malaysia has the biggest share of Islamic banking: it accounts for 70 percent of total global Islamic bonds in issue and 40 percent of global Islamic unit trust assets (see my article on Malaysian banking and real estate).

Arabs love Malaysia. They’re busy buying up stakes in Malaysian banks: RHB, EON, Affin. Think petrodollars and you will realize that the potential is enormous. The barriers to entry are immense: there’re few Muslim countries with reasonably strong financial infrastructure. Even as the Arabs come in, Malaysian banks are expanding outwards. Maybank is the best example, albeit getting some bad press as well from its aggressive acquisitions in Indonesia and now Pakistan, and it might not stop there.

What this all means for a Malaysian banking solutions provider like Silverlake is threefold:

* as the best-known Malaysian banking software company the potential of serving new Arab banks setting up shop in Malaysia is exciting;

* it can use its connections with these Arab banks to establish a beachhead in the emerging banking market in the Middle-East itself (it has already made a breakthrough there last year);

* it can follow its key Malaysian banking customers out of Malaysia (it has a strong working relationship with Maybank).

There are risks, too

Nowadays in the aftermath of the US subprime mortgage crisis, people won’t touch anything banking-related with a ten-foot pole.

In the case of Silverlake, it is important to note the geographical distribution of its banking customers.

It has a predominantly Asian (indeed, mainly Southeast Asian) clientele but it is being broad brushed together with other players in the financial industry. Its downgraded valuation is actually a good thing for the stock and its buyer, not a bad one.

The main risks are:

- Failure to secure more contracts. The last quarter saw a significant drop in licensing revenue due to fewer contracts, and a subsequent drop in share price. This should be monitored.

- IT spending of banks goes down globally as they become more cautious. Right now general IT industry vibes are that IT spending is still strong (which is why HP bought EDS, I think).

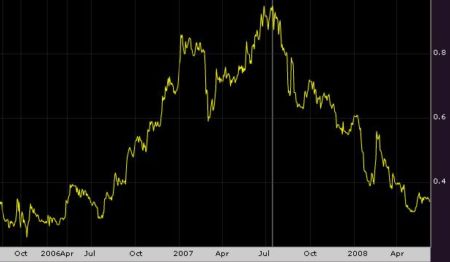

This is an above-average risk, high potential return stock, in my view. But the risk was higher several months back when it was trading at 60-80 cents. Now the valuation risk is significantly reduced at 30-40 cents. Over a down-and-up cycle, this could be a multi-bagger if Silverlake plays out its cards well.

Brokers' views

DBS Vickers, Kim Eng Securities and OCBC Securities have ‘buy’ recommendations on Silverlake at current prices. As far as I know, there are no "sell" calls around.

DainelXX is a 30-something investor who is an engineer by training. His blog is http://mystockthoughts.blogspot.com/