Mark Wakeford, 44, CEO of Indofood Agri. Photo by Sim Kih.

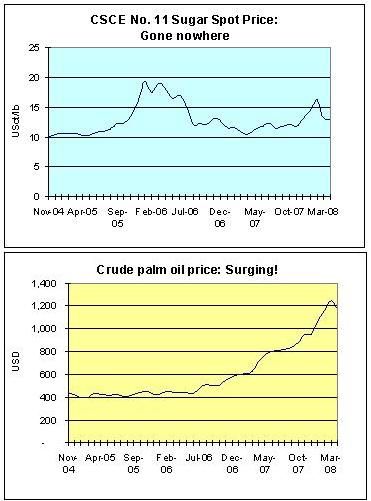

PRICES OF agricultural commodities are widely known to have been on an upswing in recent years. But sugar?

The trend for sugar has been far less uplifting (see chart below) but the future could bring interesting rewards to investors - at least in Indonesia, and at least that’s what Indofood Agri Resources Ltd (IndoAgri) thinks.

Largely perceived as being a palm oil play, IndoAgri (recent market capitalization: S$3.7 billion) intends to add a sugar plantation to its expanding agribusiness.

There is at least one key benefit from that. “Different crops have different price cycles,” noted Mark Wakeford, CEO of IndoAgri, in an interview on Tuesday (May 20) with NextInsight at his office in Raffles Place.

IndoAgri is a unit of PT Indofood Sukses Makmur Tbk, one of the world’s largest instant noodle makers and flour milling company which is controlled by tycoon Liem Sioe Liong’s eldest son, Anthony Salim.

IndoAgri, whose core competence is managing plantations, intends to acquire – via a 90%-owned subsidiary – a 60% stake in PT Lajuperdana Indah by injecting S$56 million new capital into the target company.

Sugar cane: Likely positive trend in price in the future. Photo: stock.xchng

PT Lajuperdana owns a 21,500-hectare sugar cane plantation in South Sumatra. That's about a third the size of Singapore. Approximately 18,600 hectares is intended to be cultivated with sugar cane. Currently, 2,800 hectares is planted with sugar cane.

“The sugar industry is an attractive proposition with growing demand in both the Indonesian and international markets,” according to IndoAgri’s announcement on the SGX website on May 10.

“Domestic demand for sugar in the Indonesian market is increasing, driven by factors such as rapid population growth, the rapid development of the processed food and beverage industries, and the expansion of sugar-based industries such as ethanol processing which utilises molasses as a basic raw material.

“This, coupled with a shortfall in domestic supply in Indonesia and a prevailing world shift in land use from the growing of food crops to the growing of energy crops, implies a likely positive trend in the price of sugar in the future.”

Mark said that raw sugar and molasses obtained from the PT Lajuperdana plantation would be sold to third parties.

In time, IndoAgri may venture into vertical integration for its sugar business but its priority now is to increase the planted area and complete in two years' time the construction of a US$120-million sugar factory, he added.

Sugar cane and other crops that are part of IndoAgri’s portfolio will, going forward, increase in importance with respect to the company’s revenues. In comparison, its SGX-listed peers, Golden Agri Resources and Wilmar, are largely palm oil plays with soyabean businesses.

Rubber price has risen nearly three fold in four years. Chart adapted from www.sicom.com.sg

Rubber plantations a third the size of S’pore

Then there is the rubber business too.

Until last November, IndoAgri had 5,000 hectares of rubber plantation. It subsequently acquired a 64.4% stake in PT Perusahaan Perkebunan London Sumatra Indonesia TBK (London Sumatra) for S$935 million.

London Sumatra owns 16,000 hectares of rubber plantation. Combining that with IndoAgri’s would result in 21,000 hectares, which is the size of about a third of Singapore.

IndoAgri and London Sumatra sell crumb rubber (blocks of high-grade rubber) and sheet rubber (low grade) to third parties in Asia and the US for making consumer products such as tyres. So, no vertical integration here either.

Cocoa, coconut, tea

These crops contribute on a small scale to Indofood’s revenue.

London Sumatra owns 2,600 hectares of cocoa plantation in Java. The cocoa is processed and exported to confectioners, mainly in Europe, such as chocolate manufacturers.

London Sumatra has a tea plantation outside of Jakarta, producing 12 different grades of tea which are sold at auctions in Jakarta mainly for local consumption. In time, IndoAgri may go for vertical integration by developing its own brand of tea for consumers in Indonesia

For the coconut business, Indofood currently buys copra to produce coconut oil for export to Europe. It doesn’t own coconut plantations.

Palm oil: A vertically integrated business for IndoAgri.

Palm oil – the No. 1 contributor

By virtue of the sheer size of its planted area (approximately 86% of IndoAgri-London Sumatra’s combined 187,000 hectares as of end-2007), palm oil is the key contributor to Indofood’s revenue.

IndoAgri's has a vertically integrated business for palm oil, with refineries located in Medan, Jakarta and Surabaya, the three biggest cities in Indonesia. They produce margarine and cooking oil.

IndoAgri has a 38% share of the Indonesian market for branded cooking oil, margarine and branded oil and fats. The high-end of the market is less affected by inflation.

Mark cited an example: “For our cooking oil, we increased the price by 56% last year, and another 20% this year. Yet our Q1 sales volume this year were 20% ahead of Q1 last year.”

Assuming each household buys four litres of cooking oil a month, the extra cost would be just US$2, said Mark. "IndoAgri can achieve higher margins on branded cooking oil than unbranded, hence we compete only in the branded section."

Golden Agri and Wilmar, however, produce unbranded cooking oil for the masses, many of whom probably would not be able to bear a US$2 increase a month.

Charts by NextInsight

Amazing goals

By any measure, planting 5 million palm oil trees a year is an amazing feat - that's the equivalent of a tree for each resident of Singapore.

But that's what IndoAgri and London Sumatra plan to carry out this year on 37,000 hectares of Indonesian land, which is an area slightly bigger than half the size of Singapore.

Currently, IndoAgri and London Sumatra have 192,000 hectares of planted area – that is nearly three times the size of Singapore – of which 166,000 are for palm oil. There already are about 20 million trees!

When mature, they are harvested every 10 days by 25,000 workers.

Aside from its expertise in managing plantations (which involves culling weak plantlets in the nursery, subsequently nurturing the rest in the field with adequate amounts of fertilizers and regularly getting rid of weeds, etc), IndoAgri and London Sumatra have expertise in breeding seeds for palm oil plants.

The results are telling. IndoAgri and London Sumatra obtain a yield of about 5.5 tonnes of crude palm oil per hectare annually, significantly higher than the 3.6 tonnes achieved by Indonesia’s operators on average and 3.8 tonnes by Malaysian operators.

IndoAgri and London Sumatra may surge further ahead in their quest for higher yield. They are developing seeds that could yield seven tonnes of oil per hectare annually when the trees enter their prime age seven or eight years after planting, said Mark.

At today’s prices, the extra yield of 1.5 tonnes translates roughly into US$1,500 per hectare of revenue. The potential financial upside does look very sizeable, given that IndoAgri and London Sumatra collectively own 166,000 hectares of plants with varying levels of maturity.

| INDOAGRI Rp’ million | 2006 | 2007 | Q1 ’08 (Growth vs Q1 '07) |

| Sales | 4,088,900 | 6,505,642 | 2,849,823 (+137%) |

| Net profit attributable to equity shareholders | 646,506 | 889,094 | 542,085 (+525%) |

| EPS (Rp) | 648 | 671 | 374 (+412%) |

Indofood Agri website: www.indofoodagri.com

Recent NextInsight story: AGRICULTURAL commodities on the upswing