CHALLENGES LURK in China’s fast-growing textile industry which will lead to a restructuring. The fittest which survive will emerge with greater dominance.

China’s zipper industry is enjoying a boom driven by demand for apparel and sports goods.

Its textile industry is expected to grow about 20% a year over the next 5 years, according to China Jianyin Investment Securities.

Yet price wars and rising costs of labor and raw materials are forcing smaller players in the labor intensive zipper trade to either close down or switch to higher margin products.

"Producers of low quality zippers without branding will not have the margins to survive,” said Hong Qing Liang, the CEO of China’s largest zipper maker, Fuxing, in a recent interview with NextInsight.

Besides focusing on higher-tier zippers, Mr Hong intends to cut production staff strength 30%-40% by automating production lines.

Even for now, Fuxing is an example of a business with good margins: its 1Q08 net margins spiked a hefty 10 percentage points upward y-o-y.

1Q08 sales edged down 2.7% to Rmb 190.0 million, while net earnings grew 63.7% y-o-y to Rmb 49.5 million.

|

1Q08 |

Revenues |

Net Profit |

Net Margin |

|

Fuxing |

FLAT -3% |

UP 64% |

26% |

|

SBS Zipper |

UP 8% |

FLAT 0% |

8% |

In close competition with Fuxing’s sales performance was

Shenzhen-listed SBS Zipper, which grew 1Q08 top line 8% to Rmb 171.1 million.

However, SBS Zipper’s net earnings growth was a flat 0% at Rmb 12.5 million. Fuxing’s net margins works out to be 26%, compared to SBS Zipper’s paltry 8%.

Both companies have a niche in the mid-tier zipper market, so what accounts for the difference?

From mass market zipper chains to premium finished zippers

The maturing Chinese consumer is demanding more of lifestyle products that express individualism.

This means demand for low quality or commodity zippers is being replaced by premium zippers that fetch higher margins.

That’s why Fuxing wants to move up the value chain by investing in facilities for premium zippers.

As much as Rmb 33.83 million from the company’s IPO last September went toward facilities for premium zippers at its HQ in Jinjiang (Fujian).

The company started moving up the value chain in 2006, when it shifted its focus from zipper chains to finished zippers.

From 5% in FY06, sales contribution of finished zippers had grown to 21% for FY07. Zipper chains contributed 37% while zipper sliders contributed 42% during the last financial year.

Having more finished zippers in the company’s product mix was also the reason Fuxing’s 1Q08 gross margins expanded two percentage points y-o-y to 38%.

Additional facilities in Jinjiang, Fujian and Shanghai to produce finished zippers are expected to be operational by 1H08.

“We price our premium, mid and low-tier zippers to generate gross margins of 40%, 30% and 20% or more, respectively,” revealed Finance Director Hong Ming You.

Target leading sporting and apparel labels

By reserving production capacity for China's leading sports and fashion apparel manufacturers, the company eliminated the need to provide for doubtful debts for the current quarter.

Most zippers used by Anta (安踏), one of China’s leading sporting footwear brands, are supplied by Fuxing, said the management.

Other customers which are big names on China’s fashion apparel and sports scene include Sept Wolves (七匹狼), K-Boxing (劲霸), Xtep(特步) and 361-degree.

Fuxing's sales growth was surprisingly flat but trade receivables were decimated: from Rmb 102 million in 1Q07 to Rmb 9.6 million in 1Q08.

No allowances for doubtful debt were made for 1Q08, compared to Rmb 16.9 million in 1Q07.

As a result, its 1Q08 general and admin expenses on the profit and loss statement dropped drastically by 84.8% y-o-y to Rmb 2.9 million.

Cash flow from operations improved significantly as a result, up 15-fold from Rmb 5.8 million for 1Q07 to Rmb 85.6 million for 1Q08.

UOB Kayhian's target

UOB Kayhian maintained its buy call on Fuxing on Friday (May 16) after its results were announced the evening before.

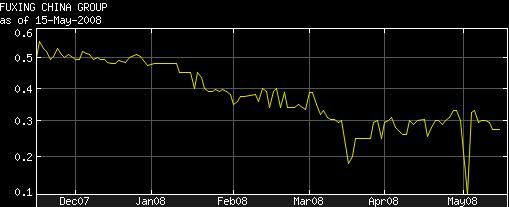

The broker’s target price remained unchanged at 63 cents, which is more than twice Fuxing’s last close price of 28 cents. The stock was listed last September at 46 cents.

At 28 cents, Fuxing trades at historical PE of 4.7 and has a market capitalisation of around S$224 million.