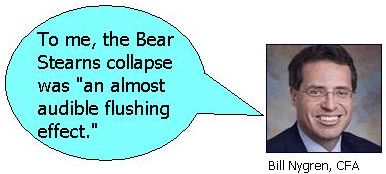

AN EMAIL making the rounds from a Singapore broker recently highlighted an excerpt of a Mar 31 commentary by William C. Nygren, CFA, which is reproduced below.

Nygren is the portfolio manager of the Oakmark Fund, and he has been described reverently as an Old Master by Fortune magazine in Dec ’07.

“More than any time in history, mankind faces a crossroads. One path leads to total despair and utter hopelessness. The other, to total extinction. Let us pray we have the wisdom to choose correctly.”

Woody Allen

“My Speech to the Graduates”

August 10, 1979, New York Times

I guess Woody Allen wouldn’t be an uplifting commencement speaker. But his view of the world, almost thirty years later, seems to be the dominant view in today’s commodity and credit markets.

If prices in those markets reflect fundamentals, then we are facing a future of materials shortages and unprecedented bankruptcies.

If one looks at Main Street instead of Wall Street, the picture, though far from perfect, looks much brighter. Businesses are profitable, unemployment is low and consumer spending remains at reasonable levels.

Is it possible that market forecasts could be that far off the mark?

In 1995, the financial author John Train wrote The Craft of Investing. Five years ago I cited a section from his book that described a typical market bottom. I think it is worth revisiting:

"At a major bottom, current business news is usually terrible and many authorities feel that things are likely to get even worse. There are several spectacular bankruptcies, of international importance. Unemployment is usually up.

There is usually some grave unresolved national problem that is bothering everybody. The brokerage business itself is likely to be in the dumps, with many bankruptcies. Big "producers" of

the up years have to cut back on their lifestyles.

”Wall Street's own desperation reinforces the syndrome. When in a market collapse everything finally caves in during a few catastrophic days and weeks, there is an almost audible flushing effect. Stocks are hurled into the abyss, like the cargo of a sinking ship that the crew is desperately trying to save. Value means nothing."

To me, the Bear Stearns collapse was "an almost audible flushing effect." There is, of course, no guarantee that things won't get worse, but this environment seems to closely parallel Train's description of a bottom. Time to buy?

Bill Nygren's full commentary, here.

Q&A with Bill Nygren, here.