A large capital outlay is required to compete with us, says BH Global's managing director Vincent Lim. Photo by William Lim / SageStudio

A large capital outlay is required to compete with us, says BH Global's managing director Vincent Lim. Photo by William Lim / SageStudio

MARINE ELECTRICAL equipment stockist BH Global stands out in the marine & offshore supply chain as a relatively small business with impressive returns on invested capital.

In FY '07, its return on invested capital (ROIC), at 48.4%, is one of the industry's highest (see table below).

In simple terms, ROIC is a measure of how effectively a company uses money invested in its operations. The metric is an important one but is seldom highlighted in reports on corporate results in the mass media.

BH Global's scale of operations is expanding: it near-doubled inventories from S$18 million in FY06 to S$35 million in FY07 and will double warehousing capacity in FY08.

The company supplies cables and lighting to over 800 customers worldwide, including ship chandlers, ship owners, ship management companies, shipyard operators and ship repair contractors.

Its top three customers - Keppel FELS, SembCorp Marine and Labroy Marine - account for over 20% of its sales.

FY07 sales was S$81.9 million, up 39% y-o-y. Net profit surged 56% to S$17.5 million.

Gross margins recovered by 2.3 percentage points to 40.7% after slipping to 38.4% during FY06.

| SGD | Last Close Price | Mkt Cap S$mln | Sales S$mln | PE (Curr Yr Est) | EBIT growth % | Operating Margin % | Asset Turnover | Return on Invested Capital % |

BH GLOBAL MARINE |

$0.60 |

166.60 |

81.87 |

9.6 |

83.3 |

25.9 |

1.3 |

48.4 |

AQUA-TERRA SUPP |

$0.36 |

126.36 |

154.32 |

9.7 |

22.9 |

6.8 |

1.5 |

27.6 |

HG METAL |

$0.44 |

140.15 |

438.14 |

5.8 |

79.4 |

7.0 |

1.6 |

35.1 |

Source: NextInsight, Tue 29 Jan 2008

Two key competitive strengths of BH Global stand out:

-

A comprehensive range of quality products;

-

Sophisticated inventory management and logistics

Comprehensive product range

A regionally leading stockist with over 7,000 products on its catalogue, BH Global is the sole distributor in the Asia Pacific for top-ranked brands of marine cables and lighting.

And its position looks hard to challenge. “It takes a fair amount of capital to reach critical mass supplying the gamut of electrical products a vessel requires,” says managing director Vincent Lim.

Based on 3-4 months of credit terms to shipyards (the norm in Singapore), one needs as high as S$18 million worth of inventories to generate sales of about S$5 million a month.

A worldwide equipment shortage is stretching delivery of electrical supplies to 5-6 months, up from 3-4 months previously. Delivery time for some offshore cables now take as long as 6-8 months.

BH Global's current trade receivables of over S$22 million plus inventory of over S$35 million add up to working capital requirements of over S$57 million.

That is the capital required to start a stockist business of sufficient volume and product range to compete with BH Global, says Vincent.

The company acquired 11,700 m2 of warehousing space recently, which will more than double existing warehousing capacity to 20,000 m2 by end 2008.

Premium quality

France’s Nexans and Italy’s Prysmian are two of the world’s top three cable makers which rely solely on BH Global to sell their products in Asia Pacific, including China and Dubai.

Sales of cables and related accessories have been strong, jumping 41% y-o-y to S$ 56.5 million. Segment revenue contribution has been rising steadily from 54% in FY05 to 69% in FY07.

“Electric cables are as important to a vessel as blood veins are to a human body,” says Vincent.

Cables comprise but about 1% of a newbuild’s cost of construction, which is why ship-owners can accept the 30% premium that BH Global’s European cables command over lower-quality alternatives such as Korean cables.

The price premium is not merely for niceties such as the lightweight and thin Prysmian cables specially designed for vessels where space and weight are scarce resources.

Downtime is highly costly, as vessels are chartered at tens of thousands of dollars per day, points out Vincent.

Sophisticated inventory management and logistics

“The most important aspect of working with cable factories is projection of cable demand,” says Vincent, refering to the global supply shortage.

Using its records of historical orders, BH Global provides factories with a projected schedule with of cable demand so that the factories it works with can purchase copper and other raw materials in bulk.

Doing so allows the company to save on per unit cost through bulk purchase.

A second edge that allows BH Global to generate good margins is its world-class logistics system.

Commercial ships discharge and turn around within one or two days as holding up a ship is expensive. Ship chandlers are therefore willing to fork out higher prices for speedy delivery.

BH Global’s logistic system delivers to Malaysia, Indonesia, Thailand, Sri Lanka and even Dubai within 24 hours. Commercial freight forwarders such as DHL take 36-48 hours in comparison.

With shipyards, the stockist provides just-in-time logistics project management and technical consultancy as value-added services.

Expanding into China and India

BH Global is able to deliver over 7,000 types of marine cable & lighting products across the globe in 24 hours.

BH Global is able to deliver over 7,000 types of marine cable & lighting products across the globe in 24 hours.

Demand from ship-yard operators for BH Global's products look set to remain high: orders signed in 2007 for newbuilds jumped 40% y-o-y to 240.9 million dwt, according to Clarksons Research Services.

Given that cables are installed halfway (about 1.5 years) into the shipbuilding progress when the hull is ready, the 40% jump in 2007 newbuild orders suggests a corresponding jump in cable orders in the following year and a half.

Capacity at shipyards is so full over the next two years it now takes up to 3.5 years (2.5 years previously) after a ship owner places an order for a newbuild to be delivered.

Ships calling at the Singapore port is another demand driver for the stockist's business.

Demand from ship chandlers and ship repair contractors is likely to benefit from Singapore's strong throughput volume.

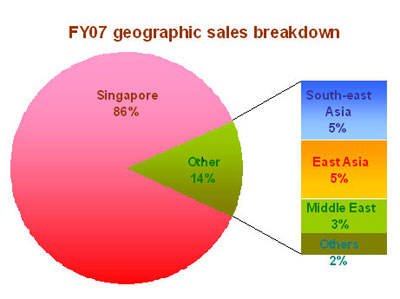

Singapore which generated some 86% of BH Global’s FY07 revenues, looks set to maintain its lead as the world’s busiest port in terms of shipping tonnage, the world’s top bunkering port, and major container transhipment hub.

Container traffic in 2007 hit 27.9 million Twenty-Foot Equivalent Units (TEUs), a 12.7% increase from the 24.8 million TEUs handled in 2006.

The stockist wants to export its successful business model from Singapore to the Middle East, and grow its China cable business.

Singapore, China and the Middle East make up about 5%, under 20%, and 20% of the global marine cable and lighting market.

China already contributes S$3.5 million to the company's top-line.

Plans are underway for an outfit to open in the Middle East by 2Q08.