OUT OF over 2,000 zipper manufacturers in China, CMZ has emerged as one of the top manufacturers with a niche in the mid to high-end market.

Founded in 1985 with 20 staff by executive chairman Shao Kesheng, 61, CMZ has over 1,000 employees today.

Having the technical expertise to customize the zipper for fashion designers like Calvin Klein gives CMZ branding power.CMZ is one of three zipper manufacturers that American fashion designer Calvin Klein has designated as its preferred zipper supplier. The other two are Japan’s YKK, the world’s largest zipper maker, and China’s Fujian SBS Zipper S&T.

Having the technical expertise to customize the zipper for fashion designers like Calvin Klein gives CMZ branding power.CMZ is one of three zipper manufacturers that American fashion designer Calvin Klein has designated as its preferred zipper supplier. The other two are Japan’s YKK, the world’s largest zipper maker, and China’s Fujian SBS Zipper S&T.

Calvin Klein’s garment makers in China are required to purchase zippers from one of the above three designated suppliers.

CMZ supplies zippers to over 2,000 such garment and bag manufacturers in China.

The company more than doubled its customer base from 1,033 garment and bag makers in 2004 to 2,305 in 2006 by adopting a strategy of sewing up deals directly with international fashion designers, bypassing Chinese garment and bag contract manufacturers.

Its CEO, Shao Dajun, who is the son-in-law of the chairman, is stepping up the company's entry into the big league: He wants to cease CMZ’s supply to smaller contract manufacturers and concentrate on the larger players as part of its brand-building efforts.

Shao, 37, tells NextInsight that CMZ targets the mid to high-end market segment, but not the luxury segment.

His target segment offers high margins as clients require product customization. On the other hand, demand for luxury zippers is too low in absolute numbers to justify dedicated production lines, he explains.

Manufacturers of (semi-finished) zipper components operate 24-7 but produce commodities without pricing power.CMZ’s production lines operate at 60% to 70% utilization, which is very high among manufacturers of finished zippers, says Shao.

In supplying to international design houses, CMZ displays technical expertise to pander to the whims of fashion trends, says Shao.

Zippers vary according to colors, teeth size, materials and slider design. The slider alone comprises five components.

The mid- to high range zipper market is subject to quarterly fashion seasons. Sales seasonality in CMZ’s myriad zipper models cancel out when consolidated.

Revenues do not show seasonality, as a result.

Resilience to price erosion

The finer details in a garment’s finishing are the reason why consumers pay a premium for designer labels, Shao explains.

His shirt from the luxury Parisian label Hermes would retail for S$300 to S$400 if not for its zipper. Shao says that the shirt’s luxury Italian Riri zipper multiplies its retail price three times to S$980.

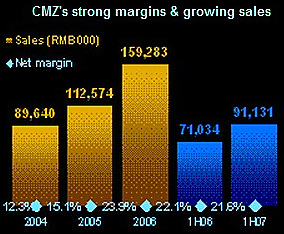

Finer details are the reason for CMZ’s high profit margins, and why CMZ has a strong grip on its customers.

International fashion labels view zipper quality as necessary for success.

In May this year, CMZ together with three other zipper makers manufacturing out of China were designated zipper suppliers to German fashion retailer Tchibo.

Tchibo is one of Europe’s top garment retailers with over 1,200 concept retail outlets.

Other than Calvin Klein, diverse apparel labels ranging from North America’s Guess and Donna Karan New York to sports apparel and equipment makers such as Reebok, Italy’s Lotto and Germany’s Puma all use CMZ’s zippers.

The zipper’s miniscule one to two percent component cost of what a fashion designer pays its sub-contractors makes it easy for zipper makers to pass on price increases.

CMZ increased average selling prices of its metal zippers about 20% y-o-y in 2006 when prices of raw materials such as copper and zinc rose about 35%.

CMZ further increased average selling prices 26% in 1H07 in anticipation of a 5% to 10% increase in raw material prices.

Actual raw material prices fell 5% y-o-y in 1H07 instead, leading to improved gross margins.

Straightforward industry without substitute goods

“We like CMZ for its niche in the upmarket segment of a straightforward industry that has no replacement product,” says Eric Ong, assistant vice president at SBI E2-Capital Asia Securities’ research team.

Picture by William Lim/Sage Studio

He also likes CMZ for its strategy to raise margins: focus on brand equity and compete for overseas customers out of China’s low cost manufacturing environment.

SBI-E2 sponsored CMZ’s listing on 16 July 2007 of about S$70 million worth of shares (based on IPO price of S$0.23). The Shao family holds 55.9% in the company.

The S$17.5 million raised in the IPO will fund expansion of production facilities, product R&D and expansion of its sales network.

Specifically, S$7.7 million has been earmarked for the construction of buildings and plants, and the acquisition of land and equipment.

The company is planning to double its current capacity of 221 million zippers to 400 million within a year.

Shao is also considering acquiring competitors to ramp up capacity. He is upbeat about regaining orders lost in the previous year as a result of limited capacity.

He turned away over RMB 20 million worth of orders in 1H07 due to capacity constraint.

"Major fashion buyers will stay with us into the lull seasons only if we have delivered on the scale of orders which they require during the peak months of May and June," says Shao.

The company forecasts capacity requirements by averaging each zipper design's three highest monthly orders for the year. In doing so, seasonality in demand for individual zipper designs is accommodated.

CMZ plans to use about S$1 million of the IPO proceeds to expand its sales network. To strengthen relations with buying houses of international fashion designers, CMZ intends to set up sales offices in Hong Kong this year and in the US by next year.

Another S$1 million will be used for research and development.

Comments

Thanks !