"The response to a funding campaign is one method of crowd validation that hints at the potential success of the business," said Fundnel co-founder and CEO Kelvin Lee. Photo by Sim KihINVESTMENT CROWDFUNDING is the next big thing in capital markets, opening up financing channels for ideas and early stage businesses with great solutions that banks and venture capitalists may not be able to support.

"The response to a funding campaign is one method of crowd validation that hints at the potential success of the business," said Fundnel co-founder and CEO Kelvin Lee. Photo by Sim KihINVESTMENT CROWDFUNDING is the next big thing in capital markets, opening up financing channels for ideas and early stage businesses with great solutions that banks and venture capitalists may not be able to support.

This form of alternative financing is taking off in a big way. In 2010, global crowdfunding proceeds were reported to total US$880 million. By 2015, global crowdfunding proceeds would have ballooned to US$34.4 billion, overtaking the venture capital industry, according to estimates by research consultancy Massolution.

Three parties come together in the crowdfunding financing model, as follows:

1.) The companies that start the businesses to be funded

2.) The investors, who are the individuals from the crowd who financially support the business idea

3.) The platforms, usually technology marketplaces that support the efforts of the companies and investors.

NextInsight recently had the opportunity to interview Kelvin Lee, the CEO of home-grown crowdfunding platform, Fundnel. Fundnel is a year old but has already raised US$5 million for 6 companies in Malaysia, Hong Kong and Indonesia.

“Fundnel is one of the few platforms with regional access to deal flow,” said Kelvin.

“The background of our team members as well as our experience and approach to deal-making puts us on the side of the company. We have gained the trust of company owners who would otherwise have been hesitant about accepting new investors. Fundnel is all about faster fundraising and better businesses,” he added.

Fundnel was founded by three former investment bankers from JP Morgan. Their banking background enabled Fundnel to establish partnerships that generate deal flow from China, Indonesia, Malaysia, India, Thailand and Australia, in addition to Singapore and Hong Kong.

Real businesses

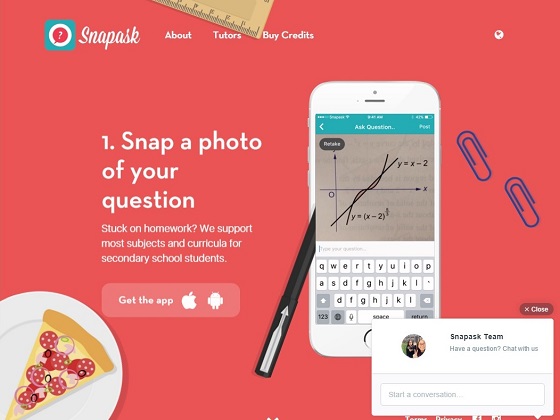

One of its successes was Snapask, a smartphone app for students. Snapask users only need to snap a photo of any homework question, post it on the mobile app, and real-live tutors will come to their aid through online chat sessions. The US$1.8 million in angel funding that Fundnel raised for Snapask was the largest pre-IPO financing for an educational technology company in Hong Kong.

Fundnel raised US$1.8 million for Snapask, a smartphone app that does away with tuition agencies and tuition centers in linking students to tutors. The app has amassed 20,000 users and 1,800 tutors. Graphic: Snapask

Fundnel raised US$1.8 million for Snapask, a smartphone app that does away with tuition agencies and tuition centers in linking students to tutors. The app has amassed 20,000 users and 1,800 tutors. Graphic: Snapask

Six businesses are currently running fund raising campaigns on Fundnel. One of them is Studio Fitness, with a revenue-sharing campaign that is open to participation by retail investors. In such a program, the entrepreneur shares a percentage of business revenue with backers up to a predetermined investment multiple.

Studio Fitness is a fitness studio based in Hong Kong that wants to raise US$250,000 for capital expenditure on a new outlet in Singapore. Backers get to support its expansion plan by pumping in a minimum of US$5,000, and will receive a percentage of the revenue generated every month from its Singapore outlet. (Click on Fundnel's website for more details)

“We chose to work with Studio Fitness because it had a track record of building a significant, tight-knit community within its first year of operation,” said Kelvin. What’s more, backers who participate in Fundnel’s revenue-sharing campaign for Studio Fitness get a 6-month Unlimited membership to its fitness studio facilities and services.

Financing mechanisms

Fundnel offers investors four ways of financing a project, as follows:

1) Bonds

2) Private Equity

3) Convertible Bonds

4) Revenue-sharing

All individuals may participate in a revenue-sharing campaign but only accredited investors may participate via bonds, private equity and convertible bonds. To be an accredited investor in Singapore, you must meet at least one of the following requirements:

» Net personal assets exceeding US$2 million in value, or its equivalent in a foreign currency, or

» Income in the preceding 12 months of no less than US$300,000, or its equivalent in a foreign currency

| Here is a summary of typical questions asked by a backer on Fundnel’s platform, and the answers provided by Justin Chow, Fundnel’s Chief Marketing Officer. |

|

1. What are my investment exit routes for the different types of funding mechanisms? A bond offers a fixed payback schedule but convertible bonds and revenue-sharing do not. Bonds: The backer gets his principal investment back upon maturity of the debt instrument, which is typically one to 5 years later. The holding period will be explicitly stated on the investment documents. The rate does not change with investment quantum. On our platform, the terms of the deal are not dependent on deal size. The advantages and risks are the same whether investor is accredited or not. Our target clientele at this point of time is the sophisticated investor. This is because of the following reasons. (1) The sophisticated investor is more educated on the risk profile of the asset class that we are currently offering. (2) Regulatory reasons. Investors are responsible for evaluating their risk and reward prior to participating in any fund raising campaign. Fundnel is only responsible for facilitating the liaison and document exchanges between the parties that participate in its fund raising campaigns. 7. What attitude should the backer have? To maximize personal investment gain, or to contribute to social enterprise as a charitable act? Fundnel positions itself as a platform where individuals can maximize personal investment gain by supporting small and medium-sized enterprises (SMEs). On the other hand, there are backers who place greater emphasis on social enterprise (such as supporting a fledgling local business, the thrill of backing a potential game-changer, funding a good cause, etc.) over investment returns. |