Excerpts from DBS Vickers' 25-page initiation report dated 4 March 2014.

Analyst: LEE Wee Keat, CFA

Stadium-style multi-gaming: There are 100-200 terminals, or better known as Live Multi Game (LMG) machines, encircling live dealers handling various table games such as Baccarat, Roulette and Sic Bo. There is a live feed of the results of each game to the terminals. Bets are placed on each terminal and payouts are made automatically. Photo: Company

Stadium-style multi-gaming: There are 100-200 terminals, or better known as Live Multi Game (LMG) machines, encircling live dealers handling various table games such as Baccarat, Roulette and Sic Bo. There is a live feed of the results of each game to the terminals. Bets are placed on each terminal and payouts are made automatically. Photo: Company

Analyst: LEE Wee Keat, CFA

Stadium-style multi-gaming: There are 100-200 terminals, or better known as Live Multi Game (LMG) machines, encircling live dealers handling various table games such as Baccarat, Roulette and Sic Bo. There is a live feed of the results of each game to the terminals. Bets are placed on each terminal and payouts are made automatically. Photo: Company

Stadium-style multi-gaming: There are 100-200 terminals, or better known as Live Multi Game (LMG) machines, encircling live dealers handling various table games such as Baccarat, Roulette and Sic Bo. There is a live feed of the results of each game to the terminals. Bets are placed on each terminal and payouts are made automatically. Photo: Company|

Rise of the machines • Cornering the US$2.35bn U.S. machine market

• Cheap proxy to casino business in Macau

• Stock offers strong earnings growth and potential dividend surprise

• Initiating coverage with BUY, HK$9.80 TP (62% upside)

|

Explosive growth from machine sales. Paradise’s LMG (live multi-game) machine is a proprietary gaming product patented in the U.S. and Macau.

The initial 24 machines installed at The Palazzo, Las Vegas, are already performing better than expected (>US$350 daily net win per machine). This is sending a ripple across The Strip and we expect 700 machine sales this year.

The sales figure will more than double in 2015. We estimate that the U.S. market is worth US$2.35bn conservatively. Overall, we expect 3,000 unit sales in 2014 – Macau (1,000 units), Australia (1,000), U.S. (700) and ASEAN region (300).

Total sales will hit 4,000 units in 2015.

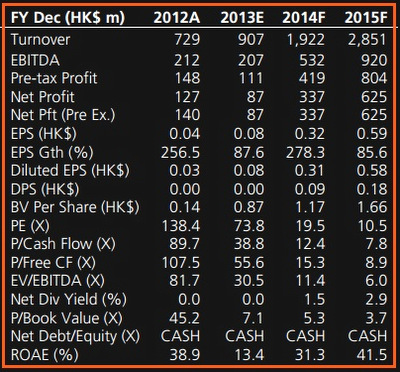

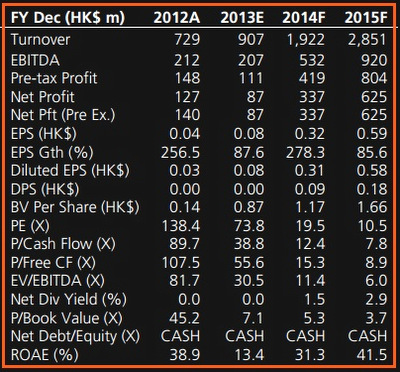

Earnings to quadruple on two-pronged business expansion. Machine sales is where the growth story is (FY13-15F EBITDA CAGR of 197%).

Earnings to quadruple on two-pronged business expansion. Machine sales is where the growth story is (FY13-15F EBITDA CAGR of 197%).

Paradise will also introduce a daily maintenance fee of US$25/machine for its new generation of LMG machines in Macau.

Separately, the casino management business will continue to provide stable, recurring income to the company.

We expect Casino Kam Pek (2013: HK$80,000 per table) to grow in tandem with the industry, while Casino Waldo will take 12-18 months to ramp up from its current daily net win of HK$43,000 per table.

Overall, we see total EBITDA surging fourfold to HK$920m in 2015 (two-year CAGR of 111%).

The initial 24 machines installed at The Palazzo, Las Vegas, are already performing better than expected (>US$350 daily net win per machine). This is sending a ripple across The Strip and we expect 700 machine sales this year.

The sales figure will more than double in 2015. We estimate that the U.S. market is worth US$2.35bn conservatively. Overall, we expect 3,000 unit sales in 2014 – Macau (1,000 units), Australia (1,000), U.S. (700) and ASEAN region (300).

Total sales will hit 4,000 units in 2015.

Earnings to quadruple on two-pronged business expansion. Machine sales is where the growth story is (FY13-15F EBITDA CAGR of 197%).

Earnings to quadruple on two-pronged business expansion. Machine sales is where the growth story is (FY13-15F EBITDA CAGR of 197%). Paradise will also introduce a daily maintenance fee of US$25/machine for its new generation of LMG machines in Macau.

Separately, the casino management business will continue to provide stable, recurring income to the company.

We expect Casino Kam Pek (2013: HK$80,000 per table) to grow in tandem with the industry, while Casino Waldo will take 12-18 months to ramp up from its current daily net win of HK$43,000 per table.

Overall, we see total EBITDA surging fourfold to HK$920m in 2015 (two-year CAGR of 111%).

Paradise Entertainment executive chairman Jay Chun. Photo: www.macaubusiness.comA growth story unravels. Paradise is under-researched. The casino business alone (~78 gaming tables inventory) is worth HK$4.80/share (11x FY15F EBITDA).

Paradise Entertainment executive chairman Jay Chun. Photo: www.macaubusiness.comA growth story unravels. Paradise is under-researched. The casino business alone (~78 gaming tables inventory) is worth HK$4.80/share (11x FY15F EBITDA). The gaming machine business adds another HK$2.08/share at peer average multiple of 9x FY15F EBITDA.

More importantly, the market has yet to appreciate the value of the daily maintenance fee business model.

This steady recurring income stream is worth HK$1.81/share on our DCF.

This gives Paradise a price target of HK$9.80/share (HK$1.14 cash/share).

We see potential dividend payout (30% net profit or 3% yield), as FCF yield improves.

Recent story: PARADISE ENTERTAINMENT: Expects "Remarkable Business Growth" In Gaming