Isaac Chin, 64, (in Vienna, above) made his money from property and stock investing - and he and his wife travel frequently to enjoy diverse cultures in Europe and Asia.

Isaac Chin, 64, (in Vienna, above) made his money from property and stock investing - and he and his wife travel frequently to enjoy diverse cultures in Europe and Asia. Photo courtesy of Isaac.

For the past decade, Isaac Chin has been a full-time investor after a career as a chartered accountant. “I didn't have an inspiring career as an accountant. Nothing great came out of it. If I have to work hard for a salary and put up with a lot of stress, I might as well work for myself - and earn more,” he said. Now aged 64, he has reaped handsome profits from investing in property, equities and bonds.

Dear Friends, I would like to share with you my stock picks for 2014, based purely on my trading and investment experience of the last 2 years.

In fact, 2012 and 2013 were one of the most fascinating periods in my investing career.

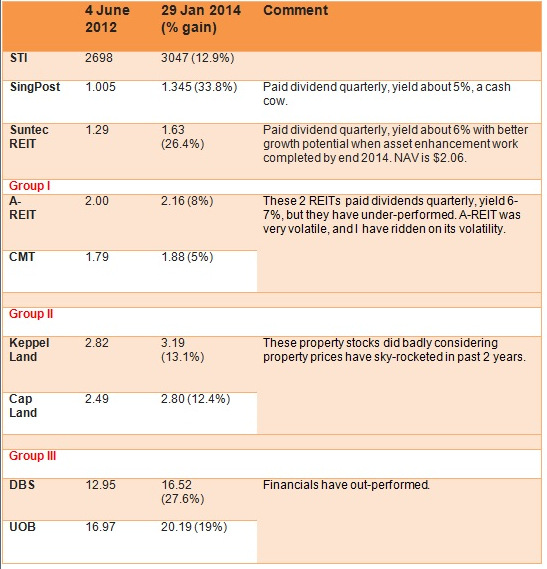

I was lucky for the second time in entering the market on 4 June 202 when the Straits Times Index was at 2698 points. The statistics are as follows:-

I have focused mainly on Sing Post and Suntec REIT, which attracted about 80% of my investment funds.

My faith in them is as strong as Warren Buffet's faith in Coca-Cola.

I have gained close to $1M in the past 18 months from these 2 stocks.

As at 29 Jan 2014 , I was holding only 3 stocks -- namely A-REIT, SingPost and Suntec REIT.

I have about $2m in the last 2 stocks which I consider to have good value and are very defensive in times of crisis.

With all problems, political, economic, financial, weighing on the world currently, I am expecting another Global Financial Crisis in the next few years, and I have to keep enough reserves to fight the next Great Battle.

May the Year of the Horse bring Prosperity, Good Health and Happiness to all of you!

Previous story: ISAAC CHIN: It's a draw for me this year, after 12 wins and 1 loss

I am trying to get your upto date email address. I am the Director for development and Alumni at the University of Otago.

Regards

Philip