SciVision Biotech General Manager Mr. Tony Han at his Kaohsiung, Taiwan office (left) and holding some of the firm's flagship products (right). Photos: SciVision

SciVision Biotech General Manager Mr. Tony Han at his Kaohsiung, Taiwan office (left) and holding some of the firm's flagship products (right). Photos: SciVision

SCIVISION BIOTECH INC (TT: 1786) is benefiting from a big boost in consumers aiming to look younger and better as well as others seeking to remedy joint issues, said an executive with the Taiwan listco.

NextInsight met last week with SciVision -- a developer and manufacturer of wrinkle remedies and arthritic joint fluid -- headquartered beside the picturesque harbor city of Kaohsiung in South Taiwan.

Turning Heads, Turning Profits: HYADERMIS, a beauty and skincare treatment product, is a growing business for SciVision. Photo: SciVision

Turning Heads, Turning Profits: HYADERMIS, a beauty and skincare treatment product, is a growing business for SciVision. Photo: SciVision

NextInsight: SciVision’s first half revenue rose 34.4% y-o-y to 95.1 million NTD and net profit rose 17.4% y-o-y to 16.2 million NTD. Did the top or bottom lines surprise on the upside, and if so, why?

General Manager Tony Han: We expected these stellar results as we are seeing a trend toward increased aging populations in Europe, the US and many Asian markets, which is boosting demand for our ‘Hya-Joint Plus’ synovial fluid supplement products. We remain very upbeat on continued demand growth. We will continue working with partners to boost our market share in Taiwan.

Overseas, we will strive to attend more and more biotech and medical-based trade shows and conferences to find a growing number of suitable sales channels and strategic partners. At the same time, we will continue to aggressively market our products in both the PRC and international markets overall and we expect a steady global growth for biotech and pharmacological products.

SciVision makes a wide range of beauty products to cover any blemishes. Photo: SciVision

SciVision makes a wide range of beauty products to cover any blemishes. Photo: SciVision

The revenue increase was nearly double the net profit increase for the January-June period. Was this due to higher reinvestment in R&D and technology, increased equipment purchases, or lower-margin product sales?

Mr. Han: SciVision has always worked to facilitate steady sales growth on a quarterly, interim and yearly basis. Due to a recent product array adjustment, there was a slight decline in margins compared to the corresponding period. However, thanks to enhanced budgetary and spending discipline, we still managed top and bottom line increases.

What do you think are the main reasons SciVision shifted to profitability in late 2010?

Mr. Han: We were granted full domestic sales authorization at the time and also began a concerted effort to concentrate on the most profitable, high-margin offerings in our product portfolio.

Did the swing to profitability and recent strong financial performance influence SciVision’s decision to seek a main board upgrade?

Mr. Han: Our listing plan was approved by our board in June and we expect full approval and a main board listing in the near term. A sampling of some of the intricate equipment found in Scivision's Kaohsiung plant. Photos: SciVisionSciVision is being approved by an increasing amount of EU countries for sales and distribution. Might a future listing on an EU bourse be a possibility?

A sampling of some of the intricate equipment found in Scivision's Kaohsiung plant. Photos: SciVisionSciVision is being approved by an increasing amount of EU countries for sales and distribution. Might a future listing on an EU bourse be a possibility?

Mr. Han: Any offshore listing plans depend on the overall development of SciVision. That being said, we will of course also take into consideration the availability of offshore capital and the dilution impact on our Taiwan-listed shares.

SciVision is growing its market share in the EU and in countries like Jordan, India, etc. To what do you attribute SciVision’s success in competing with global powerhouses?

Mr. Han: The EU is a big market and manufacturers offering safe and effective products will always find business opportunities and will be embraced by the market.

The biotech industry is a very capital-intensive and R&D-reliant sector requiring constant upgrades and innovation to stay atop certification requirements and meet evolving scientific/medical market developments. With this in mind, how does SciVision manage to maintain such a healthy balance sheet and financial position with a relatively low gearing ratio of just 13%? And with growing profitability, are you more focused on R&D reinvestment or dividend payouts?

Mr. Han: Our asset value mainly derives from our equity capital and bank loans which has allowed us to witness steady business and capacity growth over the past few years. For future growth we plan to increasingly rely on favorable lending rates to fuel our ambitions.

What are the benefits of SciVision’s non-traditional microbial fermentation synthesis techniques to produce medical grade hyaluronic acid (HA) versus traditional synthesis using animal sources (rooster combs)?

Mr. Han: There are two forms of HA synthesis: animal and non-animal derived. We utilize the latter which is more cost effective, efficient and safer given the possibility of fowl-to-human recipient pathogen transference. Also, the purity rate of non-animal derived HA is higher. SciVision Biotech's HYAJOINT products are for those of us not ready to slow down in our later years. Photo: SciVision

SciVision Biotech's HYAJOINT products are for those of us not ready to slow down in our later years. Photo: SciVision

For the January-June 2013 period, what was the percentage of revenue contribution from your major product categories: HA medical products facial dermal implant (HYADERMIS), synovial fluid supplements (HYAJOINT), anti-adhesion gels and wound healing dressings), HA skincare products (BIOTRICE), HA nutritional products (HYACARE glucosamine tablets), parentage DNA testing?

Mr. Han: In the first half, our top line contribution came 92.8% from HA medical products, skincare/nutritional products 6.2% and DNA testing 0.9%.

Which product category has the highest profit margin?

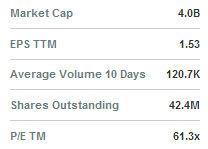

Mr. Han: Medical products. We expect this segment to continue to produce 54-60% margins over at least the next two years. SciVison recently 94.75 twd with a 52-week range of 40.94-104.20.Is there a large market disparity by geography for the volume of one product sale to another?

SciVison recently 94.75 twd with a 52-week range of 40.94-104.20.Is there a large market disparity by geography for the volume of one product sale to another?

Mr. Han: For the time being, we are most bullish on Japan, Korea and Taiwan for the skin care segment.

Are aging populations in many industrialized economies, especially Europe, Japan and even Mainland China, helping boost demand for your HA products, especially HYAJOINT, given the prevalence of joint problems in seniors and the elderly?

Mr. Han: In Europe, 15% of the total population is already over 65 and by 2025 the UN estimates it will exceed 20%. Similar trends are seen in Japan, North America, Taiwan and the PRC. With continued economic expansion in these markets and higher living standards, seniors are demanding more in their golden years and lead increasingly active lifestyles. This presents tremendous opportunities for SciVision going forward.

SciVision Biotech Inc was founded alongside Kaohsiung Harbor in 2001. Based on a self-owned genetic transfer technique as well as high-tech equipment, SciVision successfully developed a non-traditional microbial fermentation technique to produce medical grade Hyaluronic Acid (HA) with high quality and high safety. In 2003 and 2009, SciVision was respectively awarded the “Leading Innovative Product Research and Development Program” by the Ministry of Economic Affairs, which affirmed SciVision as the leading company in the medical grade HA field. SciVision’s products have passed intact assessments including in vivo, in vitro and clinical tests. Its factory complies with ISO 13485 & ISO 9001 quality management systems as well as medical device GMP. Hya-Joint Synovial Fluid Supplement and Hya-Dermis Facial Dermal Implants were approved with medical device export permits by the Department of Health, Executive Yuan and available for sale worldwide. Hya-Joint also received the medical device permit issued by the Department of Health, Executive Yuan and achieved the 2008 National Biotechnology and Medical Care Quality Award in the Medical Appliance Category. Now, this product is eligible for health insurance reimbursement to serve and care for Taiwan’s people through the national medical-care system.

See also:

ASIAMEDIC: How It Will Win Clients For Its Cord Blood Bank Business