Bocom: HK JEWELRY Sales Surge YTD

Bocom: HK JEWELRY Sales Surge YTD

Bocom Research said recent retail sales performance in Hong Kong has beaten estimates, and is maintaining its “Outperform” recommendation on HK-listed consumer plays.

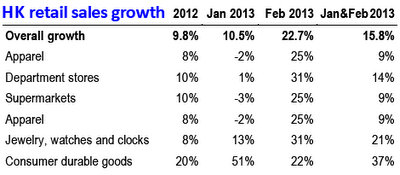

February Hong Kong retail sales growth (in value) saw a strong acceleration to 22.7% (vs. +10.5% in Jan) and was much better than the consensus estimate of 15.7%.

“Apart from the strong local consumption (due to the CNY shift), the robust Chinese tourist arrivals (+36% in Feb vs. +14% in Jan) was the key attributing factor,” said Bocom.

Combined with January (to remove the CNY distortion), average Jan-Feb growth was 15.8%, still showing a noticeable improvement compared with the last two months of 2012 (+9.1%/+9.4% in Dec/Nov) and the overall 2012 (+9.8%).

The key segments that saw the strongest growth were jewelry & watches (+31% vs. +13% in Jan) and department stores (+31% vs. 1% in Jan), followed by apparel (+25%, vs. -2% in Jan) and supermarkets (+ 25%, vs. -3% in Jan).

“With a stable local consumer climate and continued resilient growth support by Chinese tourists, we continue to expect Hong Kong retail sales growth to see a steady improvement in 2013,” Bocom added.

The brokerage is maintaining “Buy” calls on retailer Sa Sa (HK: 178) and jewelry play Luk Fook (HK: 590).

Merrill Lynch: CHOW SANG SANG 2012 Margins Surprise on Upside

Merrill Lynch said it is maintaining its “Buy” call on Chow Sang Sang (HK: 116) after the jewelry retailer’s 2012 results surprised on the upside.

“Financial results were 6% higher than expected on better margins,” Merrill Lynch said.

Chow Sang Sang's shares began 2013 with an upsurge.

Chow Sang Sang's shares began 2013 with an upsurge.

Chow Sang Sang posted 6.4% y-o-y higher revenue in 2012 with the jewelry segment growing 17.5% (2H: 4.3%) while other business fell 25% (2H: 13.4%).

As such, retail segment’s contribution improved to 81% from 74% in 2011.

“SSSG was decent at 9%/5%, respectively in HK & Macau/China,” Merrill Lynch said.

Better than expected margins on mix/segment upgrade

“The higher sale of mass-jewelry (enjoys higher GPM vs high-ticket items, which posted no growth) and segment mix improvement in 2H helped boosted GPM 50bp higher to 20%,” the brokerage said.

Merrill Lynch’s 12-month target price of 23.5 hkd on Chow Sang Sang is based on a blend of P/E (24.4 hkd) and DCF (22.7 hkd).

UBS: CHOW SANG SANG a ‘Buy’

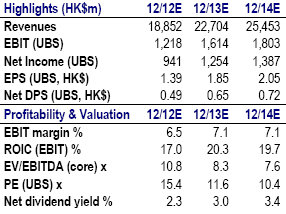

UBS Investment Research said it is keeping its “Buy” call on jeweler Chow Sang Sang (HK: 116) with a target price of 25.0 hkd.

Chow Sang Sang reported 9% and 5% SSSG in Hong Kong and China, respectively, for the full year 2012, implying low single digit SSSG in H212, which was “well expected” by the market, UBS said.

Chow Sang Sang reported 9% and 5% SSSG in Hong Kong and China, respectively, for the full year 2012, implying low single digit SSSG in H212, which was “well expected” by the market, UBS said.

“Sales momentum has picked up strongly since November 2012 and the strong performance continued into January and February.”

UBS said it expects GPM to be “at least stable” compared with 2012 due to an easier base.

“With potentially more benign rental hikes and less discount activities from competitors thanks to a recovery in sales momentum, gross margin and operating margin could expand in 2013.”

See also:

CHOW SANG SANG: Better Times Ahead