Property investments are not always winning ones. This may sound alien to less-seasoned investors who have only seen prices go up in the last couple of years. But the government has laid on intense cooling measures targeted at the property market. Interest rates can only rise in the coming years. Whither the property cycle? Here, a reader shares his loss-making experience as a first-time property owner.

MY FIRST foray into the property market was the purchase of an HDB flat in year 2000. There weren't any HDB grants during my time and we couldn't afford a flat near our parents as we had only started working.

We couldn't afford the Executive Condo either. My starting pay was only $1,850 per month to be exact.

There were only 3 choices of location -- Woodlands, Jurong or Sengkang. Not much of a choice, so we selected the "cheapest" location in the north as Sengkang was much more expensive.

MY FIRST foray into the property market was the purchase of an HDB flat in year 2000. There weren't any HDB grants during my time and we couldn't afford a flat near our parents as we had only started working.

We couldn't afford the Executive Condo either. My starting pay was only $1,850 per month to be exact.

There were only 3 choices of location -- Woodlands, Jurong or Sengkang. Not much of a choice, so we selected the "cheapest" location in the north as Sengkang was much more expensive.

The problem with picking the north zone was that it was very far from our parents' place. Once the baby came, we had to move near to the care-givers.

In the end, we hardly stayed in our executive flat which cost $380,000. The problem was that under HDB rules, we could not buy any property within 5 years and could not lease out our home either. The rules were extremely strict. In the end, we kept it empty for almost 5 years. To top our stupidity, we spent $40k on renovations.

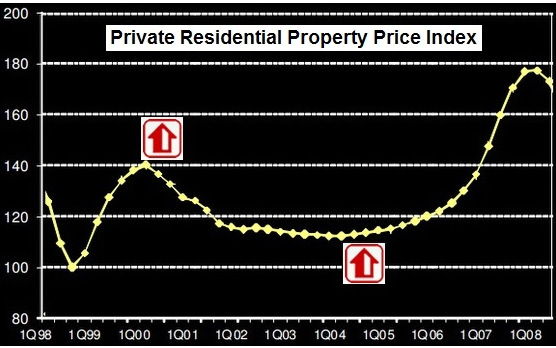

The chart shows you we bought exactly at the peak of the market cycle and sold at the bottom. What "perfect timing"!

You can see the market was in a doldrums from 2001-2005.

In the end, we hardly stayed in our executive flat which cost $380,000. The problem was that under HDB rules, we could not buy any property within 5 years and could not lease out our home either. The rules were extremely strict. In the end, we kept it empty for almost 5 years. To top our stupidity, we spent $40k on renovations.

The chart shows you we bought exactly at the peak of the market cycle and sold at the bottom. What "perfect timing"!

You can see the market was in a doldrums from 2001-2005.

Lesson 1 - Buy a property only if you intend to stay in it or rent it out.

We couldn't stay in it and we couldn't rent it out due to the rules. It was basically a white elephant. We could have 'secretly' rented it out but it was illegal to do so.

We couldn't stay in it and we couldn't rent it out due to the rules. It was basically a white elephant. We could have 'secretly' rented it out but it was illegal to do so.

Having said that, if you own a HDB flat today and are eligible to rent it out, my advice is that you keep the goose that lays the golden egg unless the offer is too compelling and you have better use for the proceeds. The yield from HDB flat is one of the best you can find.

Lesson 2 - Don't buy a property that comes with so many restrictions

The fact that I could not buy another property or sell within 5 years were restrictions imposed to ensure that we did not abuse the "market subsidy"which we supposedly received when we bought the HDB executive flat.

Lesson 3 - Don't be greedy when buying HDB flat!

"It took me more than 10 months to find a buyer and the buyer was a PR family which offered me $295k for my flat."

"It took me more than 10 months to find a buyer and the buyer was a PR family which offered me $295k for my flat."Photo: Internet It was very funny to see the reactions of people when I told them I lost money on my HDB flat. They couldn't believe it. I have to tell you that I was greedy. I thought to myself, "HDB sure can make money if you buy directly from them".

I could not be more wrong. Hahaha. I bought the biggest flat available to us instead of 4- or 5-room flats and as you know, executive flat received the lowest "market subsidies" from the government.

After 5 years, I decided to sell my flat at a loss and move on but the joke was that there were many unsold units in my block even after 5 years. At the time when I was selling my flat, HDB was selling the unsold units in my block for between $220k to $280k.

It took me more than 10 months to find a buyer and the buyer was a PR family which offered me $295k for my flat.

The real joke was HDB wrote a letter to me, wanting an explanation from me why i sold my flat for $295k when the valuation was $340k. I gladly replied that I would love to sell it to them for $340k if they were willing to buy. (As a side note, my brother-in-law bought a 4 room flat in Sengkang and after 5 years, sold it for a good profit).

Lesson 4 - Cut loss and move on

By 2005, I had lost enough money from the stock market to know how to cut loss and learn about market cycles. I wanted to free up my CPF savings to buy properties in better locations and catch the next property cycle. The fact that I didn't even live in my flat and couldn't rent it out provided the catalyst for me to do something about it.

As you can see,my first foray into the property market is a painful one. Lost at least $100k if I include part of the renovations. Sigh.

It was a painful lesson which I will never forget but I will treat the $100k as an expensive school fees. There are no better schools to teach you about what life really is.

Epilogue: The fortunate thing is we didn't have to top up the "CPF losses" suffered from the sale but there wasn't much money left anyway. :-) The loss almost wiped out our CPF accounts and we each had a couple tens of thousands left.

We had been working for more than 8 years and had been diligently saving up but the combined amount wasn't fantastic -- probably around $100k. Coupled with the remaining $50,000 in the CPF, we had a capital of $150,000 to buy the next property.

We had been working for more than 8 years and had been diligently saving up but the combined amount wasn't fantastic -- probably around $100k. Coupled with the remaining $50,000 in the CPF, we had a capital of $150,000 to buy the next property.

This article was first published on a blog, 2Y Real Estate Fund, and is edited and republished with permission.

1. He purchased a HDB which he himself cant afford . An Executive hdb with a price tag of $380K with a monthly pay of $1,850 . which means his monthly installment will be $1,369.16 per mth . if he did not stay he can always seek approval from HDB to rent it or rent out a room to reduce the loan.

Therefore,always buy a housing you can afford .

for 8 years he had been diligently saving up $100k plus CPF $50K, total $150K to buy the next property. 8 years from 2005 should be 2013.

Looks Mr IPO has not learn his lesion. He will “Buying High” as what Greenrookie point out.

Secondly, when purchasing such property, there is also a need to differentiate between HDB and private properties. Although it has been claimed by the government that purchasers of HDB flats are owners, in actual fact, what they are holding onto is a piece of paper which allows them a long term rental of 99 years with rental being paid in advance. That piece of paper is called a Deed of Assignment ; whereas in the case of a private property the purchasers are real and legal owners of such properties because they are issued a Subsidiary Strata Title (in the case of condo or flat units) or a certificate of (land) title (in the case of landed properties.

A deed of assignment has got not much value in the secondary market because they are unlikely to be accepted by bank for third party mortgages, or even for collaterised loans by the owner himself. Subsidiary strata and land title certificates allow owners the availability to access financial recourse through collaterised mortgages, whether by the owners themselves or for third parties. There is therefore, the aspect of availability of access to liquidity which differentiates HDB from private properties.