Time & date: 10 am, Thursday, 10 Jan 2013

Venue: Technics Oil & Gas, 72, Loyang Way

SHAREHOLDERS OF Technics Oil & Gas enjoyed a 22% capital gain on their stock in the past year.

Add in 8 cents a share in dividends, and the total gain came up to 28%.

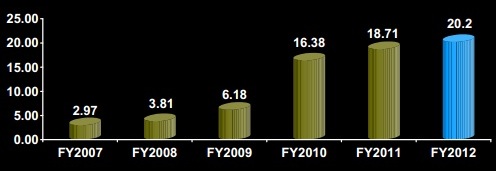

With that sort of return, and a record net profit achieved by the company in FY12 (ended Sept 2012), there was little for shareholders to grouse about at the AGM on Thursday (Jan 10), unlike at AGMs of some companies that I have attended in the past year.

Instead, there was shareholder query about, and interest in, some recent key developments, especially:

> Eversendai Corporation: This listed Malaysian company emerged in December 2012 as a substantial shareholder of Technics.

> Vietnam Offshore Fabrication & Engineering: It was 100% acquired by Technics in Aug 2012. It is the biggest such operation in South Vietnam.

Drawing from a brief Q&A session at the Technics' AGM and recent Technics announcements, here is the picture regarding Eversendai:

1. Eversendai is a RM1 billion market cap company which is an integrated structural steel turnkey and power plant contractor. It has no footing in the oil & gas industry that Technics operates.

2. Through open market purchases of Technics shares, Eversendai emerged as a substantial shareholder with a 13.85% stake in early Dec.

It is targeting to own 20% to become an associate and is able to equity account Technics' profit.

3. To support Eversendai's move towards the 20% target, Technics has proposed to issue new shares amounting to 5% of its enlarged capital. An EGM will be held for shareholders to vote on this later this month.

Assuming the share issue is approved, Eversendai still has to go to the open market to buy the shares it wants for it to hit its target 20% stake.

4. What are the synergies between the two companies? Technics now fabricates and commissions topside modules for wellhead satellite platforms (WSP), but does not do the heavy jacket fabrication.

a. OSK-DMG analyst Lee Yue Jer, in a recent report, saw Technics bidding for full WSP contracts and then subcontracting the jacket fabrication to Eversendai.

Further, Eversendai’s presence in Malaysia may be Technics’ entry point into the highly-lucrative Petronas capex budget.

b. Technics executive chairman Robin Ting said Eversendai has highlighted its strong business contacts in the Middle East and its potential to pave the way for Technics to secure business in that region which Technics is not established in.

Mr Ting added that he himself is seeking more clarity from Eversendai on any business collaboration.

There is meaningful upside to look forward to -- after all, why would Eversendai invest some S$45 million for a 20% stake, request a board seat, and not create significant synergies for both?

As for Technics' purchase of Vietnam Offshore Fabrication & Engineering (VOFE), a shareholder Jimmy Chua (who happens to have an investing blog http://ghchua.blogspot.com/) asked for the rationale for the purchase.

Mr Ting said Vietnam is a key market for Technics, having accounted for 30% or so of revenue in the past.

Buying VOFE, which is about twice as big as Technics' yards in Singapore and Batam, enables Technics to meet certain local content requirements for major projects.

There would also be cost savings from doing fabrication work for its Vietnamese customers there.

For lack of know-how in doing offshore fabrication work, VOFE has barely made money in this area -- but profit margins at its other divisions are said to be good.

VOFE was sold to Technics for S$7.7 million, which was at NTA plus 10%. It's a good price, said Mr Ting.

OSK-DMG analyst Lee Yue Jer has a 'buy' call and target price of $1.20 for the stock, based on a valuation of 12x FY13F EPS.

Recent stories:

TECHNICS OIL, NAM CHEONG: Positive developments

YANGZIJIANG, TECHNICS OIL, SEMBMARINE : What analysts now say....