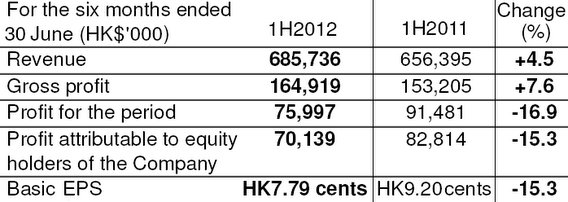

CHU KONG SHIPPING Enterprises (Group) Co Ltd (HK: 560), a major player in China’s passenger and cargo shipping services, managed to boost its first half revenue nearly 5% year-on-year to 686 million hkd despite “a sea of global uncertainties,” management said.

CKS, one of the largest passenger and cargo shipping services providers in the Pearl River Delta Region covering Guangdong Province, Hong Kong and Macau, said its January-June gross profit was 165 million hkd, up 7.6% year-on-year, with the gross profit margin rising to 24.0% (1H2011: 23.3%).

The bottom line decreased by 15.3% to 70.1 million hkd due to non-recurrence of one-off gains arising from the disposal of Dongguan Humen Great Trade Containers Port Co Ltd.

Excluding the impact of this one-off item, net profit would have increased by 6.9%.

Basic earnings per share amounted to 7.79 HK cents (1H2011: 9.20 HK cents), with the Board not proposing an interim dividend for the first half (1H2011: 1 HK cent).

Huang Liezhang, Managing Director of CKS, said: "CKS's 1H2012 performance continued to remain steady despite a sea of global uncertainties.”

He said the European debt crisis has negatively impacted trading activity around the world.

“We persist in adopting a pragmatic approach, promoting professional operations, rolling-out business upgrades and transformations, and encouraging innovative business ideas.

“In the meantime, we place an emphasis on increasing sales and improving our service quality,” Mr. Huang said.

He said this approach not only helps it to fend off the impact from external shocks, “but also will facilitate the completion of various business tasks this year."

Cargo Transport Slowed

Due to the weak economic environment, the growth of CKS's cargo transport business slowed.

However, with CKS's efforts in rolling out its port enhancement business strategy, overall container transport volume and handling volume registered year-on-year growth of 5.6% and 13.7%, respectively, to 528,545 TEU and 539,699 TEU.

As for the break bulk cargo transport business, it was affected by the overall trend of "containerization,” so transport volume and handling volume decreased by 14.5% and 10.5%, respectively, to 133,205 tonnes and 755,573 tonnes.

During the period, Zhaoqing Chu Kong Logistics (Sihui) and Foshan New Port reported an increased profit contribution to the Group. Zhaoqing Chu Kong Logistics (Gaoyao) and Civet (Zhuhai Bonded Area) Logistics successfully turned around from losses and delivered positive profit contributions to the Group.

The improved financial performance of these ports was the main driver for the underlying profit growth of CKS.

Passenger Transport

CKS recorded a good performance in passenger transport business during the first half.

The number of passengers for agency services of CKS rose by 4.4% to approximately 2.98 million, while the number of passengers for terminal services grew by 7.0% to 3.23 million.

Passenger transport business contributed a profit of 32.3 million hkd, a year-on-year increase of 35.4%.

Chu Kong Passenger Transport Co Ltd (CKPT) operated a total of 17 ferry routes in urban areas in Guangdong Province, Hong Kong and Macau and concurrently is engaged in passenger services at the Hong Kong International Airport SkyPier.

Strategic Alliances, New Projects

CKS has made progress in several key business projects.

The Group formed a strategic alliance with China Duty Free Group and completed tasks including the design of logistics services, analysis and alteration of storage facilities, as well as the research and development of business operating systems.

Secondly, CKS inked an agreement with THT Logistics Singapore (THT) to jointly develop Guangzhou Nansha International Logistics Park (NLP) as the logistics center serving China and Southeast Asian markets.

Worthy of note is that CKS's wholly-owned subsidiary -- Chu Kong High-Speed Ferry Co Ltd -- signed a services agreement with Cotai Ferry Co Ltd (a subsidiary of Sands China Ltd; HK: 1928) to manage and operate the high speed ferry fleet "CotaiJetTM" of Cotai Ferry, commencing from 31 July 2012.

The new business marks a milestone for CKS, as its experience in operating the high-speed ferry fleet has gained international vessel owners' recognition.

The new business will also increase CKS's profitability.

"The current turmoil in the global economy also provides numerous opportunities for the Group in the Pearl River Delta Region. Within the '12th Five-year Plan', the State has formulated very detailed expansion plans to develop a modern inland river transport system,” said Huang Liezhang, Managing Director of CKS.

He added that with CKS’s “strategic position” in the transport industry within the Guangdong-Hong Kong-Macau region, the Group enjoys “a strong competitive advantage and has room for expansion.”

“We will continue to adopt the acquisition and alliance strategy, enhance upgrading the cargo terminals, consolidate and rationalize our internal resources, and improve our operational efficiency.

“Moving forward, we remain optimistic about the prospects of our logistics services and passenger transport segments."

Chu Kong Shipping Enterprises (Group) Co Ltd (CKS) is a listed Group incorporated in Hong Kong and held by Chu Kong Shipping Enterprises (Holdings) Co Ltd (CKSE).

Its strategic orientation is "based in Hong Kong, backed by the mainland and facing the world" and is principally engaged in navigation logistics, high-speed waterway passenger transportation and tourist business between Hong Kong, the Pearl River Delta Region (PRD) and coastal areas.

After 15 years of development, CKS owns equity shares of 20 PRD inland barge terminals and operates more than 35 container barge routes, as well as 18 bulk freight routes between HK and PRD inland terminals.

CKS operates a total of 17 passenger routes with 16 passenger destinations in Hong Kong, Macau and Guangdong Province. CKS is one of the market leaders in the PRD waterway logistics and high-speed waterway passenger transport markets.

See also:

CHU KONG: Initiated ‘Buy’, CONTAINER SHIPPING To ‘Underperform’

Singapore's THT, Chu Kong Shipping Ink Major Logistics Tieup

CHU KONG In Ship Shape With ‘Buy’

CHU KONG SHIPPING: ‘All In Same Boat’ With Fuel Prices