Excerpts from latest analyst reports...

CAPITAL SECURITIES: MGM CHINA's valuation 'undemanding'

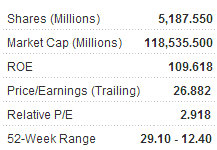

Capital Securities says it is beginning coverage of Macau-based luxury resort, hotel and casino operator MGM China Holdings Ltd (HK: 2282) with a BUY recommendation and target price of 17.08 hkd.

Capital also calls MGM China a "lagging player.”

“The company is also exploring other casino gaming development opportunities in Macau.

"We find the current valuation is undemanding,” Capital said.

Capital added that MGM China benefits from the “strong growth rate of the industry.”

Key risks include political and policy risks, interest rate risks, intensifying competition and uncertainties from the black market.

“MGM China operates a premium integrated casino resort on the Macau Peninsula, and enjoys an 11.4% market share out of the 33 casinos in Macau.

“The flagship property is MGM Macau, which is an award-wining, five star integrated casino and luxury hotel resort located on the Macau Peninsula, which is in the same neighbourhood as Wynn Macau and Encore at Wynn Macau, Casino L’Arc Macau, Galaxy StarWorld, and the Grand Lisboa.”

MGM China saw a robust first half, with total operating revenue up 94.8% y-o-y at 9.9 bln hkd, which was due to a combination of factors, including strong overall Macau market growth, enhanced marketing efforts and property improvements.

“Investors should bear in mind that MGM China released net debt to capital ratio of 28.1% (1H10: 72.8%),” Capital added.

Listed on June 3, 2011, Capital said there is really a lack of a track record for MGM China.

“As such, we find pure play approach is feasible for estimating the beta of MGM China.

"That said, we need to find a similar casino operator to derive the beta of MGM China.”

See also: GALAXY ENTERTAINMENT: Bingo! Up 1,700% In 2.5 Years

HAITONG: ‘Premium play’ WYNN MACAU gets BUY call

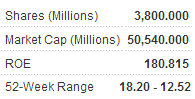

Haitong Securities says that Wynn Macau (HK: 1128) is a “premium play,” and gives the casino operator a BUY call.

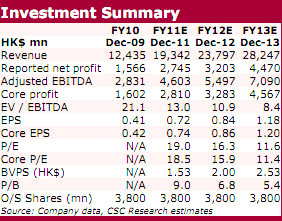

Wynn Macau announced its 1H11 results with adjusted EBITDA climbing 49% y-o-y to 3.9 bln hkd on the back of a 41% y-o-y growth in operating revenues to 14.3 bln. Net profit shot up 27% y-o-y to 2.4 bln.

“There were few surprises as its Nasdaq-listed parent company Wynn Resorts had reported WM’s 2Q11 operating figures after mid-July. Riding the industry’s soaring growth momentum, Macau’s gross gaming revenue was up 45% y-o-y to MOP124.1 bln in 1H11,” Haitong said.

WM’s reported casino revenues came in at 13.5 bln hkd, posting a robust y-o-y growth of 42%. Its mass market segment registered table games wins of 2.9 bln hkd under a y-o-y surge of 58%, outpacing its VIP revenue growth of 39% y-o-y.

The main culprit for the drop in the high roller segment’s table games win was a 0.46-ppt q-o-q drop in win rate to 2.69% in 1Q11, which led to a 10% q-o-q drop in table games win despite a 6% q-o-q leap in rolling volume to approximately 228.5 bln hkd.

“The q-o-q growth in volume and win rate of its mass market and slot machine gaming operation remained relatively flat, which we believe might be partly caused by the opening of the Galaxy Macau in mid-May, exerting pressure on its mass gaming volume.”

With regard to its Cotai project, WM is awaiting approval from the Macau government for its land grant.

“The property is expected to offer 500 gaming tables, a 1,500-room hotel largely comprised of suites, convention, retail, entertainment and food and beverage offerings.”

WM is trading at around 13x FY12 EV/EBITDA, a slight premium to the estimated average of its peers.

“We continue to retain our positive outlook towards the stock despite the absence of major catalysts prior to the opening of its Cotai project, as the company remains a strong player under prudent management with its earnings impetus derived from its existing premier offerings.”

See also: What Bear Market? 11 IPOs Eye 77 Bln Hkd In Sept, Including Hongguo