BOCOM says Chinese refiners face a “tough road ahead” as oil prices continue to rise

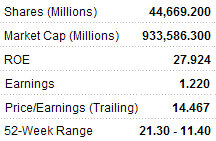

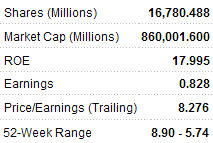

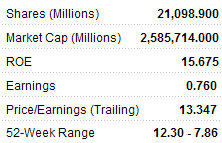

The research house stays OUTPERFORM on the refining sector with a BUY on CNOOC Ltd (HK: 883, TP: 26.25 hkd, now: 20.7), NEUTRAL on Sinopec Ltd (HK: 386, TP: 6.65 hkd, now: 8.14) and LT-BUY on PetroChina Co Ltd (HK: 857, TP: 12.95 hkd, now: 12.14).

NDRC raised oil prices on April 7 NDRC announced that it will raise gasoline and diesel prices by 500 yuan/ton and 400 yuan/ton, respectively, effective April 7.

Price of jet fuel not touched This serves as the second price hike this year following the first uplift on Feb 21, 2011, when the prices of gasoline, diesel and jet fuel were raised by 350 yuan/tonne.

22-day moving average of BRENT oil price climbed 13.9% since Feb 21 NDRC first raised gasoline, diesel and jet fuel prices in February when the 22-day moving average of BRENT oil price stood at 101.2 usd/barrel. The 22-day moving average of BRENT oil price has climbed around 13.9% from then to 115.3 usd/barrel.

Price hike insufficient to compensate for increase in crude oil costs We estimate that the latest uplift of refined oil product prices could compensate crude oil cost increases of around 5.3 usd/barrel, while the 22-day moving average of BRENT oil price has risen by 14.1 usd/barrel for the same period.

Impact of price hike on PetroChina and Sinopec Based on the production capacity of gasoline, diesel fuel and kerosene and the equity scale, PetroChina and Sinopec could achieve revenue growth of 0.167 yuan/share and 0.589 yuan/share, with their annualized EPS climbing 0.115 yuan/share and 0.088 yuan/share, respectively.

Nevertheless, given a self-sufficiency rate of over 90% for PetroChina and external purchase rate of over 80% for Sinopec on processed crude oil, the price hike will increase both the revenue and profit of PetroChina while raising revenue and reducing loss of Sinopec at the present stage.

OUTPERFORM on refining sector maintained The latest uplift of refined oil product prices could help alleviate the cost pressure faced by domestic oil refiners. Based on our estimates on the upcoming international oil price movement, we take an optimistic view on the upstream and downstream segments while holding a cautious view on the midstream oil refining business. We maintain our recent ratings and TPs for the 3 major oil producers.

See also: CHINA AUTO SECTOR In ‘Downhill’ Skid: What Analysts Now Say...

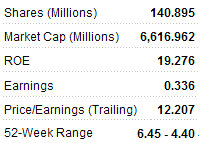

UOB Kay Hian says Kunming Machine’s negatives already priced in, hiking TP to 7.86 hkd from 6.48 (54.1% upside)

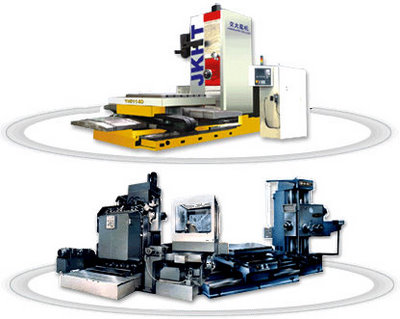

The research house is maintaining its BUY on Shenji Group Kunming Machine Tool Co Ltd (HK: 300), calling it a “laggard” in the PRC machinery sector.

Shares of Hong Kong-listed machinery plays including First Tractor (HK: 38), Haitian (HK: 1882) and Sany Heavy (HK: 631) performed strongly given increasing attention on the sector and newsflow on policy of promoting high-end manufacturing. We believe Kunming Machine (KM), a leading numerical control machine producer in China, looks attractive after the post-results sell-off.

High-end equipment manufacturing The Chinese government has recognized the importance of the high-end manufacturing industry and has designated it as one of the key industries for the country’s future economic development. High-end manufacturing will focus on the aviation, satellite, rail transport, offshore engineering and smart equipment manufacturing sectors. High-end manufacturing is expected to enter another high-growth period during the 12th Five-year Plan. Policies have been launched to support the development of leading local manufacturers.

China No.1 user of machine tools The machine tool industry is an essential component of the industrial and manufacturing sectors. It provides the equipment necessary for manufacturing and repairing machine parts that are used for manufacturing a wide range of industrial, consumer and engineering products. China became the largest global user of machine tools in 2002 and has retained its position since then. In 2010, China’s consumption of machine tools was estimated at 28.5 bln usd, up from 13 bln in 2006, implying a CAGR of 21.7%.

Stock Impact The Chinese government has designated the machine tool industry as a key industry for the future development of the national economy. The government has launched policies to support the development of local machine tool manufacturers. The outlook is positive, especially for those concentrating on the computerized numerical control (CNC) machine market, given the fast-growing heavy machinery sector, increasing import substitution, strong governmental support and machinery upgrading by downstream manufacturers.

According to the 12th Five-year Plan for the machine tool industry, output value of the whole industry is expected to reach 700 bln yuan in 2015, up from 455 bln in 2009. Output of CNC machines will reach 200,000 units per year and localization rate will reach 70% in 2015, up from 58.8% in 2010.

See also: BRIGHT WORLD, TECHCOMP: What The Edge S'pore Reported...