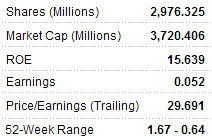

SPARKLE ROLL Group Ltd (HK: 970), distributor of Rolls-Royce, Bentley and Lamborghini cars, luxury timepieces, jewelry and fine wines in the PRC, saw its most recent half-year revenue nearly triple to 1.3 bln hkd, and its auto division – which contributes over 90% to the top line – should see “big growth” this year as well, Chairman Ivan Tong told NextInsight in an exclusive interview.

He said this had much to do with the fact that last year in mainland China, the number of millionaires rose 6.1% to 875,000.

In addition to the top-shelf auto brands mentioned above, Sparkle Roll distributes Richard Mille, DeWitt, Parmigiani, and deLaCour BiTourbillion watches as well as jewelry under the Boucheron and Federico Buccellati brand names.

Prior to 2008, Hong Kong-based Sparkle Roll was known as Jade Dynasty Group Ltd.

NextInsight: Sparkle Roll had a busy 2010. In August, Sparkle Roll was assigned as the approved dealer in the PRC for "Chateau Margaux". In July, you were appointed as approved dealer of "Domaine d'Eugénie" in the PRC (including Macau SAR). In February, you were granted Exclusive Distributorship of Italian Jewelry "Federico Buccellati" in PRC. In January, you were granted Exclusive Global Distributorship of Swiss branded watch "deLaCour" BiTourbillon.

And this year has also started out strong. On January 27 Sparkle Roll was Appointed as Approved Distributor by another renowned exporter of Bordeaux wines - Ulysse Cazabonne, and on January 19 your Beijing Rolls-Royce Dealer distributor business ranked No.1 in the 2010 Rolls-Royce Motor cars sales worldwide.

How is 2011 shaping up on this front? How many new “approved dealership” arrangements do you expect this year, and which ones can you announce now?

Chairman Tong: 2010 has been an outperformance year for Sparkle Roll; not only have we recruited new brands of watches and fine wine exporters from Bordeaux, the Group also announced the soft launch of Sparkle Roll Luxury World in Beijing in January 2011 which marked a new milestone for the Group. Looking back, Sparkle Roll recruited 6 brands in 12 months time in 2009/2010 and since then, it accelerated the Group’s development tremendously.

Sparkle Roll is a luxury brand manager with a clear growth strategy and prudent sales target. The Group has a strong foothold in Beijing and surrounding regions where high-net-worth individuals are concentrated. We are committed to becoming the leading luxury-product distributor in China via cross selling of luxury products to its high-end customers

Looking ahead to 2011 …In terms of the automobile segment, Sparkle Roll’s dealership coverage is moving beyond first tier cities to second tier cities such as Tianjin and Dalian

Sparkle Roll has in March 2011 struck a 5-year deal with another reputable diamond jewelry brand – Royal Asscher – to fill up a “missing link” in our jewelry portfolio as it plans to have at least three core brands in each of the product segments.The Group is also expanding the retail network for each of the brands by adding complementary stores in the Sparkle Roll Luxury Roll (to be named Sparkle Roll Luxury Centre) on Chang An Avenue in Beijing and the Lippo Plaza as well as Hong Kong Plaza in Shanghai. Sparkle Roll Luxury Roll has three floors, including luxury clothing brands such as Burberry as our sub-tenant, the Group’s watch and jewelry stores, and a large-scale wine cellar and wine centre to display Bordeaux wines. These shops have already announced their soft launch in January this year.

For watches, Sparkle Roll plans to open around 6 to 10 stores for each brand across China. For autos, the Group will add Rolls-Royce and Bentley dealerships in Tianjin and Lamborghini dealership in Dalian this year. For fine wines, the Group has recently launched its own private label wine called “Ex Chateau." The wines are bought in boxes, shipped straight from Bordeaux. They are available for sale in the 850 metre square wine cellar/wine shops in the Sparkle Roll Luxury World in Beijing.

Sparkle Roll is not targeting to blanket China with high-end stores. In fact, we adopt prudent and careful planning of the network distribution points to capture the most of high-end consumers in China.

Sparkle Roll has introduced Morgan Stanley Private Equity as a New Substantial Shareholder last year. How does that impact Sparkle Roll’s future business development? Subsequent to the entering of MSPEA, what is the immediate next step for the company? Any new future strategic plans in store? Why do you think investors are interested in Sparkle Roll and what is the company’s niche or competitive edge?

Chairman Tong: Morgan Stanley Private Equity Asia (“MSPEA B.V.”) has nominated a candidate to join the Group’s Board of Directors as a non-executive director to assist in formulating the business strategies of Sparkle Roll

Morgan Stanley Private Equity Asia is one of the leading private equity investors in Asia, having invested in the region for over 16 years. The team has invested approximately US$1.6 billion in Asia in industry leading companies. We believe that their participation of shares can provide an opportunity for the Group to broaden its shareholder base for our future business developments. The wealth of global experience, deep industry expertise and large global network of affiliated partners of the Morgan Stanley Private Equity Asia III fund will have significant synergies with our leading luxury distributorships businesses in the PRC.

Sparkle Roll differs from regular luxury brand dealers in various ways, including: Database information on 16,000 millionaires in China to ease business engagement; Diversified product line (including automobiles, watches, jewelry, and red wine) not limited to selling a single luxury item which prompts the likelihood of adopting cross-selling marketing strategy; Capitalizes on extensive business connections to negotiate distributorship deals of world-wide top-tier luxury brands; A strong sales team familiar with the requirements and lifestyles of ultra-wealthy customers, and: The status of being a listed company in Hong Kong that gives confidence to our foreign brand owners regarding our financial transparency and corporate management.

What were the main financial considerations and reasons for the disposal of the Group’s comics and animations business?

Chairman Tong: The reason for the disposal of the Group’s comics and animation businesses was that Sparkle Roll has recorded unsatisfactory performance in this business segment and more funding was required to be put into animation business in order to sustain this current business segment.

After weighing out the opportunity costs, the Group decided to discard the comics and animations in two tranches and in turn, focus its resources and apply the proceeds from the disposal received by installments on the principal business of luxury goods in the PRC. The Group has ceased to have any interest in animation business in April 2010 and comics business in November 2010.

Sparkle Roll has been invited to present at The 14th Asian Investment Conference (“AIC”) in March in Hong Kong. What are the major benefits (short and long-term) that Sparkle Roll can earn from opportunities like this?

Chairman Tong: Sparkle Roll has been invited to attend the AIC and I spent a half day on March 21 and a full day on March 25 in both one-on-one and group meetings there.

Asia has risen from the depths of the financial crisis to become the global leader of economic growth. AIC is being recognized by Credit Suisse as the leading event for discovering tomorrow’s opportunities. It is committed to forward-looking special sessions that showcase themes and markets which affect the economy. They have brought together some of the world’s most powerful hedge fund managers to hear their opinions on Asian opportunities. Its popularity has grown along with investor interest in the region, from some 400 delegates at the first AIC in 1998.

The AIC event is a recognizable worldwide event with more than 2,000 institutional and high net worth investors from across the globe, bringing business opportunities to companies. Through this event, local companies such as Sparkle Roll can share our market experience with other industry leaders around the world and also provide the opportunity to meet with interested investors and equity partners for business opportunities.

Being in the high-end luxury brand business, your target market (especially for autos) is very specific and well-to-do. Certainly this target demographic would already be fully aware of the existence of the auto brands you market and their top-end prestige value. Hence, does Sparkle Roll need to budget far less of an A&P/marketing budget than non-luxury car brands/dealers because of the nature of your luxury models?

Chairman Tong: Sparkle Roll is the brand manager for a unique portfolio of automobiles, watches, jewelry and fine wines. The products Sparkle Roll distributes are featured with high quality, controlled distribution and premium pricing. As a brand manager, our job is to promote the brand with the essence of their heritage, value, and design.

Unlike non-luxury brand items, luxury business, especially in the car sector, does not require massive advertising and promotion schemes. Often, the marketing is done through word-of-mouth and social gatherings of wealthy elites (i.e. VIP clubs, sharing sessions, attending invitation-only events, etc).

Also important is the shopping experience they receive and the attached implication. It is not enough to be rich. Being a VIP and being witnessed shopping at an uptown luxury shop is just as valuable and being recognized by the sales staff in luxury stores is especially appreciated. It is expected that the Company will continue to benefit from the fast-growing super luxury car sales of its dealership brands at least over the next 2 to 3 years.

For watches and jewelry, more or less, the brand owners will contribute half of our A&P/marketing budget every year. Therefore, as a whole, A&P expenses will represent a nominal portion of our total revenues.

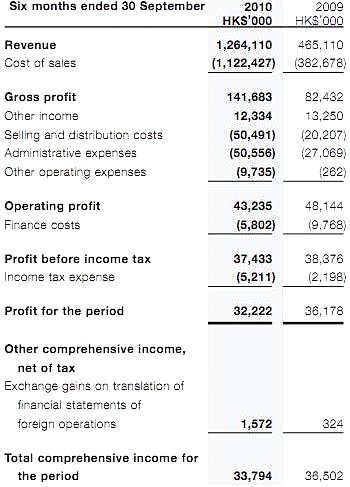

Why did revenue from trading of cars and provision of after-sale services more than triple to HK$1.2 billion during the April-September 2010 period? Is it because of more aggressive marketing of luxury auto brands, growing consumer confidence in the luxury sector, or simply because there are more and more multi-(yuan)-millionaires appearing?

Chairman Tong: The super luxury automobile distributorship business is the major revenue and earnings contributor for Sparkle Roll. Sparkle Roll derived over 90% of earnings from the strong sales of three of the top seven popular super luxury car brands in China (Bentley, Lamborghini and Rolls-Royce), with an expected 72% 3-year auto revenue CAGR. The outstanding performance of the sales is mainly attributed to synergy from cross-selling and the build-up of its VIP sales network complied with relaxation of supply for China market from the automobile manufacturers. On the other hand, we are determined to steer the company towards a consumer discretionary and hope to strike a more balanced mix in the top line in the next 2 to 3 years, say 80/20 or more preferably 85/15 between auto and non-auto businesses.

The reason for the super luxury car sales rocketing is due to a few reasons: The fast-growing super luxury car sales in China; Rising demand for super luxury automobiles due to their current low penetration rate in China and the rise in the number of wealthy individuals; New models of cars that are especially targeted at PRC consumers; Release of consumption power after people digesting the reality of increasing high-emission cars consumption tax.

Of Sparkle Roll’s five business segments, Autos, Watches, Jewelry, Wines, Comics and animations development... is it possible to provide a breakdown of revenue for each from PRC market and non-PRC markets for the latest reporting period?

Chairman Tong: All luxury products under the distributorship of Sparkle Roll are only available in the PRC market.

After the disposal of comics and animations development businesses in 2010, it is believed that all the revenue of the Group will be from the PRC.

How do you anticipate your top line revenue contribution breakdown to change in the six months to March 31, 2011 period, and going forward?

Chairman Tong: For FY March/11, auto division contributes over 90% of top line revenue. Second half of FY11 will register a big jump in both top line and gross profit.

Looking ahead, it is expected that the auto division will be able to achieve a 50-60% growth in FY12 and another 40-50% growth in FY12 and another 40-50% in FY13 while non-auto divisions are targeted to achieve a YOY growth of 70-100%.

Are you bullish on the long-term (5-10) year prospects for the luxury market in the PRC? Why or why not?

Chairman Tong: We estimate that mainland Chinese will represent almost half of the growth in the global luxury-goods market over the next 10 year. The future of the luxury market in the PRC will continue to be brands drive purchases.

According to Euromonitor estimates, Mainland China’s per-capita disposable income will grow 11% annually in the next 5 years. The rapid urbanization in China also gives a boost to the luxury-goods market, where a larger workforce with growing incomes will benefit the many high-end brands that are expanding their presence in first and second-tier cities.

China’s sustainable economic growth continues to provide people with both the appetite and the means to indulge. Sparkle Roll assumes the role of brand manager and to a great extent, a company’s ability to grow in China will depend on its ability to attract, train, and retain qualified sales staff who are capable of creating an in-store experience that reinforces a luxury brand.

China’s millionaires are becoming increasingly sophisticated in the way they spend their money, and at a remarkable pace. According the Wealth Report released in 2010 by Hurun Report: There are 875,000 millionaires in China, a rise of 6.1% on last year; Beijing is home to more of China’s rich than anywhere else, with 151,000 millionaires. Guangdong occupies 2nd position, and Shanghai is 3rd.

According to The Ministry of Commerce, China’s luxury goods market will grow 10% annually until 2015 and predicted that China would become the world’s largest luxury market by 2014, with a 23% share in the global luxury business.

According to a new report by CLSA titled “Dipped in Gold," it also forecast that overall consumption in China will rise by 11% annually over the next 5 years and sales of luxury goods will grow more than twice as quickly. Given rising incomes and supportive social factors, they expect Greater Chinese customers to account for 44% of global luxury sales by 2020.

Looking ahead, demand from mainland consumers is only capped by supply. As of now, most luxury stores are still concentrated in Tier-1 and Tier-2 cities in China, but the market will continue to expand to further penetrate into Tier-3 cities in China. We expect mainland China to represent half of global luxury-goods growth over the next 10 years.

See also: WARREN BUFFETT: How Important Is $ To Him, What Is Real Success, Etc?