Excerpts from latest analyst reports...

SBI E2-Capital says SUNDART'S (HK: 2288) cash enough for three big growth strategies

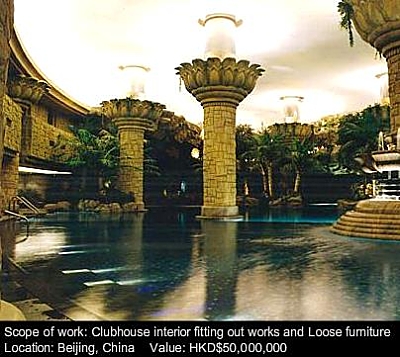

Cash-rich for 3 major growth drivers in the future By end Sept 2010, Sundart was at net cash position of HK$429m after deducting amounts due to related company and jointly controlled entity. In our view, Sundart is rich enough in cash to 1) continue to capture fitting-out opportunities in HK and Macau upon economic recovery; 2) first participate in property development in HK; 3) increase exposure in China property development with respect to investment or fitting-out contracts.

Opportunities in HK and Macau – increasing contract backlog

Economic recovery in HK and gaming sector investment in Macau both present good opportunities to construction sector as well as fitting-out business. Contract backlog by end of Sep 2009, March 2010 and Sept 2010 gradually increased from HK$885m to HK$1,120m and then HK$1,320m. In Nov the company announced additional HK$190m contracts acquired. In addition, 10 infrastructure projects in HK may bring along HK$7,000m fitting-out contracts in 5 years. Sundart has an estimated market share of 20%-25% in HK and had track record of winning Tamar Development project. Due to growth opportunities, we assume fitting-out turnover to stay HK$1,800m a year.

Opportunities in China On 15 Sept last year, the company utilized HK$20.8m to acquire 29.4% interest of Kailong REI, a leading player in China’s real estate investment / real estate fund management. Major shareholders of the fund include Carval Investors and Secured Capital Japan. Other investors include Citi Bank, Starwood Capital, Cargill and Rockpoint. President and co-founder of the fund is Stephen A. Roth, who also founded or co-founded Secured Capital Japan, STAM REI in EU and Secured Capital Corp in US. Since Sundart’s exposure in China is actual, this move should enhance sales network of fitting-out portions of renovation and provide investment opportunities in China.

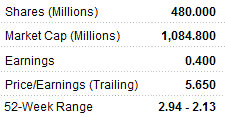

Preliminary profit forecast Market currently expects net profit at HK$154m and HK$200m for FY03/11F and FY03/12F, representing over 12% YoY fall in net profit for FY03/11F. Based on preliminary study, we estimate net profit for FY03/11F, FY03/12F and FY03/13F to be HK$138m, HK$178m and HK$461m, taking account into Kwun Tong project to be recognized in FY03/13F, which represents 7.9x, 6.1x and 2.4x P/E.

See recent: HANG LUNG PROPERTIES, SOHO CHINA: What Analysts Now Say...

ZOOMLION (HK: 1157) ‘outperform’ from KGI on China building boom

Zoomlion has one of the most diversified and comprehensive product offerings in China’s construction machinery industry. It currently offers more than 640 models of machinery and equipment covering 83 different product types across 13 product lines, which include concrete machinery, crane machinery, environmental and sanitation machinery, road construction and pile foundation machinery, earth working machinery and material handling machinery and systems.

Industry benefits from government policies: Benefits from the 12th 5-yr plan as it is expected that sales to heavy industry reached RMB900bn by end-2010, the average annual growth rate would be around 17% in coming five years. The speed up of urbanization should help boost heavy industry. Given its historical figures, Changsha Zoomlion enjoyed higher growth when compared to industry average, and the fund raising from H share listing should help the counter to expand its overseas business.

Fair valuation: Currently, its 2010 P/E would be 20 times, valuation is fair, given its strong growth perspective.

Recommendation: 'Outperform', Stop Loss: HK$17.

See recent: AUSGROUP: Heading Towards An Inflexion Point In 2H Of Calendar Year 2011

KGI bullish on med-tech firm MICROPORT (HK: 853) due to top PRC market share

Founded in May 1998, MicroPort is a leading manufacturer of medical devices in China in terms of the number of stents implanted, focusing primarily on minimally invasive interventional products for the treatment of vascular diseases and disorders. The Group develops and produces cardiovascular and other vascular devices, as well as a diabetes device.

MicroPort's products are used in over 1,100 hospitals across China (over 90% of turnover), and some of the products have been exported to the Asia Pacific region, South America and Europe.

Number one in China market: MicroPort had the leading market share, in terms of the number of stents implanted, of 28.9% of all coronary stents implanted in China in 2009 which is ranked No. 1 compared with Lepu Medical (SZA: 300003) at 22.5% and Shandong JW’s (HK: 1066) 22.0%.

PRC coronary stent market to rise at CAGR of 24% to Rmb16.9bn in 2014 which will favor the Group’s expansion in this business. Besides, the Group also develops next generation stents and medical devices for the treatment of other types of chronic ailments so as to further improve its earnings.

Diversified shareholder base will increase investor confidence: Since Japan's largest unlisted pharmaceutical company Otsuka, Chairman Chang and China Pudong’s SASAC own 33.4%, 15.5% and 15.4%, respectively, its diversified shareholder base boosts investor confidence.

Estimated net profit for FY10 is Rmb284mn, up 53% yoy. EPS for FY10 and FY11 would be Rmb0.22 and Rmb0.247, respectively.

Recommendation: Target price: HK$6.90, Stop Loss: HK$5.70.

See also: CHINA ANIMAL HEALTHCARE Down 5% On Its Dual-Listing Debut