File photo by Sim Kih

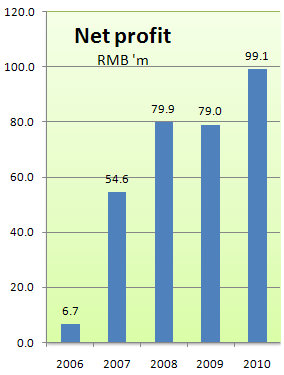

CHANGJIANG FERTILIZER had a bumper harvest of profits in 4Q with net profit soaring 138% to RMB37.6 million.

That lifted the full-year profit to RMB99.1 million, or a 25.5% growth year on year.

On an earnings per share of 27.54 RMB cents, Changjiang stock trades at a PE of 4.3X based on a recent stock price of 23 cents. It is trading at 1X book value but has no dividend yield.

Changjiang is a manufacturer of fertilizers, a business that can achieve a faster rate of growth via acquisitions – which is its stated strategy - than through organic growth.

Last year’s sterling growth was catalysed by acquisitions of the assets of two companies in Hunan province, home to Changjiang itself.

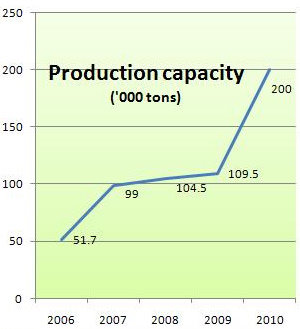

The acquisitions added 90,000 tonnes of annual production capacity from May and October for anhydrous ammonia, which is used in making fertiliser. Prior to the acquisitions, Changjiang had a capacity of 109,000 tonnes in a single plant.

Acquiring existing facilities is the best way to value-add and the most cost-efficient way to expand market share, Changjiang believes.

In comparison, setting up a brand new operation will take about two years and has the added disadvantage of burning cash in the meantime without any inflow of operating cash, said Changjiang CFO Joel Leong at a briefing for investors on Wednesday (March 2).

Also contributing to the bottomline last year were higher average selling prices of the entire range of Changjiang’s products.

However, the gross profit margin was dragged down from 30% to 28.5% for the full year as a result of a 16.8% increase in the average price of coal, a raw material in the production of fertiliser.

Coal accounted for 60% of the cost of production.

This year: More production capacity, watch out for electricity price rise

Continuing its strategy of acquisitions, Changjiang had proposed last December to issue convertible bonds with a principal amount of S$20 million.

This sum will be used to set up a joint venture with strategic investors, who will pump in S$80 million, to acquire fertilizer plants in China.

The bonds are convertible into shares at 30 cents apiece.

Changjiang expects the joint venture to complete its acquisitions this year.

In the meantime, Changjiang will expand the capacity of its first plant from 109,000 tonnes to 135,000 tonnes this year.

To fund this capacity expansion, it will rely on its healthy operating cashflow (which amounted to RMB146 million last year) and its cash balance of RMB46 million.

Another change this year could be an increase in the cost of electricity, ventured Mr Leong, adding that the cost had barely increased last year, thanks to government subsidies.

Recent story: CJ FERTILIZER: 3Q10 sales up 10.4% at Rmb 84.5 m