Excerpts from latest analyst reports…..

Kim Eng maintains 'buy' call but lowers target price of REA to 35 cts

Analyst: Eric Ong

REA, which owns a 49% stake, and Datang Renewable, its JV partner, will be responsible for the construction and subsequent maintenance of the wind farm.

Action & Recommendation

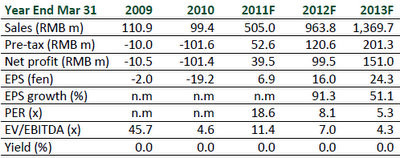

We lower our target multiple to 11x FY Mar12F PER and trim our target price to $0.35 from $0.40 following Datang Renewable’s lackluster share price performance since its debut on the Hong Kong stock exchange on 17 December 2010.

In our view, this seems to suggest waning investor appetite for wind power producers as sentiment is being weighed by sector concerns.

With 37% upside potential, we maintain our BUY call.

CIMB downgrades dry bulk shipping to ‘underweight’

Analysts: Raymond Yap, CFA, & John Tan

Downgrade from Neutral to UNDERWEIGHT. Dry bulk sector demand and supply fundamentals look weak over the next three years due to excessive newbuilding deliveries and the negative impact on commodity supply from exogenous events like bad weather.

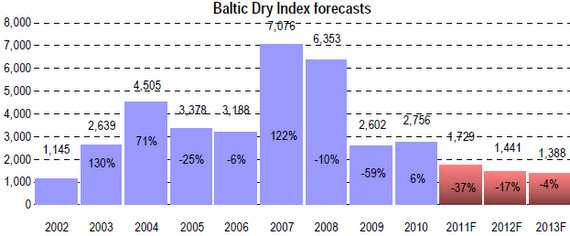

Consequently, we downgrade our BDI forecasts by 25-28% in 2011-12 and by 54% in 2013 to reflect the punishing medium-term outlook. Dry bulk freight rates will not stabilise until 2013, hence we believe investors will give the sector a miss for the next two years.

Rate volatility may provide the trading opportunities but risk-averse investors should avoid the sector. We continue to prefer the container sector for exposure to shipping.

We downgrade Pacific Basin from Trading Buy to NEUTRAL but retain our recommendations for the other stocks. Across all companies, we cut target prices 4-13% and cut earnings forecasts 7-42%.

AmFraser says BERLIAN LAJU’s stock “should see some recovery”

* Grow its business in the cabotage segment. BLT plans to grow is business by participating more in the Indonesian market under the new cabotage segment by bidding for Pertamina’s oil and gas tankers and other offshore vessels such as floating production and storage offloading vessels (FPSOs).

BLT’s share price has been hit over the past 2 years by the sharp decline in the charter rates and also increasingly high debts and liquidity problems.

We feel that the share price may have bottomed at current levels and should see some recovery in the medium term from higher charter rates in the second half of 2011 and 2012.

The shares are also currently trading below its NAV/share of USD 6.5c or Price/NAV of 0.6x and is lower than the average of 0.8x for its competitors.