SHARES OF Koon Holdings have shot up by about 77% since July, from 35 cents to 62 cents recently on the Singapore Exchange.

Dual-listed in Australia, the shares are still trading at a low PE, of about 4.2X the company's last 12 months’ earnings.

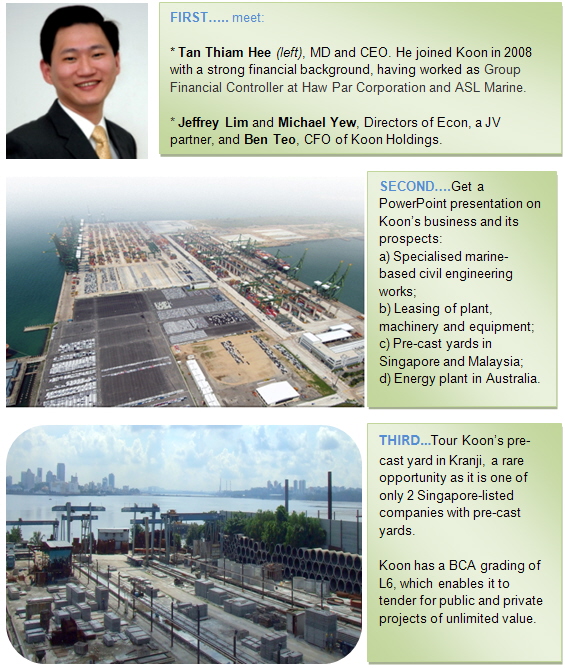

Whether you are a shareholder who is sitting on good gains or you are hearing of Koon for the first time, you are invited to visit Koon’s pre-cast facility in Kranji Way.

Date: 10 am, Saturday, Dec 11.

This is part of a series of company visits that NextInsight is organizing.

In recent months, we have organized visits to Trek 2000 (twice in fact), Mencast and MTQ – companies we view to have a strong future.

As for Koon, it is one of the largest domestic civil engineering players, and has played a part in various large-scale infrastructure and reclamation projects, including Punggol Serangoon reservoir and the expansion of Jurong Island.

Kim Eng Research said in a report in October that Koon had net cash of S$42 million (just below recent market cap of S$51 million), and may pay a special dividend.

To boost liquidity, Koon (www.koon.com.sg) is proposing a 1-for-1 bonus share issue.

At the visit to Koon, you can look forward to the following:

Recent stories:

KOON strengthens foothold in precast market

KOON: Undervalued stock strong in M&A