Excerpts from latest analyst reports….

CIMB says ‘buy’ Swing Media, targets 11.5 cents

Analyst: Jonathan Ng

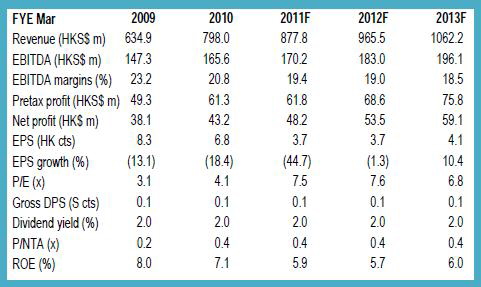

• We met up with Swing Media recently. The Company’s FY10 results were decent with sales growing 26% yoy to HK$798m while net profit rose 13% yoy to S$43.2m.

• Efforts to reduce gearing paid off with net gearing falling to 0.28x at end March 2010 compared to 0.71x at end Mar 09.

• To position against the in roads made by Blu-ray recordable discs (BD-R), the Company has already upgraded some of its machineries to BD-R capability.

• A 1 for 2 rights issue is now under subscription and if fully subscribed will further increase the Company’s cash balance. With limited capex and still profitable operations, the Company could turn net cash in FY12 while reducing neat gearing ratio further in FY11.

• Plan for a dual listing in Hong Kong remains a foot with all the relevant professional parties having been appointed.

• On its solar project, if Shanghai Huiyang can reach 50 stations by Dec 2010, Swing Media will acquire an 80% stake in this Company. Management appears confident that Shanghai Huiyang can reach 50 stations by end of this year.

• Maintain BUY, TP S$0.115 based on parity to CY10 NTA per share.