Macquarie Equities Research initiates coverage of OSIM with $1.39 target

Analysts: Patrick Yau, Somesh Kumar Agarwal

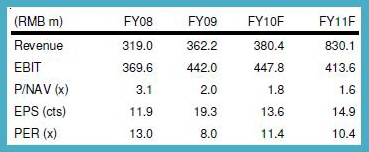

We believe OSIM is on the cusp of a strong turnaround in its operations, driven by renewed focus on its core business and profitability, and aided by strong expansion plans in China. We believe earnings are set to double in the next two years and continue to grow strongly until FY14.

For an experienced player with a strong brand name in Asian markets, the stock is attractively placed at 9.7x CY11E core earnings and could re-rate to 16x, in our view. We see strong potential upside from the Brookstone turnaround and stronger-than-expected expansion in China.

What’s causing the turnaround: Renewed focus

Back from the brink: Over 24 months, the stock had fallen to S$0.05 from S$2.00 in December 2008 after Brookstone, its 56%-owned US subsidiary, was on the verge of filing for bankruptcy, and core operations in OSIM were hit by high product discounts during the global financial crisis.

Our confidence in OSIM’s core business is reinforced by its strong results over the past six quarters, with Brookstone worries fading after OSIM wrote it off.

Renewed focus by management: The spotlight is back on profitability with Ron Sim, founder and CEO, focusing squarely on the core business of OSIM, especially in the key target market of China.

This was unlike CY05–08, when it aspired to become a global player and expanded all over the Asia Pacific.

Building up China, a greatly under-penetrated market: In organic growth, OSIM is focusing entirely on China for the next five years; it is now present in only 35 of the 175 cities that have a population of at least 1m. In China, its penetration of lifestyle and healthcare supplement markets is quite low.

Focus on profitability / cash: Osim’s successful product innovations have led to higher per-store revenue and EBITDA while outsourced manufacturing ensures lower working capital requirements. A resultant higher FCF supports capex, dividend payouts and buffer for acquisitions in key markets like China.

What’s good: Growth, profitability, cash and valuations

Earnings could double in two years; robust growth may last until CY14: We expect CAGR earnings growth of 30% over the next five years, driven by organic growth, improved productivity per store and a healthier balance sheet.

Bulging cash kitty: Unlike in the past, OSIM is now a net cash company, with annual FCF of S$30–50m, ensuring high ROICs of around 45%.

Valuations not accounting for Brookstone and strong China expansion: Our S$1.39 target price is derived from the S$1.17 value for OSIM’s core business (16x CY11E PER) / S$0.23 for Brookstone (7x CY11E EV/EBITDA).

Like-for-like peer group non existent: OSIM is basically a designing and retailing company, while most of its competitors are manufacturers.

Upside from Brookstone: All 310 stores are operative and generating cash with a new CEO appointed this year. We expect EBITDA to grow back to the 2007 level of US$55–60m by CY12.

Execution upside in OSIM: We estimate store expansion at 9% CAGR over the next three years, which could have upside on better execution.

OCBC Investment Research: “Fair value of Oceanus is 32 c”

Analyst: Lee Wen Ching

During the visit, CEO Mr Yu De Hua reiterated his long-term growth plans and highlighted the following objectives as part of the group's ten-year growth strategy:

(i) expanding Oceanus' scale inabalone farming,

(ii) increasing Oceanus' ownership of the supply chain with a focus on consolidating downstream distribution and being self-sufficient in meeting its feed supply needs (currently purchased from a third party),

(iii) expandingits processed abalone product range, and in the further future,

(iv) expanding its aquaculture activities to include other seafood products.

Mr Yu envisions Oceanus growing from its current status as an abalone farmer to being a dominant seafood supplier within the next decade. The group has recently acquired several parcels of land in Fujian, paving the way for its tank expansion plan.

Near-term challenges persist. While we like Oceanus' longterm plans, near-term challenges remain and these could result in an overhang on the stock. The greatest uncertainty stems from its Ah Yat Tian Xia restaurant chain, which in our view, grew too fast, too furious.

This segment, which was introduced barely a year ago, incurred a RMB9.6m loss in 1Q10.

Management is currently restructuring its business model, pruning unprofitable outlets and revamping its product offering in a bid to capture the premium market. The group shut down six restaurants in 2Q10.

We expect write-offs associated with the closure (previously estimated at RMB20m) to hit the group's P&L in 2Q10 or 3Q10 and have accounted for these in our estimates.

In our view, uncertainty over Ah Yat Tian Xia could linger for another year or longer as the group experiments with various alternatives before deciding whether to divest the entire restaurant chain, and this may continue to weigh on its earnings outlook.

Not ruling out additional equity raising. Besides Ah YatTian Xia, the group's potential appetite for additional equity raises uncertainty. The group now expects to generate positive cash flows only in 2012 as opposed to its initial 2010 target.

While Oceanus is in a net cash position thanks to cash raised from financing activities in FY09, management does not rule out the possibility of raising additional equity should heavy capex call for additional funds. We have cut our FY10 dividend assumptions and maintain our HOLD rating and S$0.32 fair value estimate.