MAP makes voice coil motor plates used in HDD. NextInsight file photo.

MAP makes voice coil motor plates used in HDD. NextInsight file photo.Hard disk drive (HDD) makers are expecting a strong 2010, boosted by the Chinese market and corporate replacement demand for personal computers and notebooks.

Oct to Dec 2009 revenues for world No.1 HDD maker, Seagate, were up 35% year-on-year. Likewise, revenues for world No.2, Western Digital, were up 44%, having recovered from a sharp drop in demand a year ago. (The two HDD giants dominate with a combined global market share in excess of 60%.)

And the upturn is benefiting SGX-listed HDD component subcontractors such as Beyonics, Broadway, Cheungwoh and MAP. Cheungwoh, for one, recently gave a profit guidance of a better-than-expected 2H10.

These subcontractors take care of outsourced components that require less intense R&D and integration.

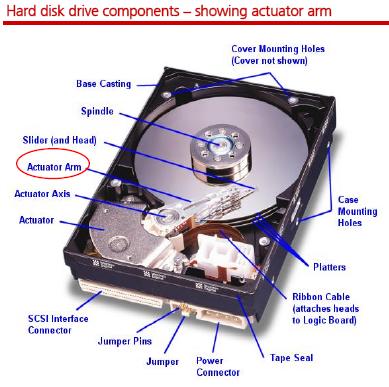

Though less high tech, some of these outsourced components are primary parts used by all HDDs. Examples include the base plate, top cover, and actuator assembly (mechanical device that converts electric currents to motion).

HDD shipments will grow 14% in 2010, according to Gartner. Graphic from DBS Vickers report.

HDD shipments will grow 14% in 2010, according to Gartner. Graphic from DBS Vickers report.

High barrier to entry

A component like the HDD cover may appear simple to the naked eye, but is so mechanically precise, capital investment to the tune of US$100 million or more is required to enter the business.

Qualification of such a part by the HDD manufacturer like Western Digital typically takes six to ten months, and at least one leading components supplier is included in the HDD design from the early stages. As such, it is difficult to simply drop a supplier once qualified, as it is risky, expensive and time-consuming to re-start the process.

Due to the high initial investment and the lengthy qualification process (during which components suppliers receive little revenue), the HDD industry’s components supply chain has become a focused and tightly connected group of companies, most of which have been in the business for years.

After years of collaboration on product design, going through the thick and thin of demand fluctuations and managing production ramp-ups, HDD manufactures have formed strategic relationships with certain suppliers.

These relationships are often pivotal in the evolution of the HDD components maker.

For example, MAP supplies mainly to its parent company, Min Aik, which supplies primarily to Western Digital. And Min Aik has been in the HDD parts business for 15 years.

And Broadway has become one of the world’s top three suppliers of HDD actuator arms, commanding a 16% to 20% market share.

After years of intense competition, the following companies are a handful from the pool of HDD component makers left in the market:

| SGX-listed HDD component maker | Product | Main Customer | Earnings announcement |

| Broadway | Actuator arm assembly | Seagate, Hitachi | 23 Feb |

| MAP Technology | Actuator arm assembly, top cover | Western Digital | 18 Feb |

| Beyonics | Design, pilot runs, aluminum die cast, e-coating | Seagate | First two weeks of Mar (YE Jul) |

| Cheung Woh | Antidisc | Western Digital | 29 Apr (YE Feb) |

Source: Trendfocus research from JCY IPO prospectus

Recent story: BROADWAY INDUSTRIAL: Momentum is good