SINGAPORE WINDSOR is a micro-cap company that listed in April 2006 on the Singapore Exchange with a post-IPO market cap of $31.8 million based on the IPO price of 26 cents.

In recent times, its stock price has stayed just below its IPO price. The stock has been anything but a spectacular performer, except for the March-June quarter in 2007 when it shot up from just above 20 cents to close at 37.5 cents in July.

That came around the time of the announcement of a good set of results for FY 07 (ended March) and the prospects of an even better year ahead for Singapore Windsor (www.sin-windsor.com.sg).

However, during the Sept 08-March 09 period, it suffered from the massive economic earthquake that hit the world. As a result, Singapore Windsor’ profitability in FY 09 (ended March 09) was dismal:

| March 31 year-end | FY2003 | FY2004 | FY2005 | FY2006 | FY2007 | FY2008 | FY2009 |

| Revenue (HK million) | 108.4 | 128.9 | 167.4 | 179.7 | 196.9 | 234.0 | 203.6 |

| Net profit (HK million) | 9.0 | 12.8 | 20.4 | 24.3 | 29.0 | 32.8 | 7.0 |

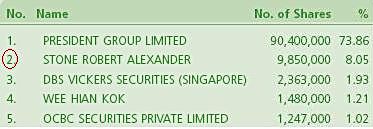

The No.1 shareholder is President Group, the investment vehicle of brothers Michael Chung and Hugo Chung, who are the chairman/CEO and executive director (business development), respectively.

No. 2 is Robert Stone, a Singapore private investor who owns 8%, an investment he made prior to the global financial crisis.

This month (Sept), Robert increased his exposure to the company further after he was named as one of three investors in a subsidiary of Singapore Windsor. He put down S$1.5 million cash for a 5% stake in Windsor Manganese Limited.

Robert has been featured previously on NextInsight for his investment approach and information on some of his stocks. (The link is provided at the bottom of this page). We asked him for his views on his latest investment:

Why bet on Singapore Windsor, which is illiquid and a micro-cap?

Robert: To me illiquidity and being a micro-cap are not features that are a disincentive to invest in a company. Such companies are usually off the radar for most investors which can mean a better valuation. With Singapore Windsor if you look at the historical revenue and profits, the upward trend was only broken for the last financial year (ended March 2009) when earnings for the second half were severely impacted by the downturn in revenue as a result of the world financial crisis.

As the world economy recovers, I believe eventually the earnings of the core businesses will revert to the long-term upward trend. One of the things I’ve learnt over the years is to only invest in companies in which I feel the management is competent and honest. In that regard I’m very comfortable with my investment in this company.

(Singapore Windsor serves component and Printed Circuit Board (“PCB”) makers in the end-product markets of telecommunications, automobile and consumer electronics. Its business can be categorised into two principal segments – first, the manufacturing of high-end PCB punching moulds, as well as die-casting and plastic injection mould bases; and second, the provision of PCB electroplating, punching and raw materials trading services.)

Why inject $1.5 million cash into the Singapore Windsor subsidiary?

Robert: The management has taken a big bet with this silicon manganese smelter which is a totally new business segment for them. It has the potential to raise the company’s top and bottom lines several times – this is my own estimation. They also have another business segment (3-D circuit technology) which I also think has great potential although it is not yet contributing anything to earnings.

What is the silicon manganese business about?

Robert: The silicon manganese business has a lot of uncertainties associated with it but very roughly it depends on the level of steel demand in China as to potential profitability. It also has in its favor the push by the central government to reduce the level of pollution from such industries. Windsor Manganese has been given considerable assistance by the local government in Hunan where the business is based.

Current smoke stack smelters in the area are being shut down. The plan is to replace that production by the output of Windsor’s furnaces, which have anti-pollution equipment to prevent poisonous emissions of any kind.

I would have preferred not to invest directly in the manganese subsidiary as I think there is better value in the listed company. However, I also wanted my cash to assist the company which it wouldn’t have if I’d bought shares from the market. With the cash injection by the new investors, they should have sufficient resources to complete the project.

At 1.2 HK cents a share, Singapore Windsor’s dividend yield (slightly under 1% yield based on stock price of 23 Singapore cts) for FY09 was not exceptionally high….

Robert: I was surprised they paid one at all as they needed cash for building the new smelters. Historically, the payout ratio was 40% in 2007 (HK9.5c) and 30% in 2008 (HK8c). If future earnings are anything like I calculate, the dividends in future could be quite significant.

Photo: Singapore Windsor

The following is an in-depth look at Windsor Manganese by Robert Stone

· Silicon manganese is a component used in the manufacture of steel long products such as rebar, angle iron, H-beams etc. The addition of the silicon manganese to the steel mix results in higher tensile strength. These steel products are primarily used in the construction industry. Usage of silicon manganese is about 7-10kgs per ton of steel produced. Demand for silicon manganese is thus correlated to the demand for steel.

· When the two furnaces are operational, Windsor Manganese will have a production capacity of 100,000 tons/yr. The local government in Ling Ling district Hunan Province is planning on issuing a total of 5 licenses to construct 25,000kVA electric furnaces with capacity of 50,000 tons/year each of silicon manganese. One license has been issued to another party.

The other two licenses have yet to be awarded but I think there is a very good chance that these licenses could be awarded to Windsor Manganese assuming the successful startup of the furnaces currently under construction. The Windsor Manganese furnaces are due to start during the Q4 this year so should contribute to financial year 2010 earnings.

· The raw materials required for the production of Windsor’s silicon manganese will be a mix of local and imported manganese ore which comprise roughly 40% of the total production cost. At current selling prices, electricity should account for about 40% of the production cost.

However, while the cost of the electricity is fixed, the cost of the ore tends to fluctuate particularly for the higher quality imported ore. Whether the selling price of silicon manganese is high or low, the key to profitability will be trying to maintain a margin between the raw material cost and the selling price. I have some confidence that the Singapore Windsor management will be able to achieve this based on their record of managing costs in their existing businesses

· The selling price of silicon manganese has been volatile in the last few years, peaking at over RMB13,000/ton last year. As the proportion of variable cost is very high compared to the total cost of production, there is little incentive to continue production at a loss. The smelters with the highest cost structures will tend to be the first to shut down while the smelters that have even a small competitive advantage should be in a position to continue profitable operations if demand and prices contract.

Windsor Manganese should have some advantage in lower variable cost from the more efficient usage of electricity due to the advanced design of the furnaces. I think they should also have some advantage from being able to source the relatively low cost manganese ore in the district. I was told by a local government official that there are 40m tons of ore in the district, which should last for some 20 years at current production rates.

· It is difficult to project sales and net profits for the manganese business due to the uncertainty of the selling price of the silicon manganese (which is typically sold at spot market prices), and the net margin that the company will be able to achieve as both the selling price and input prices fluctuate. There is also some uncertainty about whether there will be sufficient demand to enable the plant to run at its full 100,000 tons/yr capacity.

Reasons for optimism about the business

· The Central Government is pushing to phase out existing furnaces that have no anti-pollution equipment. These are often unlicensed. There have been recent cases reported in the media of children suffering from lead poisoning after being in close proximity to various types of smelters that have no pollution control equipment. The trend towards greater environmental controls in industrial production will surely only accelerate as a result of these cases. The closure of silicon manganese smelting capacity that does not include the latest anti-pollution equipment is likely to increase. This can only increase demand for output from smelters like Windsor Manganese.

· The local government is committed to the success of these furnaces. When the new licensed furnaces are up and running, the remaining small scale smelters with no pollution control equipment will be closed. I understand having production consolidated by these licensed smelters will also improve tax collection for the local government.

· The local power company has invested RMB200m to build the transmission lines and substation located right next to Windsor’s site. Obviously the power company has some interest in ensuring their customer who they’ve invested so much money to provide power to makes a success of it.

· The contractor who is building the plant is also a former owner of a smaller smelter which has been shut down. He has taken a 20% share in Windsor Manganese. The fact that with his experience of the industry in the area he is confident enough to invest RMB30m in the project gives me some confidence that it will be successful.

· Demand for steel in China which requires silicon manganese to produce is set to remain at elevated levels due to the Central Government stimulus measures. These plans include the building of a nation wide high speed rail network as well as the rebuilding of infrastructure destroyed by the Sichuan earthquake. Chinese crude steel production was 267m tons in the first half of 2009, a 1% increase over 2008.

However, this is before the impact of the stimulus spending has been fully felt so it is reasonable to expect that steel production growth for the full year 2009 will be stronger. Some industry forecasts predict growth of greater than 5% for Chinese steel production in 2009.

How much will Windsor Manganese contribute to Singapore Windsor’s sales and profits? Here's Robert's take: · Prior to the onset of the financial crisis and the resulting drop in sales and earnings for the second half of financial year 2009, SW had sales of about HKD234m and net profit of HKD32.8m for FY08 (ended March 08). For the financial year to March 2009, these figures were about HKD200m and HKD7m, respectively. · By considering a range of probable best to worst case scenarios, I estimate the likely best case contribution of Windsor Manganese to SW would be sales addition of HKD800 m and net profit of HKD120 m. This is based on selling price of RMB10,000/ton at 15% net profit margin and full production of 100,000ton/year. · Worst case is sales of HKD240 m and earnings of HKD12 m based on a selling price of RMB6,000/ton and 5% net profit margin at production of only 50,000ton/yr. This range of possible scenarios is wide enough that I think there’s at least an 80% probability that the actual situation will be between the high and low cases. At present, with the price of silicon manganese in China at about RMB7,500 per ton, if the plant were operational now and producing at full capacity, assuming a range of 5-15% net margin, the yearly contribution to the bottom line of SW would be between HKD30m and HKD90m. At either end of the spectrum, it’s a considerable boost to SW’s earnings. · If the other two licenses are awarded to Windsor Manganese, the potential earnings of the business, assuming full production, could double. |

Recent story: ROBERT STONE reaping the rewards of 3 decades of investing