- Posts: 257

- Thank you received: 19

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

Far East H Trust - Value buy..

5 years 10 months ago #25291

by divads

Replied by divads on topic Far East H Trust - Value buy..

Please Log in to join the conversation.

5 years 10 months ago #25292

by divads

Replied by divads on topic Far East H Trust - Value buy..

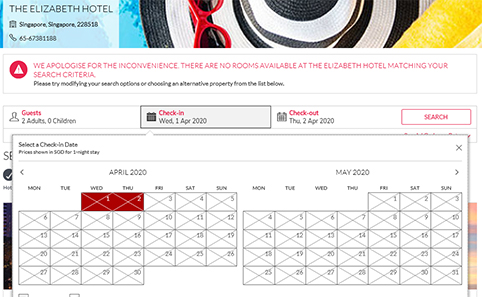

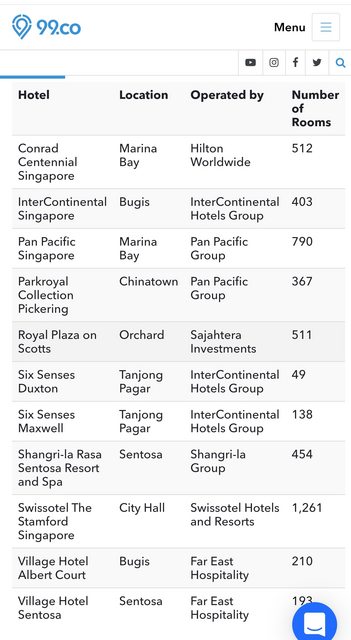

www.99.co/blog/singapore/hotel-government-stay-home-notice-shn/

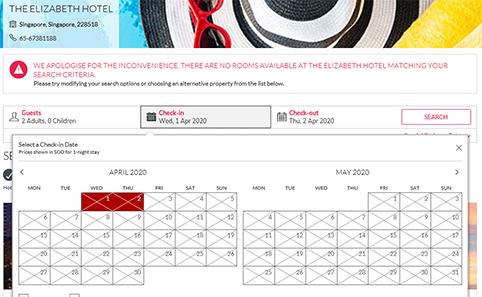

I think Elizabeth under Far East H trust too.

Quote:

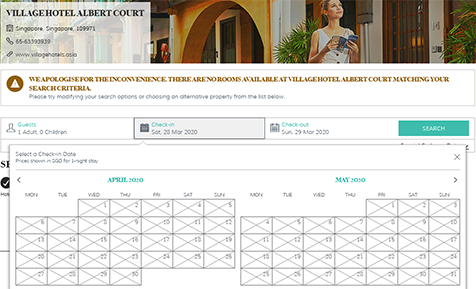

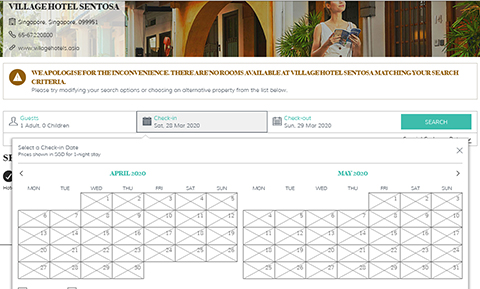

Reason #6: The hotels will otherwise be empty anyway

As we all know, tourism is dead for the time being. Hotels are facing dark times and their staff are worried about their livelihoods as

occupancy drops to zero or near zero. So, a contract with the government to provide bulk Stay-Home Notice accommodation

is a godsend, and is a move that will potentially safeguard thousands of jobs in the industry and directly boost the economy,

in addition to the recently announced Resilience Package.

I think Elizabeth under Far East H trust too.

Quote:

Reason #6: The hotels will otherwise be empty anyway

As we all know, tourism is dead for the time being. Hotels are facing dark times and their staff are worried about their livelihoods as

occupancy drops to zero or near zero. So, a contract with the government to provide bulk Stay-Home Notice accommodation

is a godsend, and is a move that will potentially safeguard thousands of jobs in the industry and directly boost the economy,

in addition to the recently announced Resilience Package.

Please Log in to join the conversation.

5 years 10 months ago #25293

by divads

Replied by divads on topic Far East H Trust - Value buy..

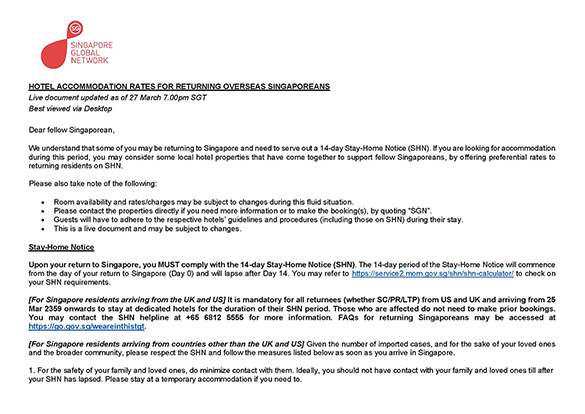

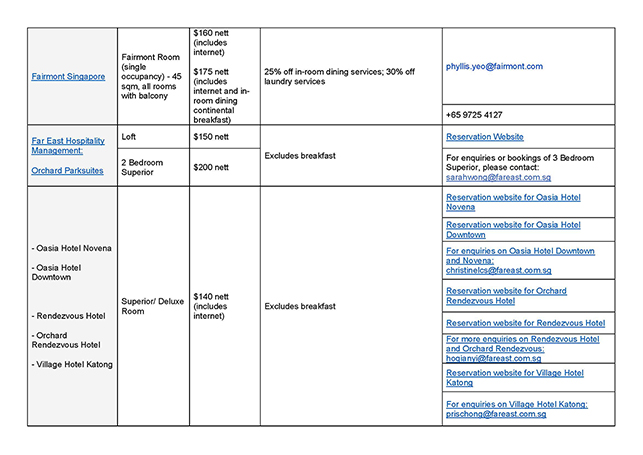

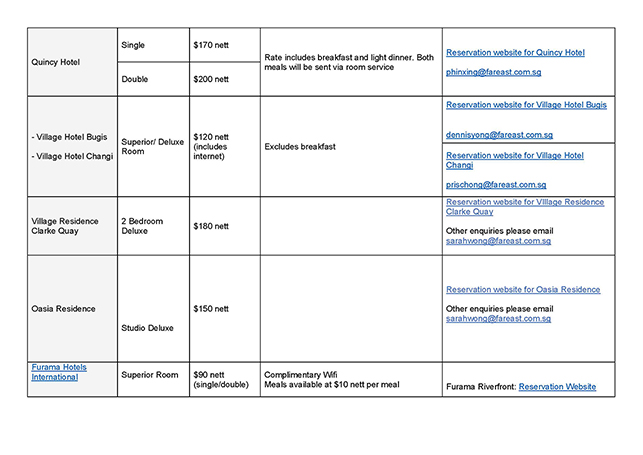

www.singaporeglobalnetwork.com/docs/Hote...eas-Singaporeans.pdf

According to this list, Far East H trust has 10 of it's hotel/service apt in the list.. Huat har!

According to this list, Far East H trust has 10 of it's hotel/service apt in the list.. Huat har!

Please Log in to join the conversation.

5 years 10 months ago #25294

by divads

Replied by divads on topic Far East H Trust - Value buy..

research.uobkayhian.com/content_download.jsp?id=55894&

h=a7c89bdd49747e2ee014528e17cfba8

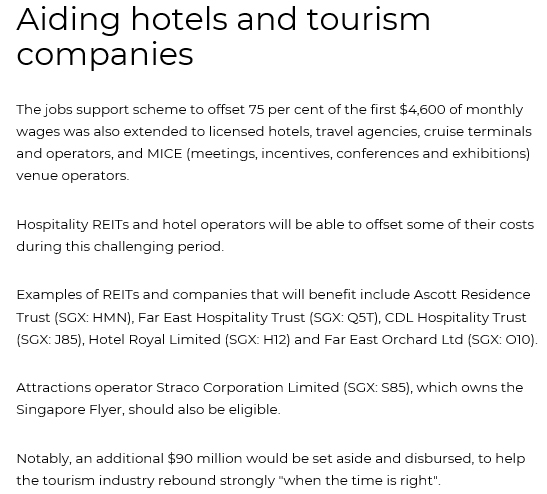

Hospitality REITs to benefit from JSS. Staffing is a significant fixed cost which is hard

to eliminate as hotel occupancies crater in the face of COVID-19 travel restrictions. Under

JSS, for every local employee payroll, hotel operators will receive support for 75% of the

first S$4,600 in gross monthly wages (incl. 25% base support). S-REITs, which have

higher exposure to Singapore hospitality assets, and under managed contracts (ie take

part in operating risk) will benefit most. In this regard, CDREIT (62% SG NPI) and FEHT

(100% SG NPI) are expected to benefit more from the scheme compared to ART (10%

FY19 GP).

Hospitality REITs to benefit from JSS. Staffing is a significant fixed cost which is hard

to eliminate as hotel occupancies crater in the face of COVID-19 travel restrictions. Under

JSS, for every local employee payroll, hotel operators will receive support for 75% of the

first S$4,600 in gross monthly wages (incl. 25% base support). S-REITs, which have

higher exposure to Singapore hospitality assets, and under managed contracts (ie take

part in operating risk) will benefit most. In this regard, CDREIT (62% SG NPI) and FEHT

(100% SG NPI) are expected to benefit more from the scheme compared to ART (10%

FY19 GP).

Please Log in to join the conversation.

5 years 10 months ago #25296

by Joes

--- The above is persuading returnees to self-isolate in the hotels & they have to bear their own room costs, etc. Is that right?

I thought govt whisks them from airport straight to hotel & govt bears the cost of room, etc. Are there 2 different schemes?

Replied by Joes on topic Far East H Trust - Value buy..

divads wrote: www.singaporeglobalnetwork.com/docs/Hote...eas-Singaporeans.pdf

According to this list, Far East H trust has 10 of it's hotel/service apt in the list.. Huat har!

--- The above is persuading returnees to self-isolate in the hotels & they have to bear their own room costs, etc. Is that right?

I thought govt whisks them from airport straight to hotel & govt bears the cost of room, etc. Are there 2 different schemes?

Please Log in to join the conversation.

Time to create page: 0.258 seconds