- Posts: 257

- Thank you received: 19

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

MFG Integration - Special Dividend/Capital reduction

6 years 7 months ago #24861

by divads

Replied by divads on topic MFG Integration - Special Dividend/Capital reduction 30 cents per share

Summary:

1) Recently they received the 1st escrow amount of around $7M (extra cash, does not affect the cash amount they company is currently holding) plus tiny left over amount, they declared 3.3 cents. Coming Friday will be last day of "CD".

2) The 2nd escrow amount of around $8.4M (again this is extra cash amounting to 3.5 cents) will be received before/on Aug 2020. So another CD of 3.5 cents will be declared next year Aug.

3) Capital reduction and a CD of 8.5 cents will be declared on coming Monday when the Court approve the scheme which is almost certain.

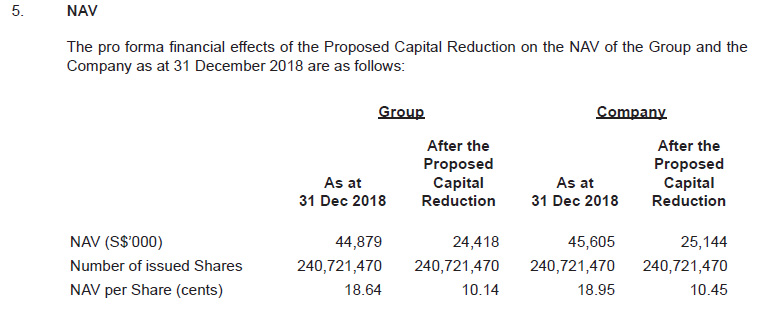

4) After distributing the CD of 8.5 cents, the company will have a NTA of 10.14 cents which consists of mainly CASH + YISHUN industrial properties without any debts. Meaning u are looking at a company that is technically worth pure cash of 10 cents. Their Yishun properties is valued even more recently but the NTA of 10 cents valued the Yishun properties at an earlier date which is much lower than the current valuation. So in actual fact the NTA should be more than 10.14 cents.

5) Assuming the current share price of 22 cents. After getting your 3.3 cents on 17 July this year, u going to get 8.5 cents pretty soon after around end of July. Then after getting 3.5 cents next Aug, it means u are paying 22 cents - 3.3 cents - 8.5 cents - 3.5 cents = 6.7 cents for a CASH company that is technically worth at least 10 cents. So expect the share price to trade near the CASH Value of 10 cents, maybe around 9.5 cents..

6) U are looking at the profit of 9.5 - 6.7 cents / 6.7 cents = 42% profit if hold for 1 year.

Is this 42% profit worth the wait of 1 year? DYODD .. Cheers

1) Recently they received the 1st escrow amount of around $7M (extra cash, does not affect the cash amount they company is currently holding) plus tiny left over amount, they declared 3.3 cents. Coming Friday will be last day of "CD".

2) The 2nd escrow amount of around $8.4M (again this is extra cash amounting to 3.5 cents) will be received before/on Aug 2020. So another CD of 3.5 cents will be declared next year Aug.

3) Capital reduction and a CD of 8.5 cents will be declared on coming Monday when the Court approve the scheme which is almost certain.

4) After distributing the CD of 8.5 cents, the company will have a NTA of 10.14 cents which consists of mainly CASH + YISHUN industrial properties without any debts. Meaning u are looking at a company that is technically worth pure cash of 10 cents. Their Yishun properties is valued even more recently but the NTA of 10 cents valued the Yishun properties at an earlier date which is much lower than the current valuation. So in actual fact the NTA should be more than 10.14 cents.

5) Assuming the current share price of 22 cents. After getting your 3.3 cents on 17 July this year, u going to get 8.5 cents pretty soon after around end of July. Then after getting 3.5 cents next Aug, it means u are paying 22 cents - 3.3 cents - 8.5 cents - 3.5 cents = 6.7 cents for a CASH company that is technically worth at least 10 cents. So expect the share price to trade near the CASH Value of 10 cents, maybe around 9.5 cents..

6) U are looking at the profit of 9.5 - 6.7 cents / 6.7 cents = 42% profit if hold for 1 year.

Is this 42% profit worth the wait of 1 year? DYODD .. Cheers

Please Log in to join the conversation.

6 years 7 months ago #24864

by divads

Replied by divads on topic MFG Integration - Special Dividend/Capital reduction 30 cents per share

court hearing today. Hope by end of the day they will announce the CD of 8.5 cents

Please Log in to join the conversation.

6 years 7 months ago #24865

by divads

Replied by divads on topic MFG Integration - Special Dividend/Capital reduction 30 cents per share

MANUFACTURING INTEGRATION TECHNOLOGY LTD.

(Company Registration Number 199200075N)

(Incorporated in the Republic of Singapore)

PROPOSED CAPITAL REDUCTION EXERCISE

– APPROVAL BY THE HIGH COURT OF SINGAPORE OF THE PROPOSED CAPITAL REDUCTION AND NOTICE OF BOOKS CLOSURE DATE

1. INTRODUCTION

The board of directors (the “Board” or the “Directors”) of Manufacturing Integration Technology Ltd. (the “Company”) refers to its circular dated 30 April 2019 (the “Circular”) in relation to the proposed capital reduction exercise (the “Capital Reduction”) to be carried out by the Company pursuant to Section 78G of the Companies Act (Cap. 50) of Singapore (the “Companies Act”), which will involve a cash distribution (the “Cash Distribution”) by the Company to the shareholders of the Company (the “Shareholders”) of S$0.085 in cash for each ordinary share in the capital of the Company (the “Share”) held by Shareholders as at a books closure date to be determined by the Directors.

At an extraordinary general meeting of the Company held on 22 May 2019, the Shareholders had approved the Capital Reduction.

Unless otherwise defined, all capitalised terms and references used herein shall bear the same meaning ascribed to them in the Circular.

2. CONFIRMATION BY THE HIGH COURT

The Board is pleased to announce that the Capital Reduction was approved by the High Court of the Republic of Singapore on 8 July 2019. There are no other outstanding conditions to the Capital Reduction. Accordingly, the Capital Reduction will become effective upon the lodgement by the Company of the Order of Court approving the Capital Reduction, together with the other documents prescribed under the Companies Act, with the Accounting and Corporate Regulatory Authority, which is expected to be on 18 July 2019. The exact entitlements of the Shareholders to the Cash Distribution will be determined as at the Books Closure Date (as defined below).

3. NOTICE OF BOOKS CLOSURE DATE

NOTICE IS HEREBY GIVEN that the transfer books and the Register of Members of the Company will be closed at 5.00 p.m. on 16 July 2019 (the “Books Closure Date”) for the purpose of determining the entitlements of Shareholders to the Cash Distribution pursuant to the Capital Reduction.

Shareholders registered in the Register of Members and Depositors whose Securities Accounts with CDP are credited with Shares as at the Books Closure Date will be entitled to receive the Cash Distribution of S$0.085 for each Share held as at the Books Closure Date on the basis of the number of Shares registered in their names or standing to the credit of their Securities Accounts as at the Books Closure Date. The aggregate amount of cash to be paid to each Shareholder pursuant to the Capital Reduction will be adjusted by rounding down any fractions of a cent to the nearest cent, where applicable.

2

Duly completed registrable transfer of Shares received by the Share Registrar of the Company, Boardroom Corporate & Advisory Services Pte Ltd, at 50 Raffles Place, #32-01 Singapore Land Tower, Singapore 048623, up to the Books Closure Date will be registered to determine Shareholders’ entitlements to the Cash Distribution.

4. ADMINISTRATIVE PROCEDURES FOR THE CAPITAL REDUCTION

Payment of the Cash Distribution pursuant to the Capital Reduction will be made in the following manner:

(a) Shareholders holding Scripless Shares

Shareholders who are Depositors and who have Shares standing to the credit of their Securities Accounts as at the Books Closure Date, will have the cheques for payment of their respective entitlements to the Cash Distribution under the Capital Reduction despatched to them by CDP by ordinary post at their own risk on or about 23 July 2019. Alternatively, such Shareholders will have payment of their respective entitlements to the Cash Distribution under the Capital Reduction made in such other manner as they may have agreed with CDP for the payment of dividends or other distributions on or around 23 July 2019.

(b) Shareholders holding Scrip Shares

Shareholders whose Shares are registered in the Register of Members as at the Books Closure Date will have cheques for payment of their respective entitlements to the Cash Distribution under the Capital Reduction despatched to them by ordinary post at their own risk on or around 23 July 2019.

The Company will provide Shareholders with an update on the effective date of the Capital Reduction and the date of payment of the Cash Distribution, which are expected to take place around 18 July 2019 and 23 July 2019 respectively.

5. TRADING OF SHARES

The last date and time of “cum” trading of the Shares on the SGX-ST for the purposes of the Capital Reduction will be on 12 July 2019 at 5.00 p.m. Shareholders should note that Shares traded from 9.00 a.m. on 15 July 2019 will not be entitled to the Cash Distribution pursuant to the Capital Reduction.

6. IMPORTANT EVENTS AND DATES

Shareholders should note the following events and dates:

Last date and time of “cum” trading of the Shares on the SGX-ST

:

12 July 2019 at 5.00 p.m.

Commencement of “ex” trading of the Shares on the SGX-ST

:

15 July 2019 at 9.00 a.m.

Books Closure Date for the Capital Reduction

:

16 July 2019 at 5.00 p.m.

3

Expected effective date of the Capital Reduction

:

On or about 18 July 2019

Expected payment date for the Cash Distribution pursuant to the Capital Reduction

:

On or about 23 July 2019

By Order of the Board

Manufacturing Integration Technology Ltd.

Lim Chin Tong

Executive Director and Chief Executive Officer

8 July 2019

(Company Registration Number 199200075N)

(Incorporated in the Republic of Singapore)

PROPOSED CAPITAL REDUCTION EXERCISE

– APPROVAL BY THE HIGH COURT OF SINGAPORE OF THE PROPOSED CAPITAL REDUCTION AND NOTICE OF BOOKS CLOSURE DATE

1. INTRODUCTION

The board of directors (the “Board” or the “Directors”) of Manufacturing Integration Technology Ltd. (the “Company”) refers to its circular dated 30 April 2019 (the “Circular”) in relation to the proposed capital reduction exercise (the “Capital Reduction”) to be carried out by the Company pursuant to Section 78G of the Companies Act (Cap. 50) of Singapore (the “Companies Act”), which will involve a cash distribution (the “Cash Distribution”) by the Company to the shareholders of the Company (the “Shareholders”) of S$0.085 in cash for each ordinary share in the capital of the Company (the “Share”) held by Shareholders as at a books closure date to be determined by the Directors.

At an extraordinary general meeting of the Company held on 22 May 2019, the Shareholders had approved the Capital Reduction.

Unless otherwise defined, all capitalised terms and references used herein shall bear the same meaning ascribed to them in the Circular.

2. CONFIRMATION BY THE HIGH COURT

The Board is pleased to announce that the Capital Reduction was approved by the High Court of the Republic of Singapore on 8 July 2019. There are no other outstanding conditions to the Capital Reduction. Accordingly, the Capital Reduction will become effective upon the lodgement by the Company of the Order of Court approving the Capital Reduction, together with the other documents prescribed under the Companies Act, with the Accounting and Corporate Regulatory Authority, which is expected to be on 18 July 2019. The exact entitlements of the Shareholders to the Cash Distribution will be determined as at the Books Closure Date (as defined below).

3. NOTICE OF BOOKS CLOSURE DATE

NOTICE IS HEREBY GIVEN that the transfer books and the Register of Members of the Company will be closed at 5.00 p.m. on 16 July 2019 (the “Books Closure Date”) for the purpose of determining the entitlements of Shareholders to the Cash Distribution pursuant to the Capital Reduction.

Shareholders registered in the Register of Members and Depositors whose Securities Accounts with CDP are credited with Shares as at the Books Closure Date will be entitled to receive the Cash Distribution of S$0.085 for each Share held as at the Books Closure Date on the basis of the number of Shares registered in their names or standing to the credit of their Securities Accounts as at the Books Closure Date. The aggregate amount of cash to be paid to each Shareholder pursuant to the Capital Reduction will be adjusted by rounding down any fractions of a cent to the nearest cent, where applicable.

2

Duly completed registrable transfer of Shares received by the Share Registrar of the Company, Boardroom Corporate & Advisory Services Pte Ltd, at 50 Raffles Place, #32-01 Singapore Land Tower, Singapore 048623, up to the Books Closure Date will be registered to determine Shareholders’ entitlements to the Cash Distribution.

4. ADMINISTRATIVE PROCEDURES FOR THE CAPITAL REDUCTION

Payment of the Cash Distribution pursuant to the Capital Reduction will be made in the following manner:

(a) Shareholders holding Scripless Shares

Shareholders who are Depositors and who have Shares standing to the credit of their Securities Accounts as at the Books Closure Date, will have the cheques for payment of their respective entitlements to the Cash Distribution under the Capital Reduction despatched to them by CDP by ordinary post at their own risk on or about 23 July 2019. Alternatively, such Shareholders will have payment of their respective entitlements to the Cash Distribution under the Capital Reduction made in such other manner as they may have agreed with CDP for the payment of dividends or other distributions on or around 23 July 2019.

(b) Shareholders holding Scrip Shares

Shareholders whose Shares are registered in the Register of Members as at the Books Closure Date will have cheques for payment of their respective entitlements to the Cash Distribution under the Capital Reduction despatched to them by ordinary post at their own risk on or around 23 July 2019.

The Company will provide Shareholders with an update on the effective date of the Capital Reduction and the date of payment of the Cash Distribution, which are expected to take place around 18 July 2019 and 23 July 2019 respectively.

5. TRADING OF SHARES

The last date and time of “cum” trading of the Shares on the SGX-ST for the purposes of the Capital Reduction will be on 12 July 2019 at 5.00 p.m. Shareholders should note that Shares traded from 9.00 a.m. on 15 July 2019 will not be entitled to the Cash Distribution pursuant to the Capital Reduction.

6. IMPORTANT EVENTS AND DATES

Shareholders should note the following events and dates:

Last date and time of “cum” trading of the Shares on the SGX-ST

:

12 July 2019 at 5.00 p.m.

Commencement of “ex” trading of the Shares on the SGX-ST

:

15 July 2019 at 9.00 a.m.

Books Closure Date for the Capital Reduction

:

16 July 2019 at 5.00 p.m.

3

Expected effective date of the Capital Reduction

:

On or about 18 July 2019

Expected payment date for the Cash Distribution pursuant to the Capital Reduction

:

On or about 23 July 2019

By Order of the Board

Manufacturing Integration Technology Ltd.

Lim Chin Tong

Executive Director and Chief Executive Officer

8 July 2019

Please Log in to join the conversation.

6 years 7 months ago #24873

by divads

Replied by divads on topic MFG Integration - Special Dividend/Capital reduction 30 cents per share

EX CD the share price will trade around 11 cents next Monday.

By next August, there will be another 3.5 cents dividend.

And hopefully they will monetise their yishun industrial property which is worth around 6 cents.

So hopefully by next year we are seeing a total dividend of 9.5 cents and a remaining company worth net cash of 5 cents + a CEM business.. fingers crossed..

By next August, there will be another 3.5 cents dividend.

And hopefully they will monetise their yishun industrial property which is worth around 6 cents.

So hopefully by next year we are seeing a total dividend of 9.5 cents and a remaining company worth net cash of 5 cents + a CEM business.. fingers crossed..

Please Log in to join the conversation.

6 years 7 months ago - 6 years 7 months ago #24881

by Big Fish

Replied by Big Fish on topic MFG Integration - Special Dividend/Capital reduction

Divads, i believe the 2 Yishun properties are valued at $12 m, or 5.1 cents per share.

I don't think they should be sold yet because they provide much needed cashflow from rental for MIT's P&L to look decent. The contract mfrg business has yet to report a profit (but could be not too far away). In the meantime, these properties are discounted by the market (as applies to all property counters), so the discount can be 0.5 book value.

Regardless, at 10.6 cents now, MIT is a steal given it has cash of 5 cents a share + next year's 3.5 cent dividend + Yishun properties + CEM business (which hopefully can start to turn in profit next year)

I don't think they should be sold yet because they provide much needed cashflow from rental for MIT's P&L to look decent. The contract mfrg business has yet to report a profit (but could be not too far away). In the meantime, these properties are discounted by the market (as applies to all property counters), so the discount can be 0.5 book value.

Regardless, at 10.6 cents now, MIT is a steal given it has cash of 5 cents a share + next year's 3.5 cent dividend + Yishun properties + CEM business (which hopefully can start to turn in profit next year)

Last edit: 6 years 7 months ago by Big Fish.

Please Log in to join the conversation.

6 years 6 months ago - 6 years 6 months ago #24929

by divads

Replied by divads on topic MFG Integration - Special Dividend/Capital reduction

Ya, the yishun properties are valued at $12M but only carry value (in financial statement and NTA) of $8M.

And current NTA is about 10.6 cents consisting of cash + yishun properties with no debt> share price of 10.1 cents.

Another 3.5 cents cash (dividend) which is in the Escrow account and not considered in the NTA will be available latest Aug 2020.

So after receiving 3.5 cents dividend next year, it could be like paying 6.5 cents for a company having NTA of 10.6 cents consisting purely of cash + the yishun properties which is valued at a much higher price than the book value so technically the NTA should be around 12 cents. And hopefully they can find a buyer willing to pay 12 cents for their yishun properties and they can sell it and declare another dividend. Keeping fingers crossed.

And current NTA is about 10.6 cents consisting of cash + yishun properties with no debt> share price of 10.1 cents.

Another 3.5 cents cash (dividend) which is in the Escrow account and not considered in the NTA will be available latest Aug 2020.

So after receiving 3.5 cents dividend next year, it could be like paying 6.5 cents for a company having NTA of 10.6 cents consisting purely of cash + the yishun properties which is valued at a much higher price than the book value so technically the NTA should be around 12 cents. And hopefully they can find a buyer willing to pay 12 cents for their yishun properties and they can sell it and declare another dividend. Keeping fingers crossed.

Last edit: 6 years 6 months ago by divads.

Please Log in to join the conversation.

Time to create page: 0.234 seconds