- Posts: 691

- Thank you received: 17

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

WORLD PRECISION MACHINERY - UNDERVALUED GEM

13 years 1 week ago #13328

by ZEN

WORLD PRECISION MACHINERY - UNDERVALUED GEM was created by ZEN

AS highlighted on NEXTINSIGHT ARTICLE recently :

www.nextinsight.net/index.php?option=com...cle&id=6364&Itemid=1

Â

But the better-than-expected China GDP in 2012 and healthy prospects for 2013 are boosting optimism at World Precision.

Very encouraging recent data confirms this as HSBC's much looked-to barometer of the PRC's industrial strength -- the China Manufacturing Purchasing Managers' Index (PMI) -- rose to a two-year high of 51.9 in January.

“The overall Chinese metal stamping machinery market is expected to grow at a CAGR of 22% from 2010 to 2015,” World Precision CEO Mr. Shao Jianjun told investors at the Aries Consulting -sponsored “Braving the Waves: China Investment Strategies 2013” conference.

And despite recent setbacks from China’s less sluggish domestic economic growth, Jiangsu Province-based World Precision -- which produces products to specific client demands --believes it was well-positioned and diverse enough to endure downturns.

World Precision makes of a wide range of stamping machines for Chinese white goods makers like Haier, Galanz and Midea; domestic automakers including BYD, Chery and Geely; and global brands like Sony, Samsung and LG.

Its recent revenue contributions were comprised of 34% from the automotive sector, 32% from home electronics and 11% from electronics, including 23% from the “other” category of which World Precision hopes to boost its orders from the fast-growing high-speed railway sector – an increasingly popular mode of inter-city transportation in Mainland China with unshakable backing from Beijing. World Precision CFO Mr. Samuel Ng said the stamping firm's net gearing ratio is 26%. Photo: Aries Consulting

Speaking the event in Shenzhen featuring China, Hong Kong and Singapore-listed firms, Mr. Shao said World Precision was well-equipped to withstand any economic downturn and expected better fortunes this year with the improving PRC economy.

That helped inform WPM's decison this month to incorporate a wholly-owned subsidiary -- World Precise Machinery Parts (Jiangsu) Co Ltd (WPMP).

WPMP mainly engages in R&D for manufacturing key components of all types of precision machine tools, and has a registered capital of 2.1 million usd.

As part of the internal restructuring of the Group, World Heavy Machine Tools (China) Co Ltd (WHMT), a wholly-owned subsidiary, will spin-off the assets and liabilities of its parts casting segment to WPMP.

The purpose of the spin-off is to take advantage of tax incentives in the PRC, as after the restructuring WHMT will apply for “High-Tech Enterprise” status which, if successful, will allow it to enjoy a preferential income tax rate of 15%.

“The year 2012 has been challenging for the China machinery industry due to the slowdown in the domestic economy and weaker demand for electronics and home appliances,” Mr. Shao said, adding that the industry is cyclical and affected by economic fluctuations.

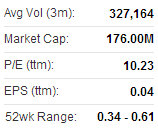

The good news is that China – the world’s No.2 economy – is turning a corner, with the just-finished quarter much stronger than expected. WPM recently 0.44 sgd

Economic growth in the PRC improved in the September-December period, allowing the planet’s most populous country to finish the year with an impressive 12-month GDP growth rate of 7.8%, higher than earlier expectations.

In the fourth quarter of 2012, the PRC’s economy expanded at a pace of 7.9%, better than analyst forecasts and ending a discouraging streak of seven straight quarters of lower numbers.

China’s GDP has leapfrogged the UK, Germany and Japan over the past few years, and despite growth being much higher than top-tier industrialized countries, the slower GDP growth since the Wall Street meltdown in 2008 has hurt capital goods firms like World Precision.

However, happy days may be here again as China's slowing GDP numbers bottomed out in the Q3 2012 and have been trending upwards ever since.

www.nextinsight.net/index.php?option=com...cle&id=6364&Itemid=1

Â

But the better-than-expected China GDP in 2012 and healthy prospects for 2013 are boosting optimism at World Precision.

Very encouraging recent data confirms this as HSBC's much looked-to barometer of the PRC's industrial strength -- the China Manufacturing Purchasing Managers' Index (PMI) -- rose to a two-year high of 51.9 in January.

“The overall Chinese metal stamping machinery market is expected to grow at a CAGR of 22% from 2010 to 2015,” World Precision CEO Mr. Shao Jianjun told investors at the Aries Consulting -sponsored “Braving the Waves: China Investment Strategies 2013” conference.

And despite recent setbacks from China’s less sluggish domestic economic growth, Jiangsu Province-based World Precision -- which produces products to specific client demands --believes it was well-positioned and diverse enough to endure downturns.

World Precision makes of a wide range of stamping machines for Chinese white goods makers like Haier, Galanz and Midea; domestic automakers including BYD, Chery and Geely; and global brands like Sony, Samsung and LG.

Its recent revenue contributions were comprised of 34% from the automotive sector, 32% from home electronics and 11% from electronics, including 23% from the “other” category of which World Precision hopes to boost its orders from the fast-growing high-speed railway sector – an increasingly popular mode of inter-city transportation in Mainland China with unshakable backing from Beijing. World Precision CFO Mr. Samuel Ng said the stamping firm's net gearing ratio is 26%. Photo: Aries Consulting

Speaking the event in Shenzhen featuring China, Hong Kong and Singapore-listed firms, Mr. Shao said World Precision was well-equipped to withstand any economic downturn and expected better fortunes this year with the improving PRC economy.

That helped inform WPM's decison this month to incorporate a wholly-owned subsidiary -- World Precise Machinery Parts (Jiangsu) Co Ltd (WPMP).

WPMP mainly engages in R&D for manufacturing key components of all types of precision machine tools, and has a registered capital of 2.1 million usd.

As part of the internal restructuring of the Group, World Heavy Machine Tools (China) Co Ltd (WHMT), a wholly-owned subsidiary, will spin-off the assets and liabilities of its parts casting segment to WPMP.

The purpose of the spin-off is to take advantage of tax incentives in the PRC, as after the restructuring WHMT will apply for “High-Tech Enterprise” status which, if successful, will allow it to enjoy a preferential income tax rate of 15%.

“The year 2012 has been challenging for the China machinery industry due to the slowdown in the domestic economy and weaker demand for electronics and home appliances,” Mr. Shao said, adding that the industry is cyclical and affected by economic fluctuations.

The good news is that China – the world’s No.2 economy – is turning a corner, with the just-finished quarter much stronger than expected. WPM recently 0.44 sgd

Economic growth in the PRC improved in the September-December period, allowing the planet’s most populous country to finish the year with an impressive 12-month GDP growth rate of 7.8%, higher than earlier expectations.

In the fourth quarter of 2012, the PRC’s economy expanded at a pace of 7.9%, better than analyst forecasts and ending a discouraging streak of seven straight quarters of lower numbers.

China’s GDP has leapfrogged the UK, Germany and Japan over the past few years, and despite growth being much higher than top-tier industrialized countries, the slower GDP growth since the Wall Street meltdown in 2008 has hurt capital goods firms like World Precision.

However, happy days may be here again as China's slowing GDP numbers bottomed out in the Q3 2012 and have been trending upwards ever since.

Please Log in to join the conversation.

13 years 1 week ago #13329

by ZEN

Replied by ZEN on topic Re:WORLD PRECISION MACHINERY - UNDERVALUED GEM

very decent dividend given every year . And it is coming soon ...

Â

Its recent revenue contributions were comprised of 34% from the automotive sector, 32% from home electronics and 11% from electronics, including 23% from the “other” category of which World Precision hopes to boost its orders from the fast-growing high-speed railway sector – an increasingly popular mode of inter-city transportation in Mainland China with unshakable backing from Beijing.

Â

Â

As above their new area of revenues from the massive railway investment in China from 2013 onwards which will contribute 23% to profit this year .

Â

Its recent revenue contributions were comprised of 34% from the automotive sector, 32% from home electronics and 11% from electronics, including 23% from the “other” category of which World Precision hopes to boost its orders from the fast-growing high-speed railway sector – an increasingly popular mode of inter-city transportation in Mainland China with unshakable backing from Beijing.

Â

Â

As above their new area of revenues from the massive railway investment in China from 2013 onwards which will contribute 23% to profit this year .

Please Log in to join the conversation.

13 years 1 week ago #13341

by ZEN

Replied by ZEN on topic Re:WORLD PRECISION MACHINERY - UNDERVALUED GEM

World Precision Machinery Limited" and together with its subsidiaries, the "Group") is a leading manufacturer of stamping machines and related metal components. The Group manufactures both standard and customised stamping machines to suit the needs of a myriad of industries including automotive, home appliances, railway, aerospace, and etc.

Â

Company is stable in paying out dividend yearly .

Â

Company is stable in paying out dividend yearly .

Please Log in to join the conversation.

13 years 1 week ago #13348

by ZEN

Replied by ZEN on topic Re:WORLD PRECISION MACHINERY - UNDERVALUED GEM

FY Result and dividend will be announce next week

Please Log in to join the conversation.

13 years 1 week ago #13356

by Val

Replied by Val on topic Re:WORLD PRECISION MACHINERY - UNDERVALUED GEM

9m 2012 net profit was 73 m rmb versus 144 m rmb in 9m 2011.

I therefore won't expect World Precision to dish out a final dividend like 2011.

I am looking at only 3% yield, or 1.25 cent a share in div. Just my view. Â

I therefore won't expect World Precision to dish out a final dividend like 2011.

I am looking at only 3% yield, or 1.25 cent a share in div. Just my view. Â

Please Log in to join the conversation.

Time to create page: 0.256 seconds