Demand for healthcare gloves has wound down sharply in post-pandemic 2022, and there was an overcapacity in the supply chain.

Some manufacturers sold gloves at a loss in order to cover overheads.

Singapore-listed Riverstone Holdings, fortunately, has a segment that continued to thrive: gloves for the cleanroom in high-tech manufacturing.

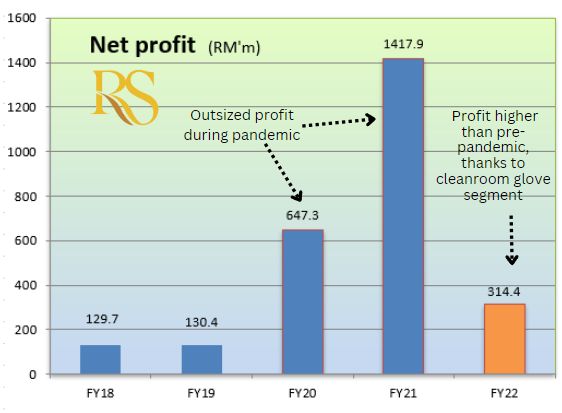

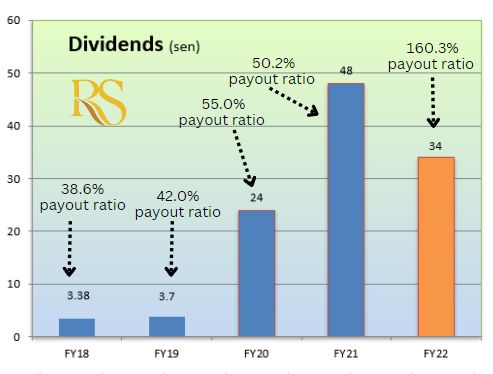

That, in a nutshell, explains why Riverstone was still highly profitable (compared to pre-pandemic) in 2022, and gave out bumper dividends as our 2 charts below illustrate: |

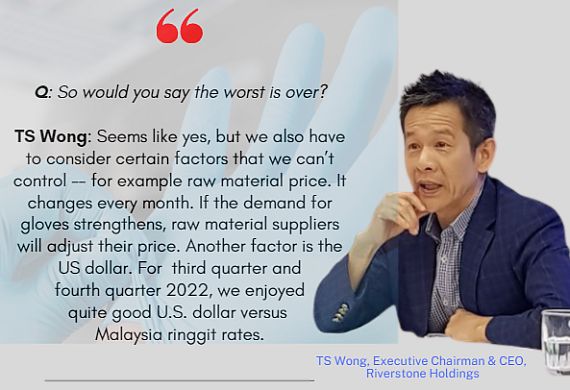

Excerpt from Q&A at FY22 investor briefing.

Excerpt from Q&A at FY22 investor briefing.

Below we excerpt CGS-CIMB report:

Analyst: Ong Khang Chuen, CFA

Another round of bumper dividends

■ 4Q22 net profit of RM42m (-62% yoy) was in line with expectations. Final + special dividend of 18 sen/share brought full-year dividend yield to 16%.

|

Riverstone

|

|

Share price:

61 c

|

Target:

60 c

|

■ Challenges in healthcare gloves remain; RSTON looks to focus on specialty/customised gloves and lower-end cleanroom gloves to drive growth.

■ Reiterate Hold with a lower TP of S$0.60 as the competitive environment for the glove industry is unlikely to improve in the near term. |

4Q22: Another round of bumper dividends

| Outperformer |

| "Riverstone continues to outperform larger scale Malaysian-listed peers (Hartalega, Kossan and Supermax all reported net loss in that quarter), given its differentiated focus on cleanroom gloves." |

Riverstone Holdings’ (RSTON) 4Q22 net profit fell to RM42m (-34% qoq, -62% yoy) with further normalisation of ASPs, but continues to outperform larger scale Malaysian-listed peers (Hartalega, Kossan and Supermax all reported net loss in that quarter), given its differentiated focus on cleanroom gloves.

Results were in line with expectations, with FY22 net profit of RM314m (-78% yoy) coming in at 98%/104% of our/Bloomberg consensus’ forecasts.

Operating landscape remains tough for healthcare gloves

Healthcare glove ASPs remain on a decline due to industry oversupply, with no signs of easing in the near term. RSTON’s healthcare segment GPM was only 5% in 4Q22 (vs. 3Q22: 10%) — mainly supported by higher priced specialty gloves; generic glove products are sold below cost across the industry as players look to cover overheads.

Despite rising cost pressures, glove players are finding it difficult to raise prices to sufficiently cover the impact.

RSTON is actively modifying its production lines to cater for specialty/customised products, which are usually in smaller order volumes and require nimble manufacturing capabilities.

Currently, specialty products make up c.20% of RSTON’s healthcare volumes.

Shifting focus towards cleanroom segment advancement

RSTON continues to see a steady outlook for its cleanroom segment and expects ASPs to remain resilient at c.US$100 (per 1k pieces). Given the weak healthcare glove outlook, management plans to broaden its cleanroom glove offerings (from its niche of higher-end Class 10 and Class 100 gloves) to include more lower-end products, such as Class 1000 gloves.

This would be enabled by its cleanroom processing capacity expansion to 2.5bn gloves p.a., which is expected to come onstream by mid-CY23F. According to RSTON, such gloves can command c.US$70 per carton selling price and c.40% GPM currently.

Reiterate Hold. While we think that fundamentals may remain weak in FY23F given the competitive environment in the glove industry, we believe downside risks can be capped with its strong cash position and plans to distribute excess cash on its balance sheet (end-Dec 22: net cash of RM1.07bn).

Ong Khang Chuen, CFAWe lower our FY23-24F EPS by 11-26% to account for lower ASP assumptions. Our TP is lowered to S$0.60 as we roll over our valuation base year, pegged to 14.5x CY24F P/E (1 s.d. below 5-year pre-Covid historical mean). Ong Khang Chuen, CFAWe lower our FY23-24F EPS by 11-26% to account for lower ASP assumptions. Our TP is lowered to S$0.60 as we roll over our valuation base year, pegged to 14.5x CY24F P/E (1 s.d. below 5-year pre-Covid historical mean).

Upside risks include higher dividend payout and continued resilience in cleanroom demand; downside risks include a prolonged weakness in healthcare glove ASPs. |

Full report here.