| • Markets are doing multiple swings as Trump slaps tariffs, raises tariffs, pauses tariffs, whatever. If you are looking for value among small mid-cap stocks, UOB Kay Hian in a note today says there's plenty in three standout companies: PropNex, China Sunsine, and Oiltek. They've got strong finances, decent or cheap PE ratios, the potential for good earnings growth, and will pay out nice dividends.  • And they have zero or very little direct trade with the US. PropNex is benefiting from Singapore’s booming property sector, China Sunsine is leveraging its leadership in rubber accelerators, and Oiltek's riding the wave of sustainable aviation fuel growth. • Read more below... |

Excerpts from UOB KH report

Analysts: Heidi Mo & John Cheong

| We highlight key discussion points from our monthly webinar on small/mid cap trends for retail investors earlier this week. The recent tariff developments have sparked investor concerns over stock impact, whether to hold cash or buy the dip, and more. In this note, we share our take on the recent market sell-off and explore value in three small/mid cap stocks, namely PropNex, China Sunsine and Oiltek. |

KEY DISCUSSION POINTS WITH THE RETAIL INVESTORS

• Will these stocks be affected by Trump’s tariffs?

We see no impact on PropNex, which operates an asset-light business model that is almost 100% exposed to Singapore public and private property sales, resales and rentals.

As for stocks with China exposure like China Sunsine, Trump’s proposed additional tariffs on China could lead investors to shy away from it.

However, we reiterate that China Sunsine has a low 2% US export share, while tyre manufacturers will likely be subject to tariffs and pass on the costs to their end-customers.

Oiltek also has a minute 2% revenue exposure to the US, and is thus relatively immune from direct tariff impact.

• Holding cash vs buying the dip.

Given the current volatility in the stock market, it is easy to be inclined to hold cash while waiting for further developments on the trade war and market shifts.

In our view, the recent market sell down presents a good opportunity to accumulate quality stocks at attractive valuations. Our stock picks have market leadership, earnings growth potential and war chests to support share buybacks.

• Comparing Oiltek to palm oil companies.

Oiltek is primarily a B2B provider, supplying equipment and its solutions to B2C palm oil producers like Wilmar International, Golden AgriResources and Sime Darby Plantation.

In our view, Oiltek is less exposed to commodity price volatility (eg CPO prices) than palm oil companies are, as its earnings are largely tied to service contracts.

Furthermore, it has an asset-light business, high ROE and provides more direct exposure to the sustainable aviation fuel (SAF) space, which is expected to see strong potential growth.

• Maintaining market leadership. PropNex has maintained its lion’s share of the market in Singapore through its reputable brand, large sales force, and focus on training and technology.

China Sunsine leads the market thanks to its loyal customer base, consistent capacity expansion and established track record of compliance with environmental laws.

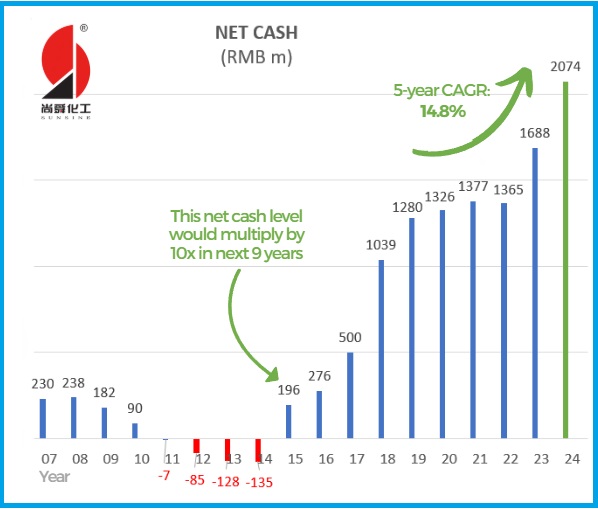

• China Sunsine remained both the world’s and China’s largest accelerator producer in 2024, maintaining stable market shares of 23% and 35% respectively.  Heidi Mo, analyst• In 2024, China Sunsine achieved record sales of 214,094 tonnes (+3% yoy), driven by higher international sales volume (+11% yoy), particularly from Southeast Asia-based tyre manufacturers. Heidi Mo, analyst• In 2024, China Sunsine achieved record sales of 214,094 tonnes (+3% yoy), driven by higher international sales volume (+11% yoy), particularly from Southeast Asia-based tyre manufacturers. With China’s automobile sales up 5% yoy to 31.4m units, Chinese tyre makers offshoring production for cost and trade advantages, and the increased adoption of electric vehicles, China Sunsine’s volumes are set to continue growing.  • China Sunsine provides an attractive yield of around 6%, supported by its strong cash position of Rmb2,074m (+23% yoy) as of end-24. This translates to Rmb2.18/share (S$0.40/share) or around 80% of its market cap. • Our target price of S$0.63 is pegged to a 7.5x 2025F PE, or 1SD above the mean PE. The stock trades at an attractive valuation of 1.4x ex-cash 2025F PE. |

Full report here.