|

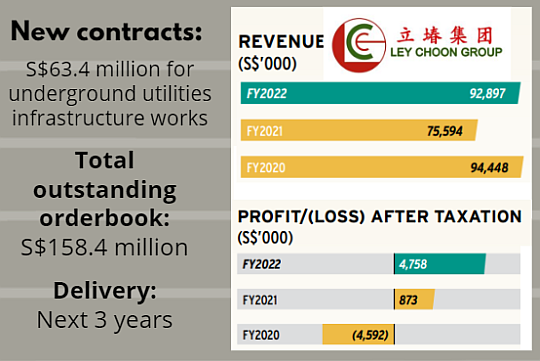

Following its FY2022 (ended March 2022) profit announcement 2 months ago, SGX Catalist-listed Ley Choon Group Holdings has now revealed continued momentum in its orderbook.

|

|

Stock price |

1.5 c |

|

52-week range |

1.2 – 2.2 c |

|

PE (ttm) |

2.2 |

|

Market cap |

S$22.6 m |

|

Shares outstanding |

1.5 b |

|

Dividend |

-- |

|

1-year return |

6.7% |

|

Source: Yahoo! |

|

Ley Choon's customers include government bodies such as Public Utilities Board, Land Transport Authority, Housing and Development Board, Urban Redevelopment Authority, Building and Construction Authority, Jurong Town Corporation and companies such as Changi Airport Group and SP Group.

Ley Choon is a BCA L6 registered contractor, the highest grade allowed to tender for Singapore public sector contracts of unlimited value in the categories of cable/pipe-laying and road reinstatement, pipes, and other basic construction materials.

It is also an A1 registered contractor in the category of civil engineering (CW02).

“With the easing of COVID-19 restrictions, there is pent up demand for the upgrading works for Singapore’s complex underground utilities system. Our expertise and track record in this space have put us in an advantageous position to capture these opportunities." “With the easing of COVID-19 restrictions, there is pent up demand for the upgrading works for Singapore’s complex underground utilities system. Our expertise and track record in this space have put us in an advantageous position to capture these opportunities."--- Mr Toh Choo Huat (卓沭橃), Executive Chairman and CEO of Ley Choon. |

The easing of Covid restrictions aided the recovery of construction work in FY2022 (ended March 2022), leading to a net profit of S$4.8 million for Ley Choon.

Gross margin was 11.7% (FY2021: 7.9%).