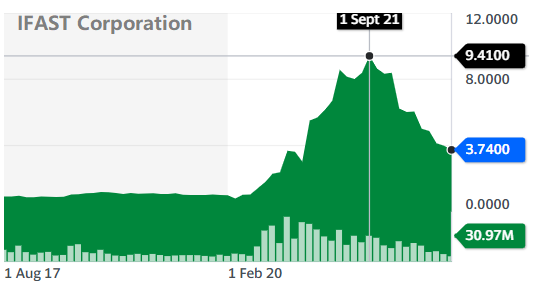

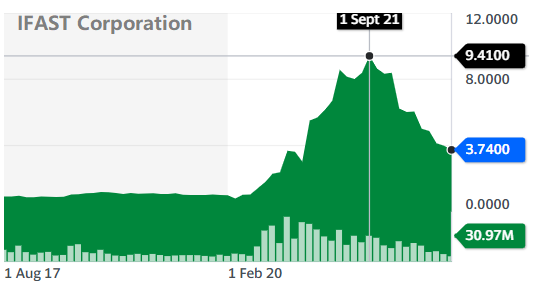

IFAST: This share may continue to drop very fast.

At the high of 9.95 in September 2021, it has dropped and keep dropping to 3.99 currently. That is a terrible 60% decline.

Chart: Yahoo!

Chart: Yahoo!

Will it drop further? Nobody can tell, and the fundamental may able to guess its future share price.

At the high of 9.95 in September 2021, it has dropped and keep dropping to 3.99 currently. That is a terrible 60% decline.

Chart: Yahoo!

Chart: Yahoo! | "Asset-light entities can only prop up their share price with high dividend and high dividend yield way above risk-free rate. Therefore, iFAST is not in that category." |

Its NAV per share is only 77 cents. Its earnings per share is only 1 cent for 1H2022 (1H2021 was 5 cents), and annualized EPS projection is not more than 3 cents.

This is despite its low share base of 293 million issued shares.

SPH has 13.28% of the shares. Free float is about 50% or 147 million shares. There is a need to monitor whether SPH will divest its investment in iFAST following the corporate restructuring.

This is despite its low share base of 293 million issued shares.

SPH has 13.28% of the shares. Free float is about 50% or 147 million shares. There is a need to monitor whether SPH will divest its investment in iFAST following the corporate restructuring.

Revenue growth is not great between 2021 and current. The big leap in revenue and profits were from 2020 to 2021.

Dividend yield currently is less than 2%.

From a fundamental analysis, the current share price doesn’t seem to be in sync with its intrinsic value. From a price-to-book and PE point of view, current share price has failed the threshold.

Asset-light entities can only prop up their share price with high dividend and high dividend yield way above risk-free rate. Therefore, iFAST is not in that category.

Dividend yield currently is less than 2%.

From a fundamental analysis, the current share price doesn’t seem to be in sync with its intrinsic value. From a price-to-book and PE point of view, current share price has failed the threshold.

Asset-light entities can only prop up their share price with high dividend and high dividend yield way above risk-free rate. Therefore, iFAST is not in that category.

Based on the chart, the share price, if it continues falling, has 3 support prices to monitor.

They are 2.90, 2.20 and 1.00. Each of the mentioned support, if broken, may head toward the next support.

The scenario could change if the furture in the digi-banking world turn promising and iFAST is able to capitalize on this opportunity to grow this sector.

They are 2.90, 2.20 and 1.00. Each of the mentioned support, if broken, may head toward the next support.

The scenario could change if the furture in the digi-banking world turn promising and iFAST is able to capitalize on this opportunity to grow this sector.