Excerpts from CGS- CIMB report

| Sector Preference and Country Top Picks With growth and recovery prospects being the key theme, Commodities and Telco are our new Overweight sectors. Banks, Construction and Property are long-term winners for an economic recovery. We also like Technology/Manufacturing on strong earnings outlook and the demand for IT-related infrastructure and life science equipment. |

The recent successful listing and outperformance of Nanofilm Technologies (Not Rated) could draw more tech IPOs to Singapore, lifting the sector’s interest and valuations.

Capital Goods could see a good run from a recalibrated focus among the Temasek-linked companies as well as M&A hope.

On the flipside, we believe the recent run-up in Transport has priced in perfection and we do not think it is sensible given its +1 s.d. to mean valuations vis-à-vis weak earnings profile; downgrade to Neutral.

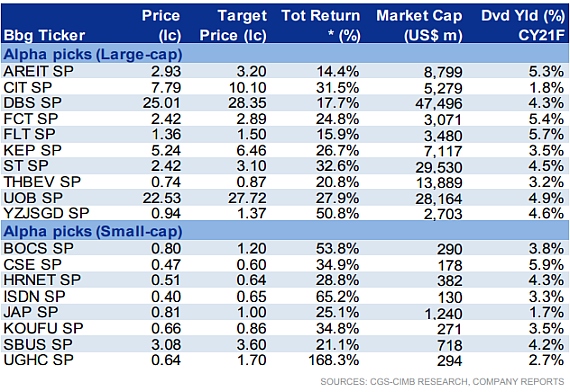

We make some changes to our country top picks — we remove SIA and CAPL after the surge in recent months.

We add YZJ, driven by heightened order momentum for containerships, and CIT, as a proxy to robust residential sales in Singapore and as a laggard play.

If liquidity is ample, we think small caps could be in vogue in 2021F and add two new names to our list

| — HRNet, on strong demand for flexible staffing by corporates and government agencies as well as growth in North Asia (China), and -- ISDN, which could outperform on super profits (+166% yoy) in FY20F from the demand for industrial automation motors, especially in China. |

Full report here.