Excerpts from Tayrona Financial report

Analyst: Liu Jinshu

| New Acquisition to Double Annual Earnings ▪ Creating a larger multi-disciplinary group. Asian Healthcare Specialists Limited announced yesterday that it has completed the acquisition of 51% of Cornerstone Asia Health Pte. Ltd. for S$32.1m.

This acquisition is not only earnings-accretive but will also create a larger platform for the recruitment of new specialists and doctors to join the enlarged group, thus expanding the group trajectory of Asian Healthcare Specialists. |

||||

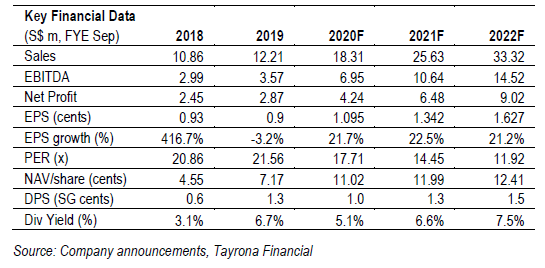

▪ Pro-forma profit attributable to shareholders to double. The acquisition is expected to add S$2.47m of recurring earnings to Asian Healthcare Specialists profit base.

The latter made S$2.87m of net profit attributable to shareholders in FY19.

We expect FY20F net profit attributable to shareholders of S$4.24m (48% growth from FY19F) and earnings per share growth of 22% from 0.9 cent to 1.1 cent as Cornerstone Asia Health will only contribute seven months of performance in FY20F.

Cornerstone Asia Health is more profitable than Asian Healthcare Specialists probably due to listing and other corporate costs that are born by the latter.

The acquisition shows effective leverage of its listing to grow and expand. L-R: Dr Yue Wai Mun (Chief Medical Officer), Dr Chin Pak Lin (Chairman & CEO), Dr Tan Chyn Hong (co-founder), Dr David Su (co-founder).

L-R: Dr Yue Wai Mun (Chief Medical Officer), Dr Chin Pak Lin (Chairman & CEO), Dr Tan Chyn Hong (co-founder), Dr David Su (co-founder).

Photo: Company

▪ Strong cash flows and balance sheet support high dividend pay-out. The group reported net operating cash flows of S$2.6m against net profit of S$2.9m.

We also like the Company for its strong cash generating ability and balance sheet.

As at 30 September 2019, the group had net cash of S$12.4m, which can be further used to make new acquisitions.

The Company has been generous in maintaining a high dividend pay-out.

We expect the Company to pay out 100% of earnings for FY20, which translates to an attractive yield of 5.1% over the current share price of S$0.194, based on projected earnings.

▪ Key risks include

| a) the newer/employed doctors may take time to exit their developmental period and deliver profit, b) some of the “acquired” doctors are already highly experienced and are at the peak of their careers. |

The true test of the Asian Healthcare Specialists platform will be how the Company mentors newer doctors such that profitability is maintained even as the older doctors eventually retire.

|

Clinics (Asian Healthcare Specialists and Cornerstone Asia Health) |

Address |

|

» Mount Elizabeth Novena Specialist Centre |

|

|

The Orthopaedic Centre |

38 Irrawaddy Rd #09-42 |

|

S H Ho Urology and Laparoscopy Centre |

38 Irrawaddy Rd #07-44 |

|

» Farrer Park Medical Centre, Connexion |

|

|

The Orthopaedic Centre |

1 Farrer Park Station Rd #14-05 |

|

Dermatology Associates |

1 Farrer Park Station Rd #12-02 |

|

CAH Specialists @ Farrer |

1 Farrer Park Station Rd #07-05 |

|

Bobby Cheng Eye & Retina Centre |

1 Farrer Park Station Rd #12-01 |

|

» Gleneagles Medical Centre |

|

|

The Orthopaedic Centre |

6 Napier Road #07-15 |

|

Ng Tay Meng Gastrointestinal and Liver Clinic |

6 Napier Rd #08-01 |

|

S H Ho Urology and Laparoscopy Centre |

6 Napier Rd #09-18 |

|

» Mount Elizabeth Medical Centre |

|

|

The Orthopaedic Centre |

3 Mount Elizabeth #17-18 |

|

» Great World City |

|

|

Twin City Medical Centre |

1 Kim Seng Promenade #01-136 |

|

» Mt Alvernia Medical Centre |

|

|

Ng Tay Meng Gastrointestinal Hepatology Centre |

820 Thomson Road |

▪ High growth supports fair value of S$0.305. Using the dividend growth model and factoring the conversion of an outstanding S$5m convertible bond, we value the group at S$0.305 per share or at S$131.09m – at 14.5x FY22F earnings.  Liu Jinshu, analyst, Tayrona Financial.The peer group average trailing 12-month P/E is 16.37x. Liu Jinshu, analyst, Tayrona Financial.The peer group average trailing 12-month P/E is 16.37x. We believe that Asian Healthcare Specialists’ financial growth visibility following the acquisition of Cornerstone Asia Health justifies the high P/E multiple implied by our valuation and rate the Company Overweight. |

Full report here.