Multi-billionaire Anthoni Salim.

Multi-billionaire Anthoni Salim.

Photo: Profilbos.comChinese water treatment companies have emerged as market darlings on SGX.

Now there is a small water play based in Indonesia -- Moya Holdings Asia -- which a big Indonesian tycoon has taken control of.

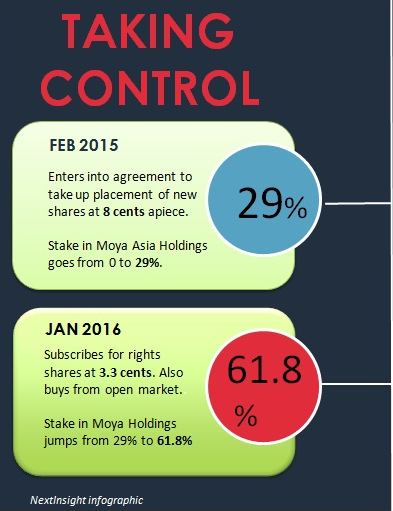

In less than a year, Anthoni Salim has taken control of Moya Holdings using S$74 million cash -- through a subscription of new shares and through a rights issue (see infographic).

In less than a year, Anthoni Salim has taken control of Moya Holdings using S$74 million cash -- through a subscription of new shares and through a rights issue (see infographic).

That works out to a cost per share of 4.3 cents, while the stock price recently was 3.9 cents (translating into a market cap of S$109 million).

The share price has shot up recently from a 52-week low of 3.0 cents.

Mr Salim's involvment is through a series of companies. Firstly, he is the controlling shareholder of PT Tritunggal Intipermata which, in turn, is a controlling shareholder of another company.

And so it goes for another six companies until we reach Tamaris Infrastructure, in whose name the Moya Holdings shares are held.

So in the space of less than a year Moya Holdings finds itself with loads of cash in hand from, mainly, a change of controlling shareholders.

The proceeds were earmarked mainly to be deployed to Build-Operate-Transfer (BOT) waters supply projects which Moya Holdings is developing in Indonesia.

|

Moya Holdings has three 25-year BOT projects in Bekasi Regency, Tangerang and Makassar, which were secured in August 2011, February 2012 and August 2013, respectively.

"The Indonesian-based group considers that the subscription would be in line with its desire to become a utilities company and would complement its existing business which involves the production of electricity from water resources." |