Excerpts from analyst's report

|

|

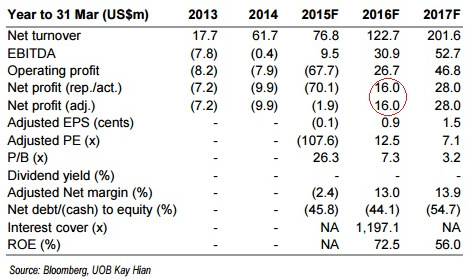

OUR VIEW  Agus Sugiono, Chairman & CEO of Resources Prima, presenting at CIMB last week. NextInsight file photo. • In FY16, profitability could be driven by:

Agus Sugiono, Chairman & CEO of Resources Prima, presenting at CIMB last week. NextInsight file photo. • In FY16, profitability could be driven by:

1. Cost savings

» Lower fuel costs. With the lower oil prices, we estimate that RPG’s recent fuel costs may have dropped by about 35%.

» Lower heavy equipment and rental costs. In 3QFY15, RPG saw a 50% yoy reduction in heavy equipment rental costs as it benefitted from the completion of an all-weather road earlier in FY15. We expect RPG to enjoy the full benefits of the cost savings in FY16.

» Lower maintenance cost for hauling road facility, as RPG plans to maintain the hauling road by themselves instead of contracting a third party contractor for maintenance.

» Lower waste mining costs. Waste mining costs currently forms about 45% of RPG’s COGS. With the revision to waste mining rates, based on management’s estimates and assuming all things are equal, the new rates would have brought about cost savings of US$3.7m in 9MFY15.

2. Ramp up in coal production volume

» RPG is currently in the midst of applying for its second IPPKH permit, which we expect will be approved by 2Q15 (1QFY16). Upon receipt of the permit, RPG will be able to increase its resource and reserve estimates, but rampup its current production as well. We expect RPG to achieve a steady production rate of 3.6 million mt from the Rinjani mine in FY17.

3. Coal logistics business

» To recall, RPG has signed contracts with five closely-located concession owners for the use of its coal logistics facilities. One of the coal mine owners is currently leasing the coal haulage road and jetty facilities from RPG, while three of the other contracts are expected to commence from FY16 onwards.