Jeremy Peh, a shareholder of Best World International, contributed this article to NextInsight.

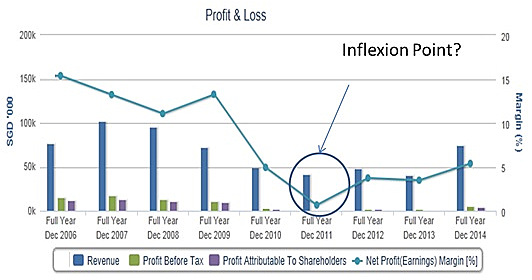

Best World International reported strong revenue and profit growth for FY2014, possibly confirming that the inflexion point for the business occurred in 2011 after it suffered a string of set backs from the Indonesian and subsequently Thai markets.

Revenue has been on an uptrend since 2011 while net profit in 2014, at $4.1 million, is about a third of the record high of S$13 million achieved in 2007 before the global financial crisis.

Revenue has been on an uptrend since 2011 while net profit in 2014, at $4.1 million, is about a third of the record high of S$13 million achieved in 2007 before the global financial crisis.  Best World International co-chairwomen Dora Hoan and Doreen Tan with distributors in the Philippines, which contributed S$18.5 million in revenue last year compared to S$2.6 million a year earlier.

Best World International co-chairwomen Dora Hoan and Doreen Tan with distributors in the Philippines, which contributed S$18.5 million in revenue last year compared to S$2.6 million a year earlier.

Photo: Company

However, it has turned around through focusing and developing other markets including Taiwan, the Philippines and China. These have exhibited steady growth over the last few years.

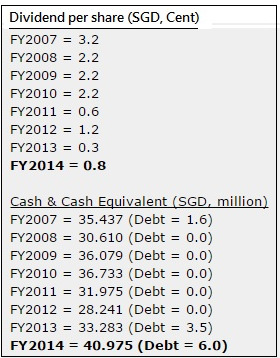

Beside strong revenue and earnings growth, its cash position has increased to $39.2 m at the end of 2014 from $31.5m in 2013.

This was largely as a result of net cash flow from operating activities, a newly acquired term loan and proceeds from the issue of shares to Mr. Shi Jinyu for the acquisition of BWZ, offsetting cash used in the acquisition of its subsidiaries.

Best World is in a strong financial position to continue growing and will be shielded from interest rate hikes.

Best World’s asset-light business model which relies on a highly-scalable distributor network has resulted in a high margin, free cash flow generative business.

Gross margin has stayed above 75% and operating cash flow has been positive for each of the past 10 years.

Operating margins were low in the past few years due to an over-expansion of ‘Lifestyle Centers’ in the regions which coincided with country-specific issues/problems.

|

Direct-selling licence in China |

Compiled by Boon @ Valuebuddies.comBest World's S$35 million in net cash constitutes 63% of its market cap of S$56 million.

Compiled by Boon @ Valuebuddies.comBest World's S$35 million in net cash constitutes 63% of its market cap of S$56 million.

Ex-net cash, the business sells for only S$21 million or a P/E of 5 times.

The Board has recommended a final dividend of 0.5 cent per share, taking the total dividend for FY2014 to 0.8 cent per share.

This represents a dividend payout of 43.5% of the Group’s FY2014 net profit.

Given such highly attractive financials, it is not surprising that insider buying was strong last year at the 19-20 cent level. The current share price is 25.5 cents.

And in the 2013 annual report, tycoon Sam Goi was listed among the top 20 shareholders. Chances are his name will appear again in the list in the upcoming 2014 annual report.