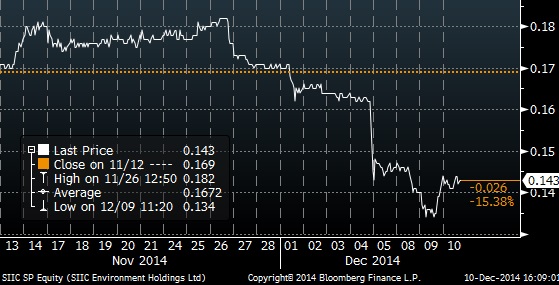

SIIC Environment's share price was battered down after Chinese sovereign fund, China Investment Corp, sold on 5 December its entire stake of 660 million shares (6.88%) for about 14.9 cents apiece. On 26 November, SIIC Environment executive director Yang Changmin sold 50 million shares at 17.1 cents apiece, paring down his stake from 1.46% to 0.79%.

SIIC Environment's share price was battered down after Chinese sovereign fund, China Investment Corp, sold on 5 December its entire stake of 660 million shares (6.88%) for about 14.9 cents apiece. On 26 November, SIIC Environment executive director Yang Changmin sold 50 million shares at 17.1 cents apiece, paring down his stake from 1.46% to 0.79%.

Excerpts from analyst's report

Maybank Kim Eng analyst: Wei Bin

Maybank Kim Eng analyst: Wei Bin

Executive director Yang Changmin founded one of SIIC Environment's key operating subsidiaries in 2003 when it was known as United Environment. Company photoCIC has cleared all its 660 million shares in SIIC Environment at SGD0.149 apiece, by placing them out on 5 Dec.

Executive director Yang Changmin founded one of SIIC Environment's key operating subsidiaries in 2003 when it was known as United Environment. Company photoCIC has cleared all its 660 million shares in SIIC Environment at SGD0.149 apiece, by placing them out on 5 Dec.The selling price was at an 8% discount to SIIC’s 4 Dec closing price or 75% above CIC’s cost.

Admittedly, it is not usual for CIC to exit after only one year of investment.

In this instance, this could due to profit-taking or portfolio restructuring.

We still believe China’s water sector is where investors can plump for in FY15.

Catalysts should include water-tariff revisions, further policy support and industry consolidation.

Operationally, SIIC continues to make progress.

YTD, it has acquired 1.1m tonnes of water-treatment capacity.

This slightly beats its 1m-tonne/year target.

From our discussions with management, there remain sufficient projects in its due-diligence pipeline.

We believe there could be more acquisitions early next year. Some plants are also ready for expansion and upgrading.

The stock is trading at 20x FY15E PER, fairly attractive against 26%/23% EPS growth for FY15E/16E.

We believe the market’s knee-jerk reaction is overdone and current price offers a good entry.

Maintain BUY and SGD0.20 TP, at 30x FY15E PER, its peer average.

Catalysts should include water-tariff revisions, further policy support and industry consolidation.

Operationally, SIIC continues to make progress.

YTD, it has acquired 1.1m tonnes of water-treatment capacity.

This slightly beats its 1m-tonne/year target.

From our discussions with management, there remain sufficient projects in its due-diligence pipeline.

We believe there could be more acquisitions early next year. Some plants are also ready for expansion and upgrading.

The stock is trading at 20x FY15E PER, fairly attractive against 26%/23% EPS growth for FY15E/16E.

We believe the market’s knee-jerk reaction is overdone and current price offers a good entry.

Maintain BUY and SGD0.20 TP, at 30x FY15E PER, its peer average.