Excerpts from analysts' reports

UOB Kay Hian starts coverage of HanKore Environment with 13.7-c target

UOB KH analyst Brandon Ng (extreme right) checking out HanKore's water treatment facility. File photoAnalyst: Brandon Ng, CFA

UOB KH analyst Brandon Ng (extreme right) checking out HanKore's water treatment facility. File photoAnalyst: Brandon Ng, CFA

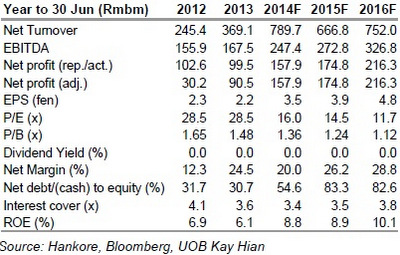

We initiate coverage with a BUY and a target price of S$0.137. As at 23 Jan 14, Hankore Environment Tech Group (Hankore) was trading at 28.5x FY13 PE and 1.4x FY13 P/B, vs peers’ 26.9x PE and 2.8x P/B respectively.

Due to a lack of details, we have not factored in the potential asset injection by China Everbright Water Investments (CEWI), although both companies had signed a definitive agreement in Dec 13.

Changes in treatment volumes beyond the 1.57m tonnes/day, acquisition opportunities, and changes to the macro landscape and government regulations for the water industry could impact our target price.

UOB Kay Hian starts coverage of HanKore Environment with 13.7-c target

UOB KH analyst Brandon Ng (extreme right) checking out HanKore's water treatment facility. File photoAnalyst: Brandon Ng, CFA

UOB KH analyst Brandon Ng (extreme right) checking out HanKore's water treatment facility. File photoAnalyst: Brandon Ng, CFAWe initiate coverage with a BUY and a target price of S$0.137. As at 23 Jan 14, Hankore Environment Tech Group (Hankore) was trading at 28.5x FY13 PE and 1.4x FY13 P/B, vs peers’ 26.9x PE and 2.8x P/B respectively.

Due to a lack of details, we have not factored in the potential asset injection by China Everbright Water Investments (CEWI), although both companies had signed a definitive agreement in Dec 13.

Changes in treatment volumes beyond the 1.57m tonnes/day, acquisition opportunities, and changes to the macro landscape and government regulations for the water industry could impact our target price.

China facing one of its greatest water crises. According to The Economist, China is facing a severe water crisis where its citizens are accessing just 450 cubic metres of water per year.

This is worse than “severe water stress” which is usually defined as access to less than 1,000 cubic metres of water per person per year.

This is worse than “severe water stress” which is usually defined as access to less than 1,000 cubic metres of water per person per year.

Against such a backdrop, we believe the government will be focusing on adding new facilities and upgrading old ones before the crisis gets out of hand.

• Government policies supportive of water treatment industry. Under the 12th Five-Year Plan (2011-15), China will increase its wastewater treatment (WWT) capacity target from 125m tons/day in 2010 to 208m tons/day by 2015.

However, data from the Ministry of Housing and Urban-Rural Development show that as at 1H13, the country had added only 20.5m tons/day of new WWT capacity to 145.5m tons/day.

To achieve the above target, the government will have to roll out massive BOT projects in the next 2.5 years. Such an aggressive target would provide earnings growth catalysts for Hankore in the form of BOT/TOT (Build-Operate-Transfer/Transfer-Operate-Transfer) projects as well as upgrading opportunities for its own water treatment plants.

Recent story: HANKORE: Why it needs China Everbright

To achieve the above target, the government will have to roll out massive BOT projects in the next 2.5 years. Such an aggressive target would provide earnings growth catalysts for Hankore in the form of BOT/TOT (Build-Operate-Transfer/Transfer-Operate-Transfer) projects as well as upgrading opportunities for its own water treatment plants.

Recent story: HANKORE: Why it needs China Everbright

Goldman Sachs maintains 'sell' rating on Suntec REIT

Analysts: Paul Lian & Jason Yeo

Marina Bay Financial Centre is among the assets of Suntec Reit. Photo: CompanySuntec City Mall AEI is on track with good commitment levels for Ph 1 and 2, setting a positive tone for Ph 3. The increase in MICE (meetings, incentives, conferencing and exhibitions) activity at Suntec Convention Centre in 2014 could also generate additional shopper traffic.

Marina Bay Financial Centre is among the assets of Suntec Reit. Photo: CompanySuntec City Mall AEI is on track with good commitment levels for Ph 1 and 2, setting a positive tone for Ph 3. The increase in MICE (meetings, incentives, conferencing and exhibitions) activity at Suntec Convention Centre in 2014 could also generate additional shopper traffic. Nonetheless, while return/rent targets may be met in the near term, we are less optimistic on the overall mall positioning and its ability to sustain shopper traffic/spend in medium term. Parco’s recent decision to vacate adjacent Millenia Walk suggests some difficulties for retail in the micro-market.

Improving broader Grade A office trends will lift its One Raffles Quay and Marina Bay Financial Centre assets, though Suntec City Office could see competition from adjacent South Beach (c.500,000sqft, completion in 4Q14).

Maintain Sell. We raise 12m DCF TP by 1% to S$1.40 and 2014/2015 DPU by 4%/2% on AEI updates and introduce 2016 DPU of S$0.106.

Suntec trades at 6.0% FY14E dividend yield vs. 10-year bond yield of 2.5%. Risks: better-than-expected AEI execution.

Recent story: CALVIN YEO: "I've bought more REITS and other dividend stocks"

Maintain Sell. We raise 12m DCF TP by 1% to S$1.40 and 2014/2015 DPU by 4%/2% on AEI updates and introduce 2016 DPU of S$0.106.

Suntec trades at 6.0% FY14E dividend yield vs. 10-year bond yield of 2.5%. Risks: better-than-expected AEI execution.

Recent story: CALVIN YEO: "I've bought more REITS and other dividend stocks"