Excerpts from analysts' reports

OCBC Investment Research raises fair value of Nam Cheong to 35 cents.

Analysts: Chia Jiunyang, CFA, and Low Pei Han, CFA

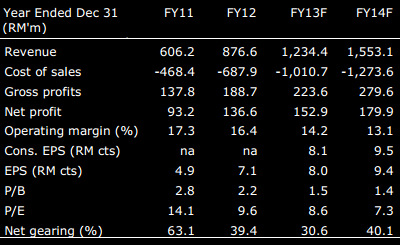

Petronas had pledged to spend RM300b in capital expenditure over 2011-15, 80% more than the previous 5-year period.

Petronas had pledged to spend RM300b in capital expenditure over 2011-15, 80% more than the previous 5-year period.

We believe this will likely result in increased investments across the Malaysian offshore oil & gas industry.

Already, Nam Cheong is seeing a healthy pick-up in order wins (FY11: 13 vessels; FY12: 21 vessels) and it has recently expanded its shipbuilding programme to 28 vessels for FY14F (FY13: 19 vessels).

Its large order-book of RM1.3b, for 26 vessels delivered over FY13-15F, helps to mitigate its risk by providing a base level of earnings.

Given the strong growth profile, we find current valuation (FY13F PER of 8.6x) attractive.

We now raise our FV to S$0.35 (previously S$0.30) on a higher PER of 11x. Maintain BUY.

Click on above video of Nam Cheong's diesel-electric vessel being launched into the sea off Miri, Sarawak.

JP Morgan sets price target of $2.20 for Olam

Analysts: Ying-Jian Chan, CFA, and James R. Sullivan, CFA

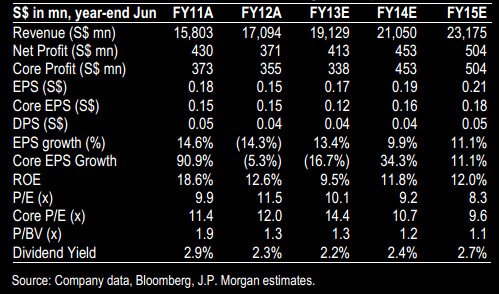

We expect Olam to sustain a c.12% FY13-15E core net profit CAGR driven by c.19% overall sales volume growth and gradual margin expansion.

We believe various concerns surrounding the stock are largely priced-in. Management has committed that it will not need further refinancing until Jun-2014.

We see limited downside for the stock, with re-rating potential from:

1) improving earnings quality as previous M&A begins contributing tangibly, and 2) rebalanced business model targeting positive free cash flow by FY14, although this could be partly offset by slower growth potential than before.

OCBC Investment Research raises fair value of Nam Cheong to 35 cents.

Analysts: Chia Jiunyang, CFA, and Low Pei Han, CFA

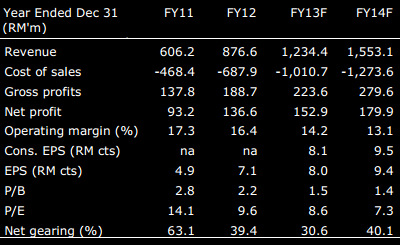

Petronas had pledged to spend RM300b in capital expenditure over 2011-15, 80% more than the previous 5-year period.

Petronas had pledged to spend RM300b in capital expenditure over 2011-15, 80% more than the previous 5-year period. We believe this will likely result in increased investments across the Malaysian offshore oil & gas industry.

Already, Nam Cheong is seeing a healthy pick-up in order wins (FY11: 13 vessels; FY12: 21 vessels) and it has recently expanded its shipbuilding programme to 28 vessels for FY14F (FY13: 19 vessels).

Its large order-book of RM1.3b, for 26 vessels delivered over FY13-15F, helps to mitigate its risk by providing a base level of earnings.

Given the strong growth profile, we find current valuation (FY13F PER of 8.6x) attractive.

We now raise our FV to S$0.35 (previously S$0.30) on a higher PER of 11x. Maintain BUY.

Click on above video of Nam Cheong's diesel-electric vessel being launched into the sea off Miri, Sarawak.

JP Morgan sets price target of $2.20 for Olam

Analysts: Ying-Jian Chan, CFA, and James R. Sullivan, CFA

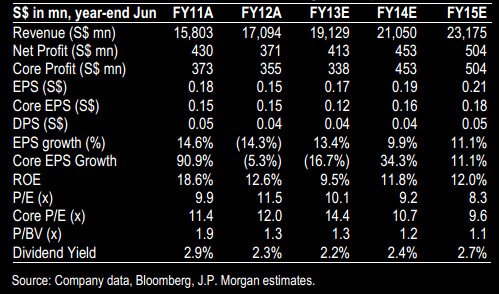

We expect Olam to sustain a c.12% FY13-15E core net profit CAGR driven by c.19% overall sales volume growth and gradual margin expansion.

We believe various concerns surrounding the stock are largely priced-in. Management has committed that it will not need further refinancing until Jun-2014.

We see limited downside for the stock, with re-rating potential from:

1) improving earnings quality as previous M&A begins contributing tangibly, and 2) rebalanced business model targeting positive free cash flow by FY14, although this could be partly offset by slower growth potential than before.

Our Jun-2014 PT of S$2.20 is based on the lower of our P/E-based and P/BV-based methodology, benchmarked against peers Noble and Wilmar.

We believe this sufficiently discounts a number of risk factors. Key downside risk is weaker demand for agri-commodities depressing volumes and margins; key upside risks include delivering on positive FCF and reduced gearing without overly compromising growth.

We believe this sufficiently discounts a number of risk factors. Key downside risk is weaker demand for agri-commodities depressing volumes and margins; key upside risks include delivering on positive FCF and reduced gearing without overly compromising growth.