Bocom: Staying ‘Outperform’ on HK Consumer Sector Despite Slowdown

Bocom International said it is reiterating its “Outperform” recommendation on Hong Kong-listed consumer sector stocks despite October retail sales growth coming in lower than expected at 4%.

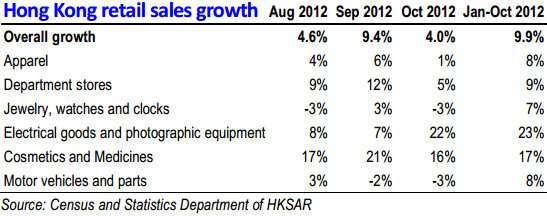

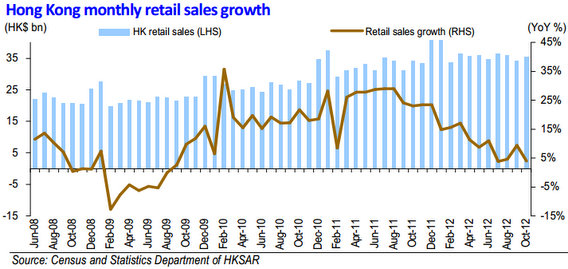

Hong Kong retail sales growth eased considerably to 4% in October from 9.4% in September, and were lower than the consensus estimate of 6.7%.

For the January-October period, the average retail sales growth was 9.9%.

The key segments seeing slowdowns were jewelry & watches (to -3% vs. 3% in September), followed by department stores (to 5% vs. 12% in September) and apparel (to 1% vs. 6% in September).

On the other hand, electronic goods showed a strong improvement (to 22% vs 7% in September).

“Apart from the sustained macroeconomic headwinds, we believe another key attributable factor for the slowing growth was the easing Chinese tourist arrivals in October due to the adverse impact of China’s Golden Week holiday,” Bocom said.

The research house added that while it expects November and December sales (the peak season of the year) to fare better as the Chinese tourist arrival growth normalizes, the continuing cautious consumer climate and the sustained high base last year (retail sales +17%/+17% in November/December 2011 vs +15% in October 11) will remain the key overhangs on sector improvement.

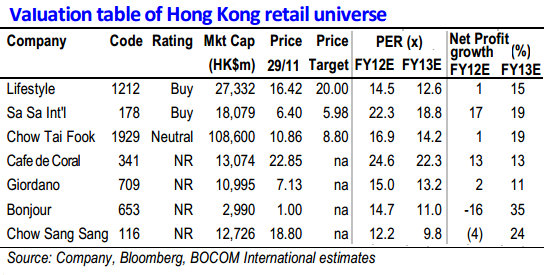

“In our Hong Kong retail universe, Sa Sa (HK: 178) and Lifestyle (HK: 1212) remain our top Buys,” Bocom said.

See also:

China Retail Rundown; XTEP ‘Buy’; ANTA Mixed

XTEP ‘Buy’; Bocom Downbeat; MAGIC Shines; PAX Impresses

XTEP Kicking Things Up A Notch; CHOW SANG SANG Target Hiked

Bocom: Maintaining ‘Neutral’ Call on OTO

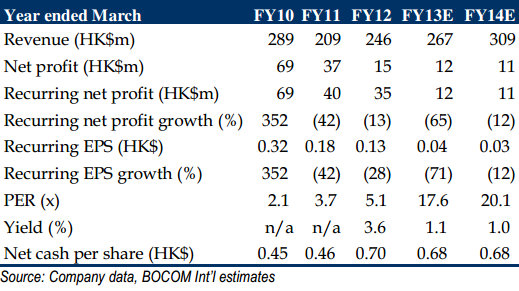

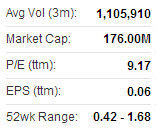

Bocom International said it is keeping its “Neutral” recommendation on fitness and wellness products play OTO Holdings (HK: 6880) with a 0.53 hkd target price based on 0.8X FY13E net cash per share (recent share price 0.67 hkd).

Bocom said that although April-September results “disappointed,” OTO’s net cash per share provides a certain level of downside cushion.

Recurring profit plunged 78% in 1H2013, due to lower-than-expected revenues from the Hong Kong and China markets and a higher-than-expected operating expense ratio.

Despite a 363% revenue growth reported by the China market, segment profit grew only 21% on increasing operating costs.

“Hong Kong retail revenue decreased on closures of mature stores and negative SSS growth. Earnings outlook remains challenging on intensified competition and a rising operating cost environment,” Bocom added.

Although the research house is lowering FY13/14E EPS by 62/69%, it maintains its “Neutral” call and target price to reflect the share price support by the estimated 0.68 hkd net cash per share in FY13E.

Interim revenue up 5%

While international sales and corporate sales recorded 12%/18% growth, Hong Kong retail revenue decreased by 12.5 million hkd on: (1) closure of mature stores (Harbour City, TST and Grand Century Place, Mongkok), the revenue loss of which could not be recovered by the new stores (Olympian City and East Point City, Tseung Kwan O); and (2) an estimated 2% SSS decline.

“Driven by the increase of stores from 11 to 47, China revenue rose from 5 million hkd to 21 million, but it was below our expectations due to a slower-than-expected expansion pace and sluggish consumer sentiment,” Bocom said.

China’s market contribution increased to 9% of profit

China market segment profit increased 21% to 2.2 million hkd, representing 9% of total profit (vs. 5% in 1H12).

“Going forward, China retail network expansion remains the major growth driver. Currently, the number of stores is 55.

“Management has concluded the tenancy agreements of another 11 new stores scheduled to open by FY13E,” Bocom said.

Key investment risks: intensifying competition, execution of China market expansion strategy and macro slowdown.

Upside catalysts: positive market reception of new products.

See also:

OTO Sees Healthy Prospects For Wellness Products