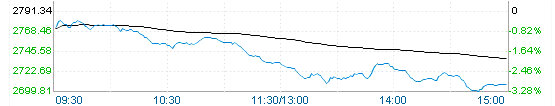

CHINA'S A SHARES tanked today on new measures to tighten credit in the country.

The benchmark Shanghai Composite Index lost 3.03% to close at 2,706.66 after investors fretted over the weekend reserve requirement ratio hike of 0.5 basis points, the seventh such increase in the past 12 months.

Banks and property counters, two heavily-exposed sectors to credit availability, were some of the biggest losers today after the minimum amount lenders must keep on hand was raised to historical highs with effect from this Thursday.

The property sub-index alone dropped a staggering 6% today.

Another shock to developers came in the form of an announcement yesterday from the mayor of China’s largest city – Shanghai – that a major objective this year for the municipality would be to implement new taxes targeting speculation in the property sector.

Photo: Andrew Vanburen

Analysts generally expect the benchmark Shanghai Composite Index to enjoy protection above the 2,700 mark over the near term as the reserve requirement hike was relatively mild.

Nearly all financial and real estate-related firms saw their share prices tumble, with some hitting their daily downside limits.

Developers Shanghai Shimao Co Ltd (SHA: 600823) and RisSun Real Estate (SZA: 002146) both dropped their daily 10% limits.

Meanwhile, industry giant Poly Real Estate Group Co Ltd (SHA: 600048) fell 8.66% to 13.60 yuan and China Vanke (SZA: 000002) lost 6.96% to 8.42 yuan.

Gemdale Corporation (SHA: 600383) was down 8.19% at 6.73 yuan while China Merchants Property Development (SZA: 000024) shed 7.73% to 16.24.

Mid-sized lenders took the heaviest blow with Ningbo Bank (SZA: 002142) losing 6.65% to 12.35 yuan and China Everbright Bank Co Ltd (SHA: 601818) dropping by 5.26% to 3.78.

The "Big Four" commercial lenders also had a day to forget, with all losing over 3%.